Deribit sets up crypto exchange battle with push into free trade

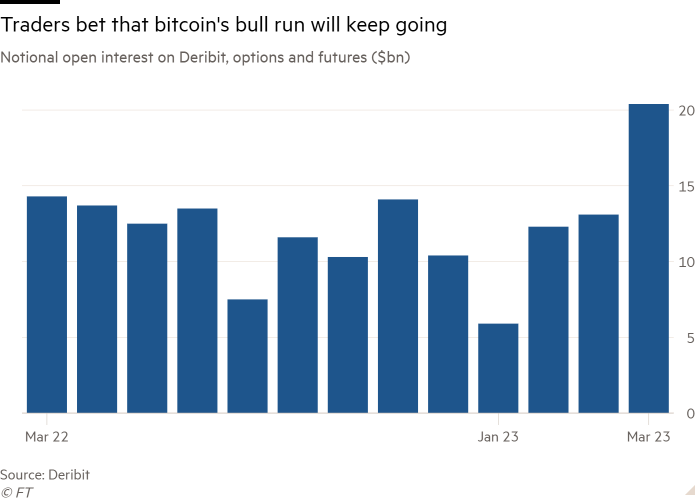

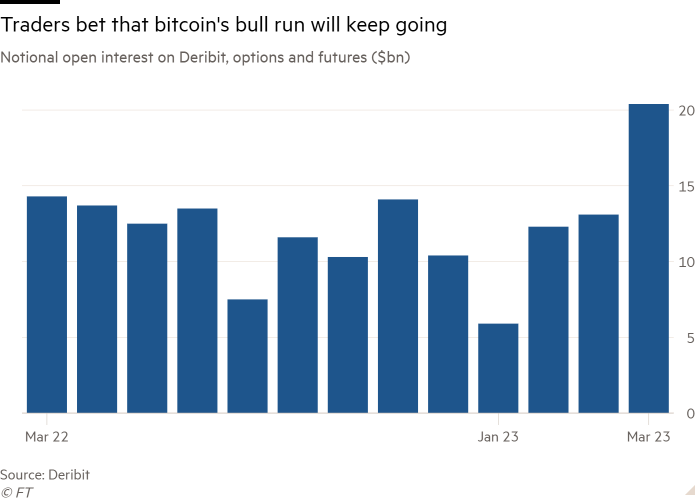

Crypto derivatives exchange Deribit is launching free trading of bitcoin and other tokens, setting up a new price war among digital asset exchanges as they try to rebound from a tough year for the industry.

The Panama-based group, the world’s largest crypto options exchange, will begin direct trading in three of the most popular cryptocurrency pairs from next week and waive the fees.

The move underscores how competition is increasing among crypto exchanges as they try to lure institutional investors eager to tap into a rising market following last year’s crash in digital asset prices and the failure of industry bellwether FTX. Around 90 percent of Deribit’s customers are institutional customers.

Popular coins like bitcoin and ether have outperformed assets like stocks and commodities this year, with gains of 50 percent and 65 percent respectively.

It also comes a month after Binance, the world’s largest crypto trading marketplace, ended a six-month entry into fee-free trading, a move that accelerated its market share.

Luuk Strijers, commercial director at Deribit, said the exchange’s move to spot trading was driven by customer demand.

“You have to buy ether on Binance instead of Deribit,” he said, adding: “If you want to convert $5 million [into bitcoin]for example, we have to tell you to go elsewhere, which is terrible customer service.”

“To have a proper derivatives offering you also need to have spot,” he added.

Big-name money managers have continued to explore digital assets and cash in on investor interest over the past year, even as the industry suffered a crisis of confidence and many companies failed.

“Serious institutional players remain committed and actually see the open space after the demise of several crypto-native players as an opportunity.” Bernstein analysts wrote this week.

Deribit will offer free trading in pairs of ether and bitcoin, and ether and bitcoin against the stablecoin USDC, which is operated by Circle. US-listed Coinbase, for example, charges up to 0.6 percent for a trade.

Strijers added that trading on the three pairs will remain free to trade “for the foreseeable future” and that future tokens that may be added will have a cost.

The market share of Binance rose by a fifth after launching fee-free trading of 13 coins and reached almost two-thirds of the total volume on the exchange, according to data provider Kaiko. However, the stock exchange’s management backtracked after it reintroduced charges.

Deribit added that it was looking to use spot trading as an entry point for clients to trade options and futures. Strijers said this would “service our existing client base and potentially attract some new clients who will then . . . also trade options, futures or perpetuities [futures]”.

Deribit was founded in 2016 and is backed by investors including crypto venture firm 10T Holdings and trading firm Akuna Capital.