Fintech firms aim to offer stability in volatile times

Making money management easier is what the more than 500 fintech startups in Israel are built for. And CEOs of these companies say their products are especially useful in these uncertain economic times.

Rising inflation remains in the headlines, with the UK CPI rising to a new 40-year high of 10.1% annually in July.

Governments are acting to counter the high cost of living, including in the US with President Joe Biden signing the Inflation Reduction Act.

In June, stocks entered a bear market due to concerns about inflation.

Limit currency exposure

“We provide stability for companies at a time of general turbulence in the world,” said Daniel Rubin, founder and CEO of Keese Finance, which helps global firms manage their currency exposure.

Keese (“pocket” in Hebrew) started by helping internationals living in Israel with multiple bank accounts, but in February the Tel Aviv-based startup decided to work with companies to limit their currency exposure – prompted by the strong shekel that reached 26-year high against the US dollar last November.

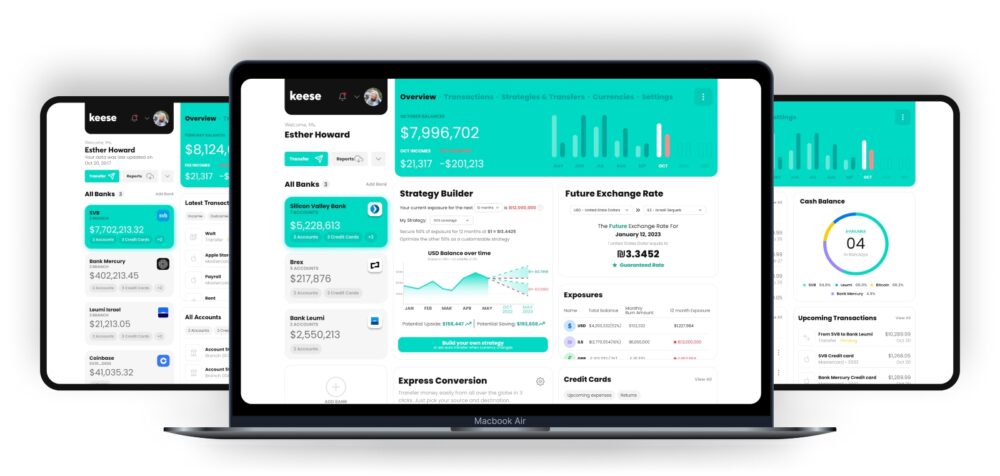

Screenshot of a Keese demo.

Businesses can manage and strategize their currency exposure via an online dashboard – locking in an exchange rate guaranteed for up to one year. Keese integrates with over 11,000 banks worldwide.

“Today, it is extremely irresponsible and outdated for a company to budget with arbitrary exchange rates for me. It’s just an extremely high-risk environment that companies shouldn’t play with, says Rubin.

“What they should do is lock in the exchange rate for the next year and be able to budget for it and not have to think about it again.”

To see the bigger picture

Gabriel Bilczyk, co-founder and chairman of Claritus. Photo courtesy of Claritus

Zooming out may be the best antidote for anxious investors riding Wall Street’s recent roller coaster ride, explains Gabriel Bilczyk.

The co-founder and chairman of Claritus emphasizes the importance of seeing the bigger picture of your investment portfolio. His personal wealth management company consolidates assets and investments in one place.

“In times like this, Claritus is even more important because when everything is going well, people say, ‘My returns are fine, I’m not very worried about the asset allocation,'” Bilczyk tells ISRAEL21c.

“But when times are volatile—when inflation rises, when the stock market wobbles, I think it’s even more important for people to be able to observe their wealth easily and locally.”

The Claritus platform can provide crucial context, providing key information about the overall portfolio so that the investor can make more informed decisions.

“It puts me in a better place to make better decisions because at the moment my portfolio might be down 20% but since starting I’ve gone up 40%. Then I can say it’s not that bad and I can be less stressed about the situation. Many people are stressed because they are in the ‘don’t know’ area, says Bilczyk.

Make smart investment decisions

Tel Aviv-based TipRanks aims to empower everyday investors by simplifying complex data, climbing to the top with its core product that showcases the best financial experts – and raising $77 million in Series B funding in April 2021.

“We’re trying to level the playing field for retail investors by making all this information available to them so they have the same level of information that an asset manager would,” co-founder and CEO Uri Gruenbaum tells ISRAEL21c.

Uri Gruenbaum, co-founder and CEO of TipRanks. Image courtesy of TipRanks

After 13 years of a bull market, Gruenbaum observed a change in the rankings of Wall Street analysts during the current turmoil in the stock market.

“Superstar analysts—typically those who cover technology—took a big hit in their ratings, so we actually saw some turnover on our top experts page,” says Gruenbaum.

“Suddenly, a lot of more cautious analysts who didn’t give crazy price targets and very optimistic forecasts are more popular on our platform.”

Last year, TipRanks added two new innovative tools: risk analysis and website traffic analysis.

The risk analysis feature identifies six risk categories for stock research so investors can make more informed decisions. The website traffic graph shows how many people visit a company’s website and the correlation with the share price.

“It’s a good way to cheat the system by getting the information from the outside before a company reports and make better investment decisions,” Gruenbaum says of the site’s new traffic analytics feature.

Going digital

Kobi Ram is on a mission to replace checks, credit cards and cash with paperless money transfers.

The CEO of V-CHECK cites the huge amount of paper check usage in Israel – 84 million transactions annually worth 800 billion shekels ($246 billion).

The startup was founded in 2015 to help small and medium-sized businesses and also large companies digitize their month-end payment process.

Through the platform, the payment can be made immediately or postponed and a contract created between the two sides.

The credit limit for these small and medium-sized companies will not be affected, emphasizes Ram.

“We’re seeing a big increase in our activities right now because a lot of people are looking for alternatives instead of charging their debit card or affecting their credit line,” he tells ISRAEL21c.

Digital payment collections are made easier with the V-CHECK platform, which includes due date reminders and the ability to view transactions in real time.

“We create a clearer situation for customers,” says Ram. “They can see all the transactions in one place.”

Ram also has some advice for business owners and individuals amid inflation concerns: Create a long-term plan for at least the next couple of years that includes cutting costs.

“See how much you’ve got in terms of income, and build your budget accordingly. Don’t expect to live on a line of credit. It could be very expensive in the next couple of years. Money will be expensive and you will have to budget what you earn.”