NYAG files action against crypto trading platform, rules ETH is a security | Skadden, Arps, Slate, Meagher & Flom LLP

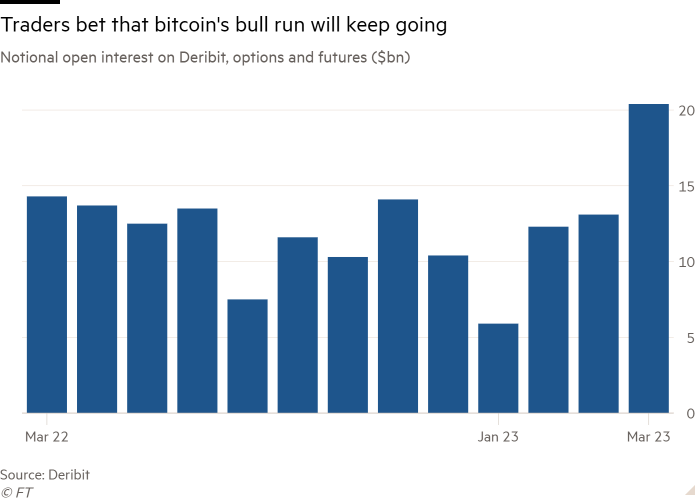

On March 9, 2023, the New York State Attorney General’s Office (NYAG) filed a lawsuit charging crypto trading platform KuCoin with “failure to register as a securities and commodities broker and falsely representing itself as an exchange.”1 In determining that KuCoin is a market intermediary for securities, the NYAG specifically claims that the Ether (ETH) traded on the platform is a security. This is the first time a US regulator has clearly taken this position, and it is in tension with certain statements made by staff at the Securities and Exchange Commission (SEC). Although mere allegations have no legal force, this new position is sure to inject a measure of uncertainty into ETH, the digital asset with the second highest market capitalization after Bitcoin, and the initial token of a blockchain where a significant part of the Web3 ecosystem, including decentralized financial protocols (DeFi) and NFT projects, have been built.

KuCoin is a virtual currency trading platform that facilitates the trading of three types of digital assets – ETH, Luna and TerraUSD (UST). After KuCoin failed to comply with an investigative subpoena from the NYAG, the NYAG filed a three-claim complaint against KuCoin under New York State’s securities law, the Martin Act: (1) KuCoin sold, offered to sell, bought, and offered to buy cryptocurrencies which are goods. and securities – here, ETH, Luna and UST – without being registered with the New York Department of Law as a commodity broker-dealer or a securities broker or dealer; (2) KuCoin issued and sold “KuCoin Earn”, a purported security that generated income for both KuCoin and investors; and (3) KuCoin represented itself as an “exchange” without proper registration. The NYAG is seeking a permanent injunction ordering KuCoin to geoblock New York residents, as well as restitution and deportation.

Focusing on the claim that ETH is not only a commodity but also a security, the NYAG alleges that Vitalik Buterin, one of the creators of the Ethereum blockchain, and the Ethereum Foundation managed and drove ETH’s development through the significant influence they maintained during Ethereum’s initial launch and, more recently, by allegedly facilitating Ether’s transition from proof-of-work to proof-of-stake.2 NYAG also alleges that Mr. Buterin and his co-founders conducted an initial coin offering (ICO) in which ETH was sold to fund the creation of Ethereum. The NYAG alleges that the developers of ETH promoted it as an investment based on language on the Ethereum Foundation’s website, such as references to ETH as a “store of value” and an “investment.”

