How to get liquidity on your NFTs

Get access to Inner Circle Discord, claim the community markand enjoy exclusively Token reports and air drop guides when you subscribe!

Dear Bankless Nation,

The rise of Bored Apes and CryptoPunks generated a lot of wealth for avid collectors. NFTs are now a multi-billion dollar asset class.

The problem is that getting liquidity on NFT is a difficult decision.

It’s an all-or-nothing. Either you sell the piece or you don’t. There is no luxury to slowly trim or secure your position as one can with fungible tokens.

Is there a solution?

Sudoswap is one option. The protocol uses SudoAMMutilize one binding curve to allow superior flexibility in buying and selling NFTs.

And the platform has been in the spotlight in recent weeks as collectors swarm the marketplace to tap into this much-needed liquidity.

With it, Sudoswap has also sparked some controversy over royalties for creators, as the platform allows collectors to avoid paying them altogether.

Want to learn more?

William has you covered.

– Bankless team

Join us for Converge 22Circle’s first annual crypto ecosystem conference, takes place 27-30 September in San Francisco! Featuring extensive demos and developer workshops, plus strong guest speakers including Ethereum’s Vitalik Buterin, Aaves Stani Kulechov, Mary-Catherine Lader from Uniswap Labs, Anatoly Yakovenko from Solana and many more.

Sign up with code Bankless to receive $100 off your ticket!

Bankless Author: William M. PeasterBankless contributor and Metaversal author

Sudoswap is a new NFT AMM that goes where no NFT marketplace has gone before. It implements innovative liquidity pools and bond curves to bring much-needed liquidity to a rising multi-billion dollar asset class.

This Bankless tactic will show you how to launch your own NFT liquidity pool in this new emerging marketplace.

Launched in April 2021 by 0xmonsSudoswap started as an over-the-counter (OTC) NFT trading dapp.

A few months after its launch, 0xmons started developing a new NFT automated market maker (AMM) system, also known as SudoAMM.

Where other NFT AMMs such as NFTX rely solely on liquidity pools, sudoAMM was specifically designed to add bond curve functions to its liquidity pools to offer superior flexibility around both the buying and selling of NFTs.

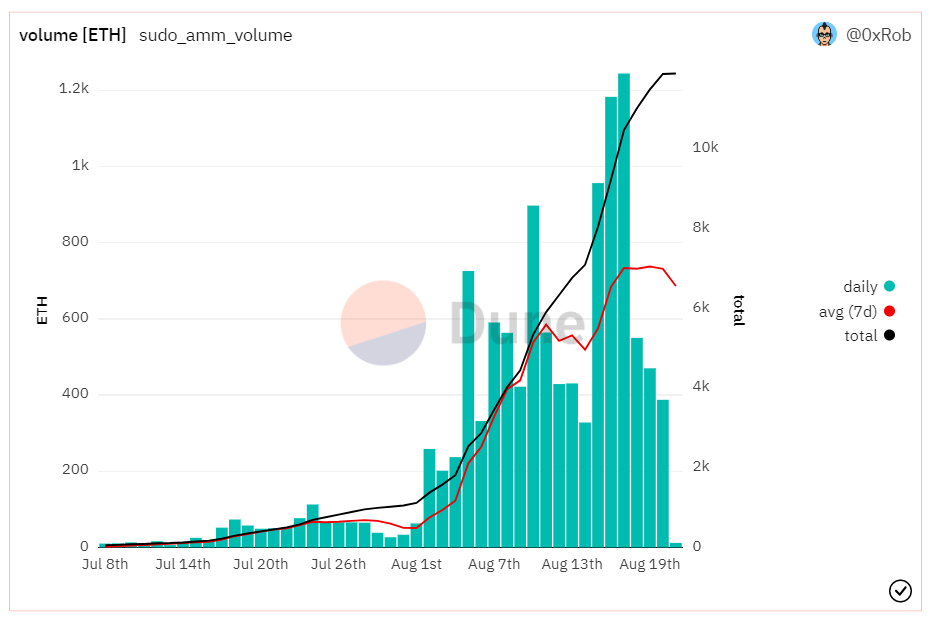

SudoAMM’s creators rolled out the technology as the new engine of the Sudoswap decentralized marketplace on July 8, 2022. Since then, trading volume on the chain has increased as people have flocked to see the project’s unprecedented bond curve capabilities and gas-efficient transactions.

