Crypto is rising for the wrong reasons

Key takeaways:

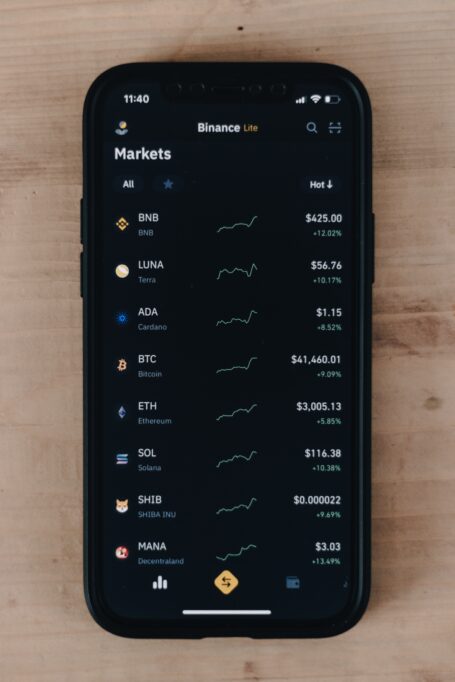

- The crypto market has grown by 40% – $20,000 to $28,000 – between January 15, 2023 and March 24, 2023.

- Experts attribute recovery efforts by the US central banks (Feds) to cushion the effects of recent bank failures as one of the reasons for the recovery.

- However, this reason for the market rise can also lead to higher inflation rates.

Even a casual observer knows that 2022 was a tough year for the crypto market. It was blow after blow in 2022, throwing the market into a perpetual state of redness. Casual traders like me could only watch our investments lose value.

It started with the American central bank aggressively raising interest rates to curb the level of inflation after the pandemic. High interest rates meant that borrowing to invest in assets was not a good move as it caused stocks, crypto and other forms of investment to crash.

As if the interest rate hike wasn’t enough to make people more reluctant to invest in crypto, Terra Luna’s crash caused more investors to steer clear of the crypto market. The Luna crash was one of the biggest crypto hits ever, wiping $60 billion from the market in hours.

The crash occurred in May 2022 when $2 billion of Terra’s stablecoin, TerraUSD, was sold, causing the dollar-pegged stablecoin to lose its value. While it is unknown what caused the sale, Terra’s CEO, Do Kwon, was recently arrested and charged with fraud.

By June 2022, Bitcoin was down 60%, and other coins such as Solana and Polkadot had fallen by 90%. And there were several hits to the market, such as major crypto lender Celsius, which froze customer withdrawals due to the declining market.

One of the most brutal and shocking hits of all was the FTX crash.

The crypto market is picking up again

In January 2023, Bitcoin showed signs of recovery after its price had fallen below $15,000, and traders were excited to see the digital asset rise to $21,000.

Ademi, a full-time trader, put the increase down to the scarcity of Bitcoin. At the time, large crypto investors, also known as crypto whales, bought up large amounts of the currency.

On the other hand, Michael Ugwu, an angel investor and managing director of FreeMe Digital, said the increase was due to news of improved macroeconomic conditions. He added that if economic conditions did not change, the rise in the price of cryptoassets would not be sustained.

Why is crypto still going up?

US inflation rates slowed to 6% in February 2023, compared to 9% in April 2022. According to Trading Economics, the prices of food, cars and trucks are growing at a slower rate in 2023 than in 2022.

While news like this can determine the prices of cryptocurrencies, the fall of three US banks could be the main reason.

Silicon Valley Bank (SVB), Silvergate Capital and Signature Bank are US banks that collapsed within a week of each other.

Silvergate Capital announced its failure on March 8, 2023, while SVB failed two days later, on March 10, and Signature Bank four days later, on March 12.

The collapse of these banks leads to an increase in crypto prices because the US government announced plans to cover their debts.

The Federal Deposit Insurance Corp (FDIC) and the Federal Reserve Board said in a joint statement that every SVB depositor will have access to all of their money.

But before the announcement, the Bitcoin price fell by 10%.

Popular stablecoin, USDC, lost stability when its issuer, Circle, held its funds as Silvergate Capital; the coin regained its peg to the dollar after the FDIC announced it.

Capital market commentator Holger Zschaepitz explained in a tweet why the injection of liquidity into the market is even causing stocks to rise.

The Fed also had to lend $300 billion to banks to avoid a domino effect after SVB, Silvergate and Signature Bank failed. The banks have lent an amount equivalent to half of what was needed to save the financial institutions during the financial crisis in 2008.

More money, more inflation

While crypto and stock markets are booming due to lower interest rates and $300 billion in liquidity pumped into the system, this could cause inflation rates to rise again.

The last crypto bull run that saw crypto reach an all-time high of $69,000 was caused by the Fed printing $4.189 trillion in response to COVID in 2020, resulting in high inflation rates in 2022.

We could have a repeat, with low interest rates at the moment and $300 billion injected into the system.

This situation puts the Fed in a difficult position where it must choose between rescuing the banking sector and ensuring financial stability or continuing the fight against inflation.

This Fortune article by Philipp Carlsson-Szlezak, managing director and partner at BCG’s and Paul Swartz, director and senior economist at the BCG Henderson Institute in New York, said: “The new reality of having to balance financial stability risk with structural inflation risk has undoubtedly pushed up the likelihood of a recession.”

This means that while traders may be enjoying the crypto bull run, a recession is looming and that could make the crypto market worse than it was at the end of November 2022.