NYAG argues that under both New York and federal law, these facts make ETH a security. For New York law, the NYAG relies on In re Waldstein, 160 Div. 763, 767 (Sup. Ct. Albany Cty. 1936), which states that “any form of instrument used for the purpose of financing and promoting enterprises, and designed for investment, is a security.” And under federal law, the NYAG claims that ETH is a security under the Supreme Court Howey test, which provides guidance on whether an instrument is an investment contract, and therefore a security, by analyzing whether it involves (1) an investment of money (2) in a joint venture (3) and a reasonable expectation of profit based on managerial effort from the organizer or a third party. The NYAG claims that ETH satisfies both the New York and federal tests, based primarily on three factors. First, members of the public invest money to buy ETH. Second, investors are in a joint venture with Mr. Buterin, the Ethereum Foundation and other developers because these individuals and the Foundation received, and allegedly still retain, significant amounts of ETH in the ICO, and funds earned from this ICO were claimed to be used to pay expenses incurred by developers, legal prerequisites and further development, thus tying the assets of the token holder to the assets of the management. Third, ETH’s management team promoted it as “profit opportunities”, depending on the growth of the cryptocurrency network, mainly based on the work of its founders, developers and managers.

The NYAG’s position on ETH stands in contrast to the widely relied upon statements from a 2018 speech by William Hinman, then director of the SEC’s Division of Corporation Finance, in which he expressed the view that the Ethereum network had become sufficiently decentralized so that purchasers no longer reasonableness expects a group to perform significant managerial efforts.3 Therefore, he did not see a “joint enterprise” underneath Howey test and stated that application of the disclosure regime of the federal securities laws would add little value here.

However, recent developments may affect how ETH is analyzed below Howey test. On September 15, 2022, Ethereum switched from proof-of-work to proof-of-stake. On the same day, SEC Chairman Gary Gensler said that cryptocurrencies and intermediaries that allow holders to “stake” their coins may pass Howey test as “the investing public expects profits based on the efforts of others,” and compared betting services to lending.4

Last month, the SEC filed a settled enforcement case against Kraken for its betting service. According to the complaint, Kraken’s betting services allowed investors to transfer crypto-assets to Kraken, which Kraken pooled to bet on the investors’ behalf in exchange for announced annual investment returns.

None of these developments, however, address the issue raised by Mr. Hinman in his 2018 speech—namely, that a system sufficiently decentralized could undermine the claim of a common enterprise or expectation of profit based on the efforts of a definable “other.” Contrary to Hinman’s view of Ethereum, Kraken is a centralized actor and, according to the SEC complaint, created both the joint enterprise and a reasonable expectation of profit. Similarly, Chairman Gensler’s statements in September 2018 assume that it is a centralized actor that performs ” other people’s efforts”.

The NYAG complaint, which includes a legal section, alleges that it is centralized activity that gives rise to a common enterprise and a reasonable expectation of profit. Specifically, it claims that Ethereum’s creator and the Ethereum Foundation “retain significant influence over Ethereum and are often a driving force behind major initiatives on the Ethereum blockchain that affect the functionality and price of ETH”, as demonstrated by their alleged “key roles in facilitating the recent fundamental shift ” to proof-of-stake.

It is important to note that NYAG’s claims have not been proven, and it remains to be seen if KuCoin will come forward and defend itself against these new claims. While there are likely to be a number of responses to the NYAG’s claims – including serious questions regarding the constitutionality of the claims – the action is notable because it involves the first claim in court by a US regulator that ETH constitutes a “security.” Given the ubiquitous use of the Ethereum blockchain throughout the wider Web3 ecosystem, a legal ruling that ETH is a security could have broad ramifications.

_______________

1 Pet’s Mem. of L. in Supp. of the verified pet, People v. Mek Global Ltd., No. – (NY Sup. Ct., March 9, 2023).

2 Proof-of-stake requires network participants to pledge or “stake” their holdings in ETH to verify transactions on the blockchain. The network randomly selects participants to verify transactions, who receive a reward for digital assets.

3 SEK, Digital Asset Transactions: When Howey Met Gary (Plastic) (June 14, 2018).

4 Paul Kiernan and Vicky Ge Huang, Ether’s New “Staking” Model May Draw SEC AttentionWSJ (September 15, 2022).

Download the PDF

![Bitcoin Cash [BCH]: Everything you need to know before writing this alt Bitcoin Cash [BCH]: Everything you need to know before writing this alt](https://www.cryptoproductivity.org/wp-content/uploads/2022/10/engin-akyurt-46g_OpI_spA-unsplash-1-1000x600-120x120.jpg)