Generally speaking, Sudoswap is in the same ballpark as NFTX, as it is a protocol that also facilitates streamlined trading around “floor” NFTs.

That said, a router system that works across multiple uniquely parameterized liquidity pools and customizable bond curves is Sudoswap’s main starting point from NFTX.

This means that users can set up buy-only, sell-only or buy-and-sell NFT pools according to predictable price targets. For example, 0xmons has explained in a previous blog post about sudoAMM:

“For liquidity providers, unilateral pools allow DCA-ing in or out of a large NFT position. For example, a buy-side pool that buys its first NFT for 10 ETH, then 9 ETH, then 8 ETH, etc. (assuming linearly decreasing bond curve). Or a sell-side pool that sells its first NFT for 1 ETH, then 1.5 ETH, then 2.25 ETH, etc..”

A major point of debate in the NFT ecosystem of late has been Sudoswap’s approach, or rather the lack thereof, to honoring NFT royalties.

In fact, one of sudoAMM’s main selling points has been how their traders don’t have to pay royalty fees compared to using other NFT marketplaces. As a result, this saves collectors around 5-10% on each purchase.

To understand why this dynamic is controversial, you have to go back to 2020 when a group of now legendary crypto artists demanded and won minimum 10% secondary sales royalty on all NFT resales from prominent NFT marketplaces.

Since then, 10% royalties have become a de facto standard for crypto artists on their pieces, and is widely celebrated in the NFT space as a web3 rejection of the historical status quo, where artists typically never received some secondary sales royalties from the resale of their work.

Consequently, there is a very strong pro-royalty culture throughout much of the old guard in the NFT ecosystem, and many in this camp see the outcome towards zero royalties to let Sudoswap as backsliding, exploitative, and a red line not to be crossed.

On the other side of the spectrum, you have more cynical views of how this race to zero royalties is all but inevitable whether you love it or hate it, as epitomized by this recent Udi Wertheimer tweet:

Then there are those in the middle who say that Sudoswap is mainly suited to offer liquidity flexibility around large PFP pools, more than a few of which have already experimented with their royalty approaches.

For example, two of the three most traded projects on Sudoswap to date have been Based on Ghouls and 8 encumbrances. The Based Ghouls team created their own Sudoswap liquidity pool to control their liquidity, while 8liens charges a 0% royalty fee for strategic reasons.

For this kind of project, Sudoswap makes a lot of sense in my opinion.

Anyway, NFT aggregators like Gem are adding opt-in royalties for Sudoswap transactions, so it will soon be possible to trade on Sudoswap and honor royalties as well.

I write Bankless’s Metaversal NFT column and lately I’ve been focusing on DIY solutions like how to create your own PFP collectionhow create your own embossing UIand how create an approval list for coining.

Let’s say you’ve created your own NFT collection and now you’re ready to open it up to the world. How to create your own NFT liquidity pool on Sudoswap:

