BTC Plunges to $23,047 as Bear Market Persists – Cryptopolitan

The recent Bitcoin price analysis reveals that the bears are leading the price chart for the day and the cryptocurrency value has been drastically reduced. The bearish wave has been going on for the past two days, and the price has been constantly declining. The price has also devalued in the last 24 hours because the bearish trend is getting stronger. The price is now at $23,047 and a further decline can be expected if the bears continue to lead in the future.

The current support level is at $22,906 indicating that the bulls are trying to resist the downward pressure of the bearish wave. However, the bulls can make a comeback if the support level holds. The resistance level is at $23,289 and any breach of this level will be seen as a positive sign for the bulls.

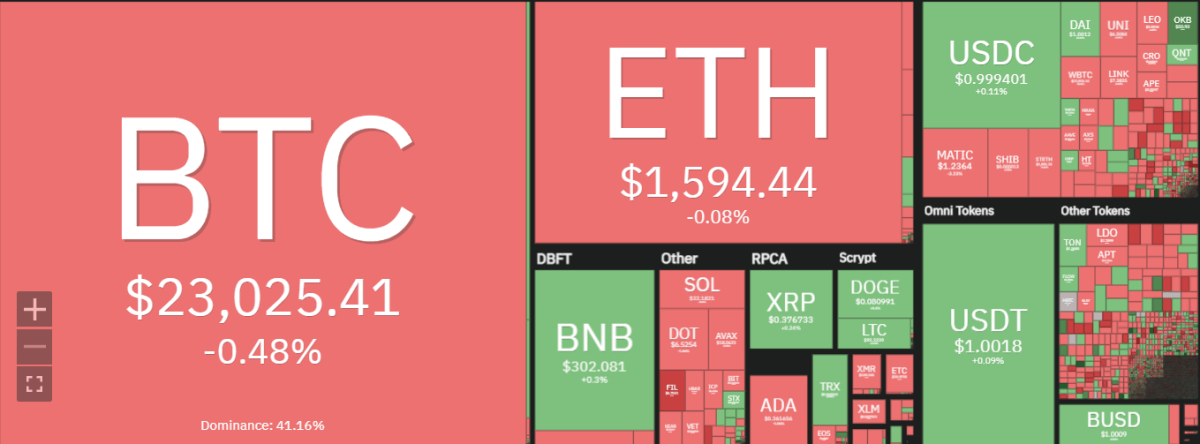

The current trading volume for BTC/USD is $17 billion and it has decreased in the last 24 hours. The market capitalization of the cryptocurrency is currently at $444 billion.

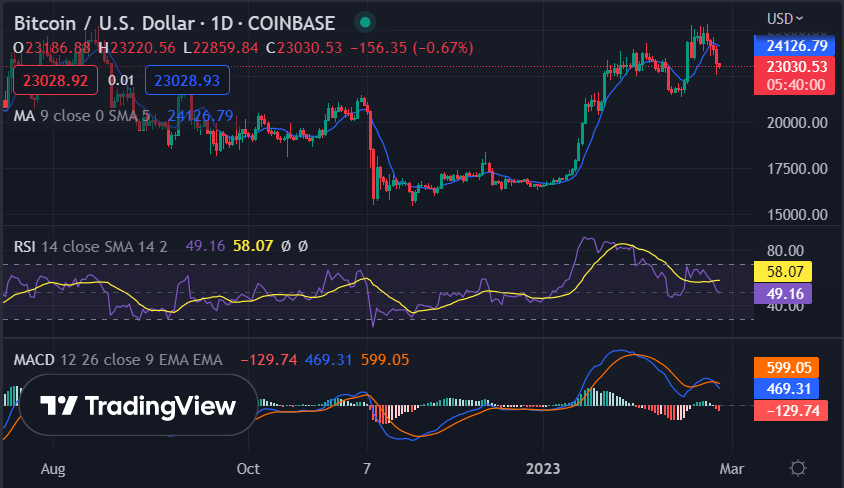

BTC/USD 1-day price chart: Further downside is expected as the bearish trend intensifies

The one-day Bitcoin price analysis dictates an increase in bearish momentum during the day. The price has fallen to alarming levels as the bears have maintained their lead quite effectively. The price has fallen up to the $23,047 mark today and a further fall in the BTC/USD value is highly expected.

Furthermore, the moving average (MA) value of the cryptocurrency is relatively high, which is a sign of bearish sentiment in the market. The MA for Bitcoin is currently at $24,126 and any break above this level could induce an uptrend. Looking at the MACD indicators, the bearish divergence is increasing as the MACD line and the signal line are both in the negative zone. The Relative Strength Index (RSI) is also in the oversold region, suggesting that the bears are in control of the market.

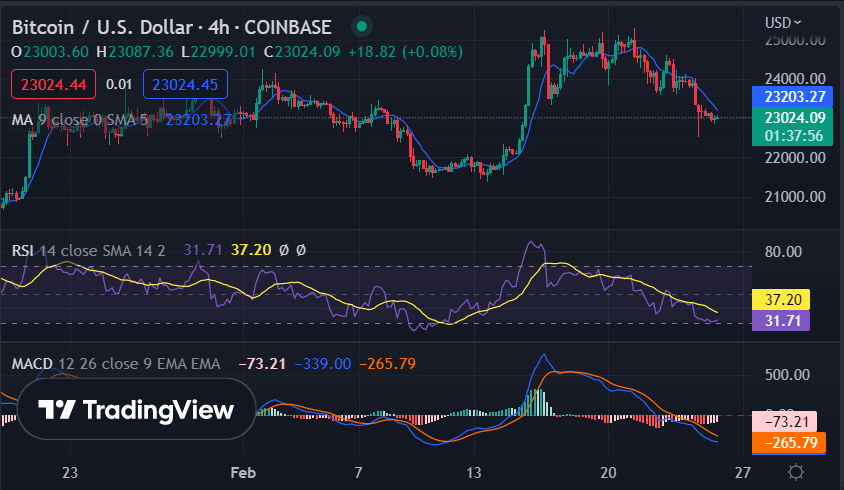

Bitcoin Price Analysis: BTC trades in $23,000 range as bear market persists

The 4-hour Bitcoin price analysis is supportive for the bears as well, as the price has downgraded to $23,047 as per the latest update. The last week’s price action has shown mixed results, but today the trends have turned in favor of the bears.

The moving average is quite above the price value at $23,203, with the 50-day MA and 200-day MA both in the negative zone. The MACD and signal line are declining and crossing each other and also showing signs of a negative crossover, which also supports the bearish sentiment. Finally, the RSI is in oversold territory and any rise above this level will be seen as a positive sign for the bulls.

Bitcoin price analysis conclusion

To summarize, the Bitcoin price analysis shows that bearish sentiment prevails in the market. The bears now dominate and any break above $23,289 could induce an uptrend. The support level remains at 22,906, while further downside can be expected in the event of a negative crossover.

While you wait for Bitcoin to move forward, check out our price estimates on XDC, Polkadot and Curve