Get Ready for Bitcoin to Make a Big Move Right Now (Technical Analysis)

Velishchuk

Over the past few months, things have been pretty sleepy in the Bitcoin (BTC-USD) part of the crypto universe. Instead, all the hype has been around Ethereum (ETH-USD) and GPU mining while the former moved from proof of work to proof of effort. But Bitcoin has not changed any of its core systems significantly during this time. It has been almost lulled to sleep by the trading pattern of recent weeks. But what appears to be a paint-drying moment for traders looks set to be a big move in the coming weeks.

Those who have been following my writing may remember my last technical analysis a year ago when I pointed to higher highs when Bitcoin was trading at $54,000. Of course, my subscribers got the information while it was at $42,000 as the setup unfolded. Bitcoin hit $22 or $69,000 exactly one month later. This has been my go-to tool for predicting where Bitcoin is headed in the near future and in the medium term, and it has worked many times.

For some reason, Bitcoin likes to revert to similar trading patterns and structures. And while the current setup doesn’t include the same falling bullish flag or fully formed cup and handle as last year, it does repeat yet another one of its popular patterns right now.

A look at the pattern

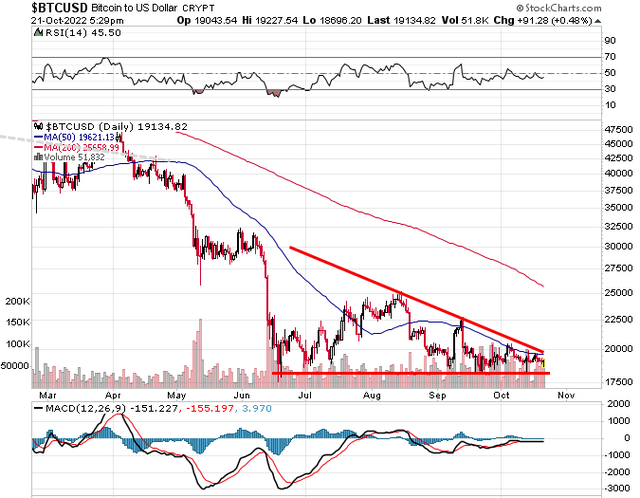

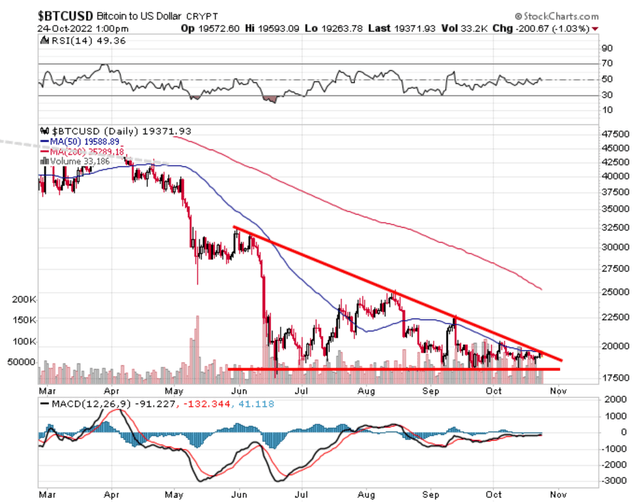

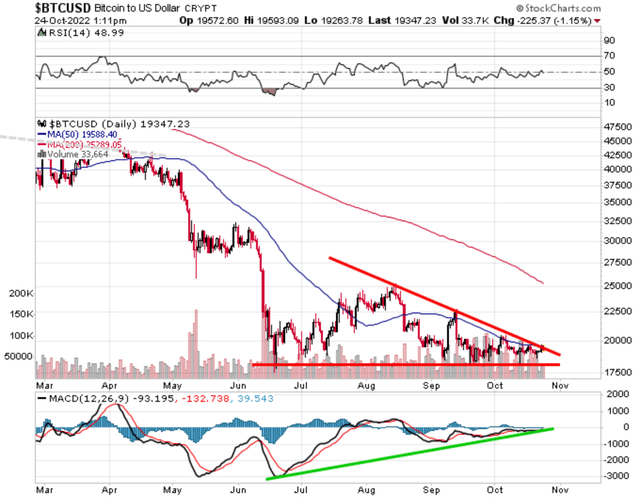

The problem with this pattern is that while it is traditionally a bearish pattern used to predict a continuation of a downtrend, it can also be a reversal pattern. Therein lies the problem with understanding the direction of this breakout: is Bitcoin going higher or lower? Unfortunately, a descending triangle is not easy to interpret, but we have some signals and indicators to help us.