-

Go to Sudoswap.xyz

-

Connect to your wallet

-

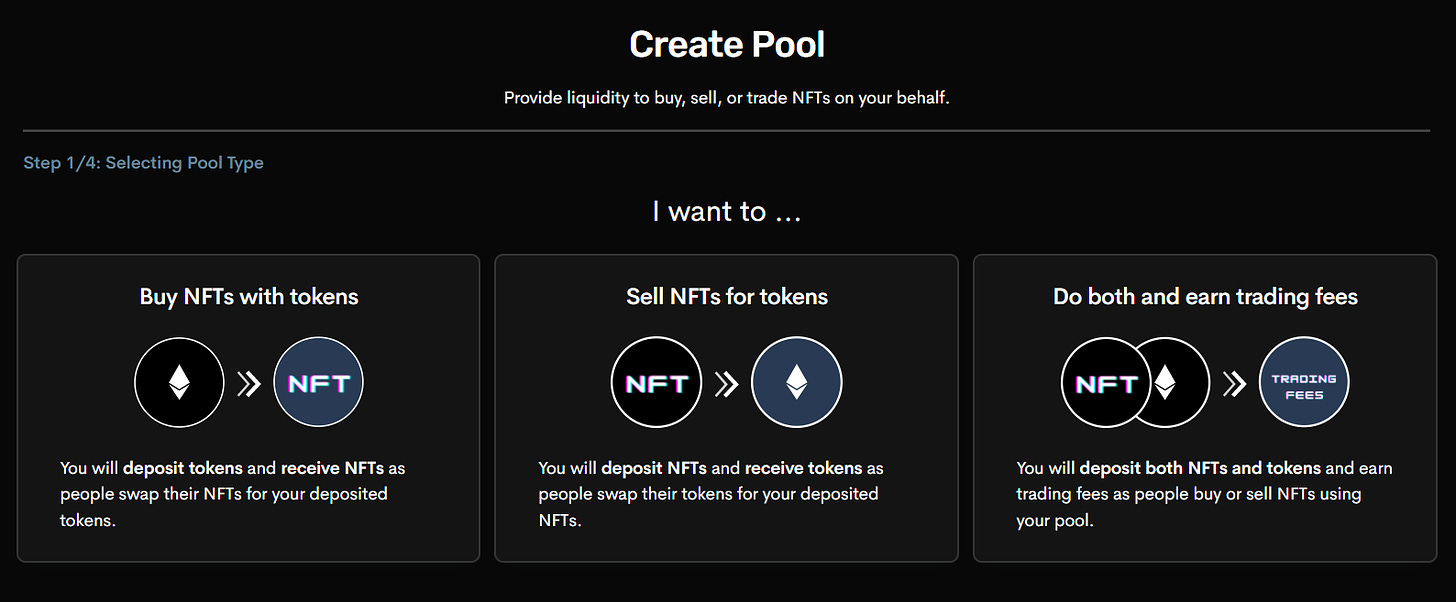

Click on the “Your Pools” tab and then on the “+Create Pool” button. You will arrive at this user interface:

-

Click the “Sell NFTs for Tokens” or “Do Both and Earn Trading Fees” button. For this example, we go the previous route and choose to only sell NFTs for ETH.

-

Select the NFT pool you want to deposit from and the token you want to receive in exchange (only ETH is possible for now), and then click the “Next Step” button.

