Coinbase Crypto Exchange is in big trouble

Coinbase Inc.’s top executives have been sued for allegedly using insider information to sell their shares within days of the cryptocurrency platform’s IPO, avoiding over $1 billion in losses.

The largest US-based crypto exchange was listed directly on Nasdaq in April 2021.

What is the latest lawsuit about?

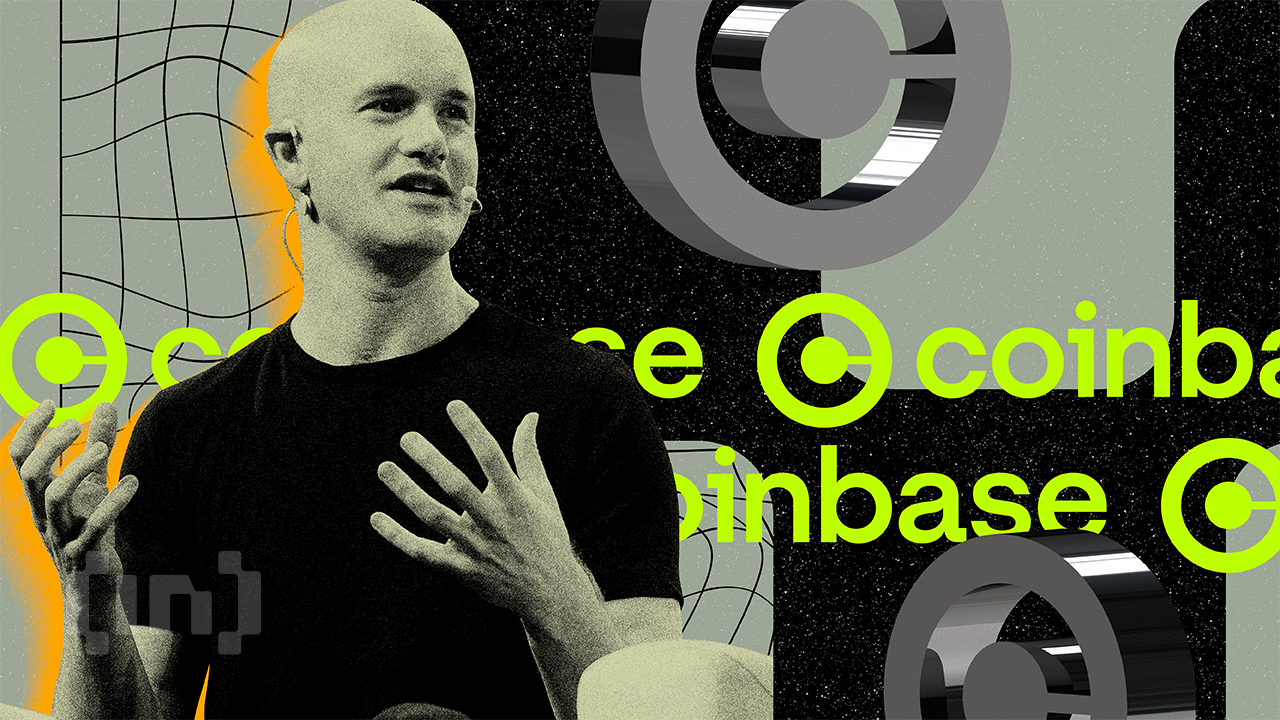

The lawsuit filed by an investor names the exchange’s chairman and CEO, Brian Armstrong, along with board member Marc Andreessen and other officers.

According to an investor named Adam Grabski, who has held shares in Coinbase since April 2021, the value of the shares fell by over $1 billion within five weeks of the alleged sale by Coinbase’s executives.

The lawsuit alleges that the defendants sold the stock before Coinbase-related bad news caused them to crash. This allegedly led to the exchange’s market value falling by more than 37 billion dollars.

The complaint alleges that Armstrong sold $291.8 million worth of Coinbase shares during the IPO, and Andreessen Horowitz sold $118.6 million. In an emailed statement, Bloomberg noted that the exchange had dismissed the allegations as meritless.

Reports make it clear that the investors claim that the executives made money from the company listing in a civil case.

Coinbase’s market capitalization passed $100 billion shortly after its debut. Share prices rose to $429 before falling to a low of around $310 shortly after the IPO.

Before Coinbase management disclosed “material, negative information that destroyed market optimism from the company’s first quarterly earnings release going forward,” court records for the complaint highlight that executives quickly sold $2.9 billion in shares after the IPO.

Mounting issues for Coinbase

Coinbase became known for the “Coinbase Effect”. This refers to certain crypto prices skyrocketing after being listed by the exchange. It faced criticism for this due to an alleged conflict of interest with Coinbase Ventures. The media accused Coinbase of using its venture capital arm to benefit from the listing by significantly increasing its investment up front.

In the meantime, the top center is also facing heat due to the loss of privacy. Bloomberg noted in a separate report that Coinbase is facing a proposed class action lawsuit. The lawsuit alleges that the cryptocurrency exchange illegally collects face masks and fingerprints of its customers. The alleged privacy violation allegedly violates Illinois’ Biometric Privacy Act. The lawsuit alleges that Coinbase harvests facial data from copies of government-issued IDs and selfies that users must upload during the account registration process under KYC norms.

The Securities and Exchange Commission (SEC) is also taking enforcement action against the US cryptocurrency exchange. On March 23, the company received the Wells Notice as the regulator intensified its campaign against cryptocurrencies.

During this time, Cathie Wood’s ARK Invest fund has purchased $8.7 million worth of Coinbase shares as of last week’s filing with the SEC. At the time of writing, the share price is down 4%. COIN is trading at $49.58 per share in premarket trading.

Disclaimer

In accordance with the guidelines of the Trust Project, BeInCrypto is committed to objective, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify the facts independently and consult with a professional before making any decisions based on this content.