Looking at the chart below, if the floor below $18,000-$17,500 is broken, we are headed for much lower lows, likely around very low five figures – think $12,000-$13,000. However, if the descending triangle breaks out to the upside, we may see the beginning of a rally.

stockcharts.com

Confirmation is relatively easy for a continuation. A breakdown below the triple bottom will confirm that more downside is in store. Validation will come on a pullback where it tests the previous triple bottom support as resistance. From there you can expect much steeper descents. A breakout to the upside will be confirmed when it moves past and closes above the falling trend line. Validation will come when it breaks past the last high in the triangle. In this case, it appears to be the $22,500 level.

In terms of measures, the first high and first low of the triangle are subtracted and then added to the breakout or breakdown. This gives us the expected level the crypto will end up at in the near future. This one is a bit tricky because if I extend the upper resistance trendline it could extend to the June highs.

stockcharts.com

This means that the difference in highs and lows is $14,767. That results in either a breakdown to $3,000 or a breakout to $34,267. However, a triangle is usually measured after the downward trend stops. This would set the first high in August. The difference in price between highs and lows in this scenario is $7,600. This creates targets of $10,000 or $27,100. This is a more reasonable scenario as the targets are not completely out of range.

What direction to expect

So what are the odds of this moving in one direction rather than the other? It’s hard to tell until we get a day of high volatility or a big move. But basing it solely on pattern odds, it’s a bearish result; it fits well within the parameters of a continuation pattern.

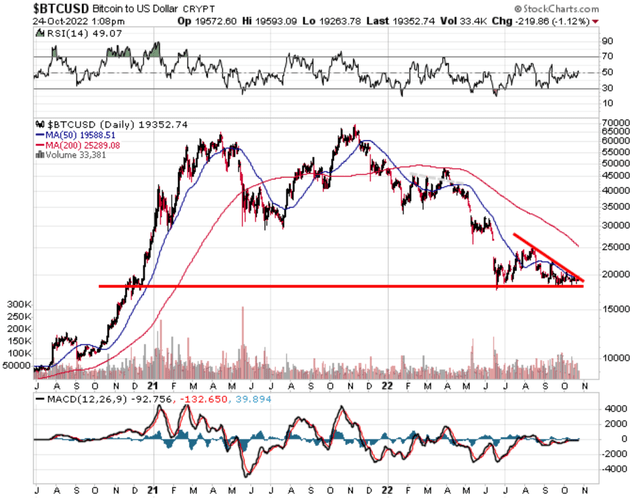

However, this level has a lot of support as it extends as far back as December 2020. This will require heavy, sustained selling to break below the support level. Not impossible or unlikely, but as I told my subscribers, with the S&P 500 (SP500) looking to go higher, Bitcoin is likely to follow (or even lead).

stockcharts.com

But to add to the bullish odds, the MACD has been trending much higher throughout this pattern. Since the June lows, the MACD has made a disproportionate move higher into the August highs; the return to the bottom of the pattern did not come with a return to the MACD low. Instead, a much higher minimum was set.

stockcharts.com

Using the indicators creates a more likely bullish outcome. However, the crypto will need to break past the 50-day moving average and the red trendline to break out to the upside. If it weren’t for the bearish trend of this pattern and the double resistance to the upside, I’d put the odds on a breakout at 60% and a breakdown at 40%. But given all the inputs, I would put the breakout at 40% and the breakdown at 60%. And if you don’t think this sounds convincing on the upside, if there were no bullish indicators, the odds would be closer to 20% for a breakout.

Prepare for a move

I expect the crypto to make a move in the next couple of weeks. Technically, by the second week of November, the triangle will peak and expire. A move should come before then. If no movement occurs, the pattern will be invalid and the analysis will need another look to see where the crypto is headed. I don’t expect this, but if it does, I will move towards a serious bottom formation if it continues sideways and doesn’t break below the ~$18,000 support level.

I will also use input from the broader markets and indices to give us an idea of where Bitcoin will go since there is a correlation between Bitcoin and the stock market (but with a larger beta). But regardless of the direction of this pattern, a big move is expected soon.