-

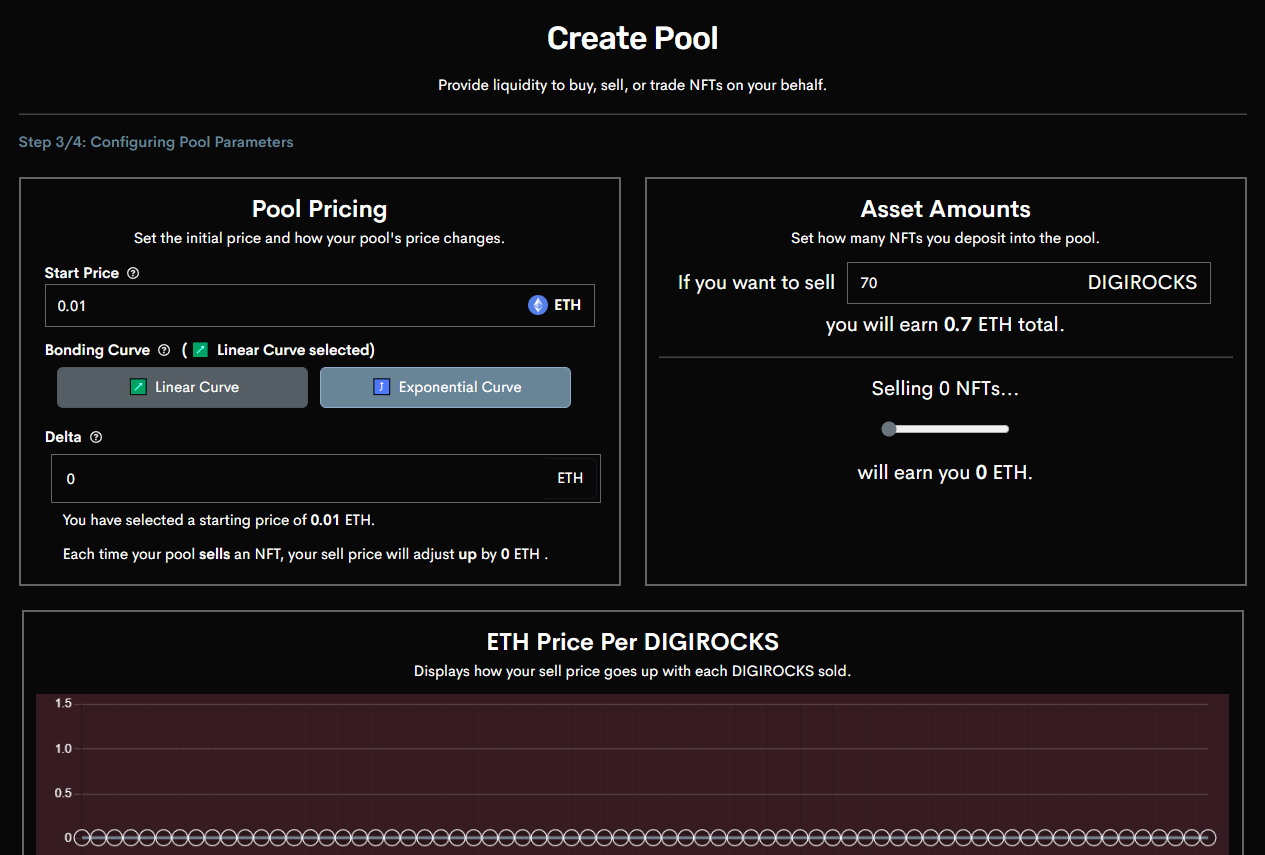

At this stage you can set up your NFT’s price point, its binding curve type and the delta at which the price changes on new transactions. Click the “Next Step” button again.

-

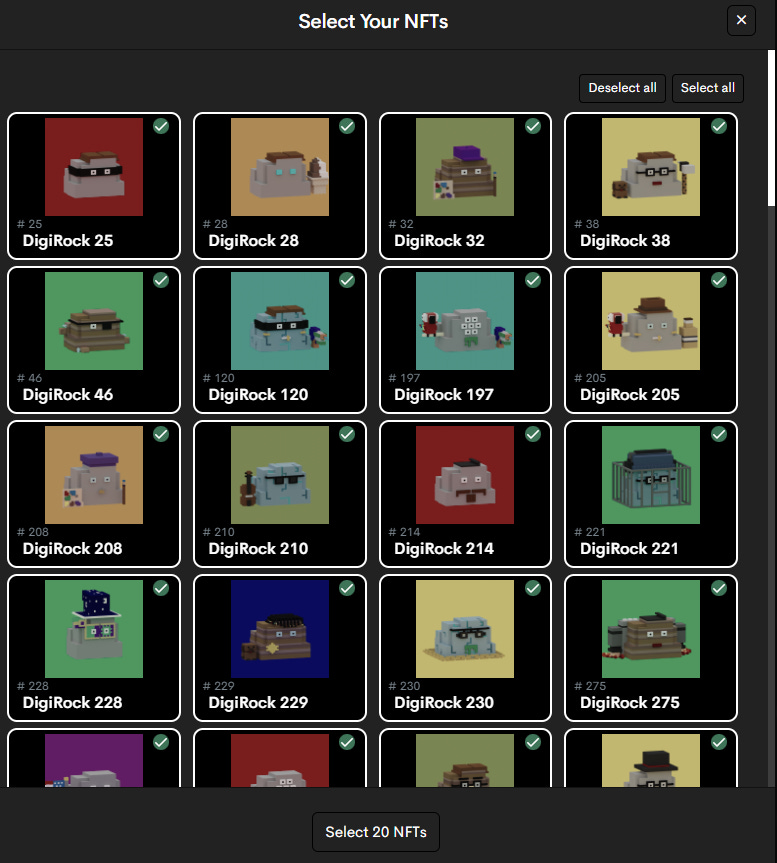

On the following page, click the “Select your NFTs+” button and browse and select the NFTs you want to deposit, like this:

-

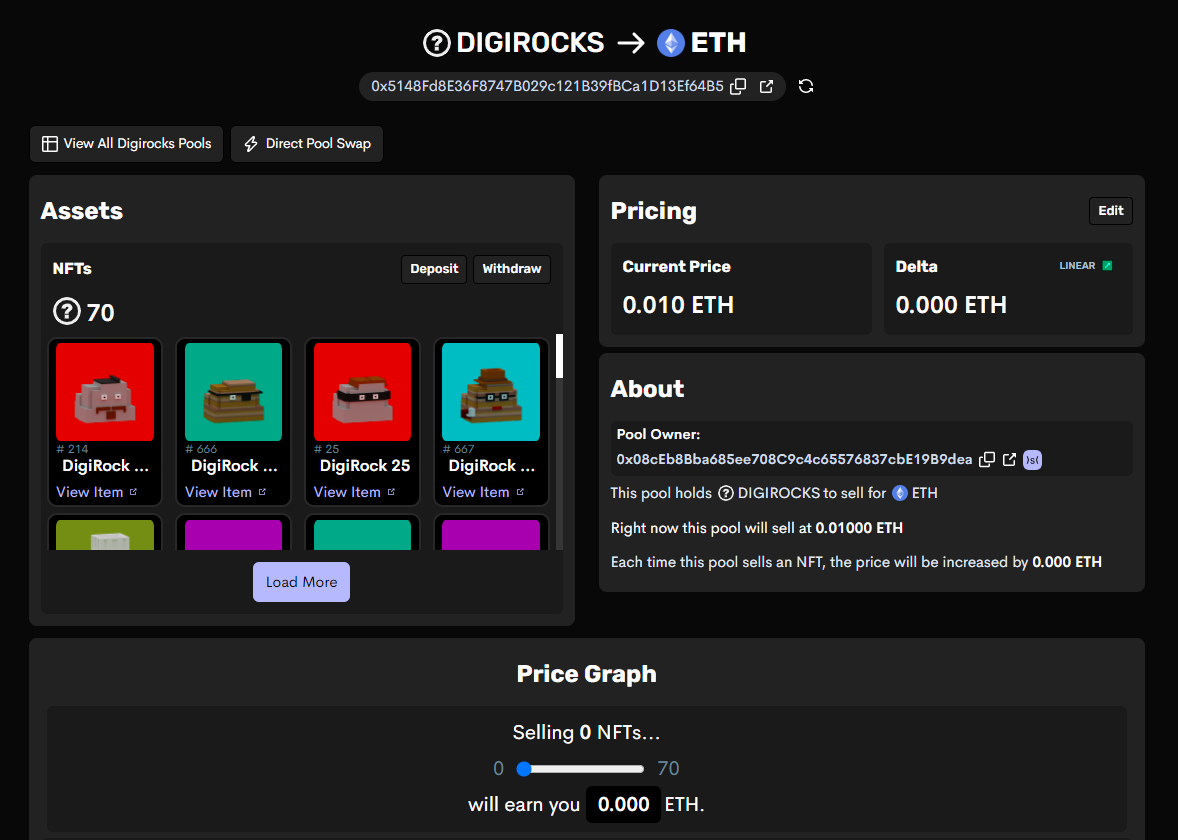

You then fire off an authorization transaction to allow Sudoswap to access your NFTs, then deposit your NFTs with a final transaction. You will then be taken to the personal pool dashboard user interface, which looks like this:

-

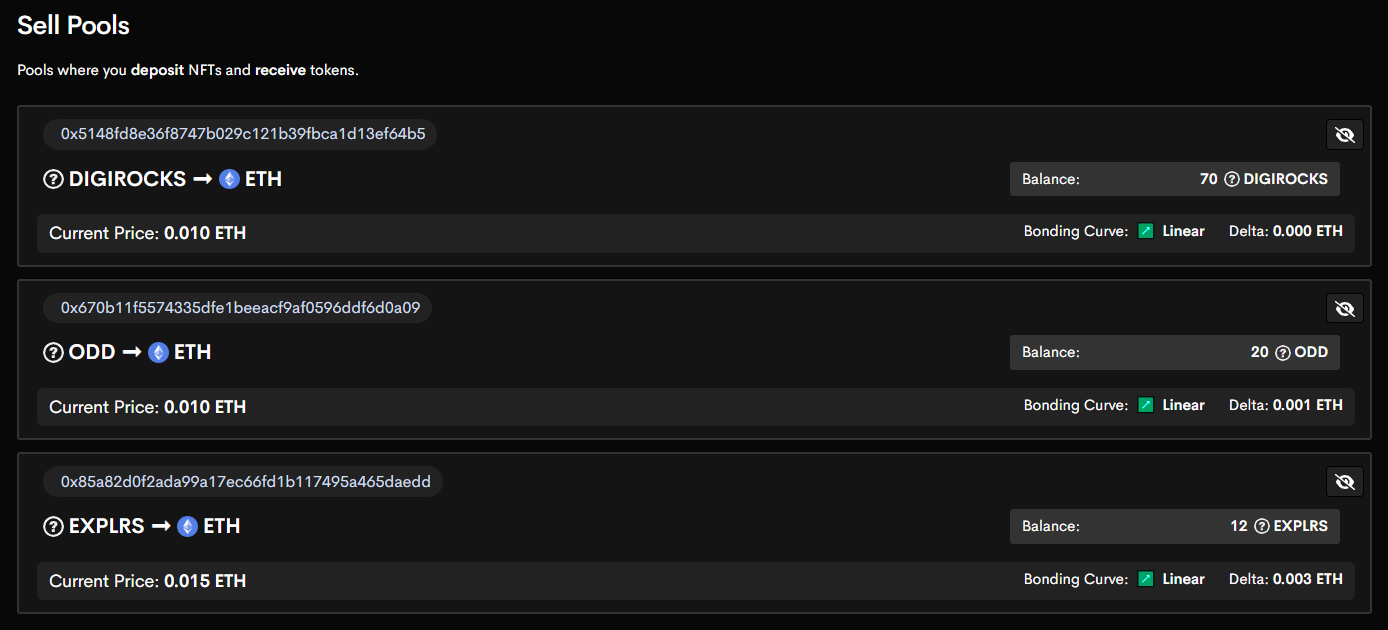

To manage your assets and track your sales, simply click the “Your Pools” button on Sudoswap to go to your liquidity pools command center:

To be sure, Sudoswap is not right for all NFT projects.

However, it may be right for you.

If you are interested in experimenting with this NFT AMM, start small, but whatever you do, don’t sleep on Sudoswap’s bond curve possibilities.

This technology alone makes Sudoswap an incredibly interesting DIY liquidity application for one of the fastest growing sectors of the crypto economy.

Subscribe to Bankless. $22 per month. Includes archive access, Inner circle & Divorced.

👉 Join us at Converge22 Circle’s first crypto ecosystem conference. Use code without bank

Want be mentioned on Bankless? Send your article to [email protected]

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Mediation. From time to time I may add links in this newsletter to products I use. I may receive a commission if you purchase through one of these links. In addition, the Bankless writers have crypto assets. See our investment information here.