Riot Blockchain: Another Top Bitcoin Mining Stock (NASDAQ: RIOT)

artiemedvedev

Riot Blockchain (NASDAQ:NASDAQ:RIOT) is another fast-growing Bitcoin (BTC-USD) mining company that I have yet to cover on Seeking Alpha.

Although I think Bitcoin will be accepted as money everywhere in the future, I think trading Bitcoin is stupid for US dollars at the moment.

However, I will give you several different Bitcoin related companies to choose from, and Riot is one of the stronger ones.

This article will discuss the pros and cons of investing in Riot Blockchain stock and share some key details about the company’s future prospects.

Rebellion overview

Riot Blockchain is an American Bitcoin mining company that mines Bitcoin in central Texas, USA. The company owns the only Bitcoin mining facility, Whitestone US, which has a total power capacity of 750 MW.

Riot’s Whitestone Bitcoin Mining Facility (riotblockchain.com)

The company has 46,658 Bitcoin miners deployed at a hash rate of 4.8 EH/S.

In the latest Q2 2022 quarter, Riot generated $72.9 million (up 112% YoY) million in revenue and mined 1,395 (up 107% YoY) Bitcoin in total.

Net loss was -$366.3 million for the quarter, mainly due to Bitcoin write-downs caused by a drop in Bitcoin’s price.

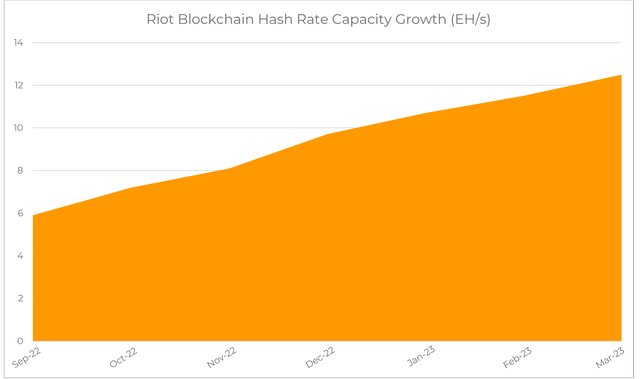

The company plans to increase its mining fleet to 115,450 ASIC miners by Q1 2023 with a hash rate of 12.5 EH/s.

Riot’s 2023 Hash rate growth (riotblockchain.com)

To boost future production, Riot announced a 265-acre, 1 gigawatt expansion site in Navarro County, Texas, with Bitcoin mining at the new facility still on track to start next summer.

Riot has 6,720 Bitcoin in its balance as of August 31, 2022.

The total value of Riot’s cash ($270 million) + Bitcoin holdings ($1343 million) equals $404 million. Investors pay almost a 3x premium on the company’s short-term cash holdings.

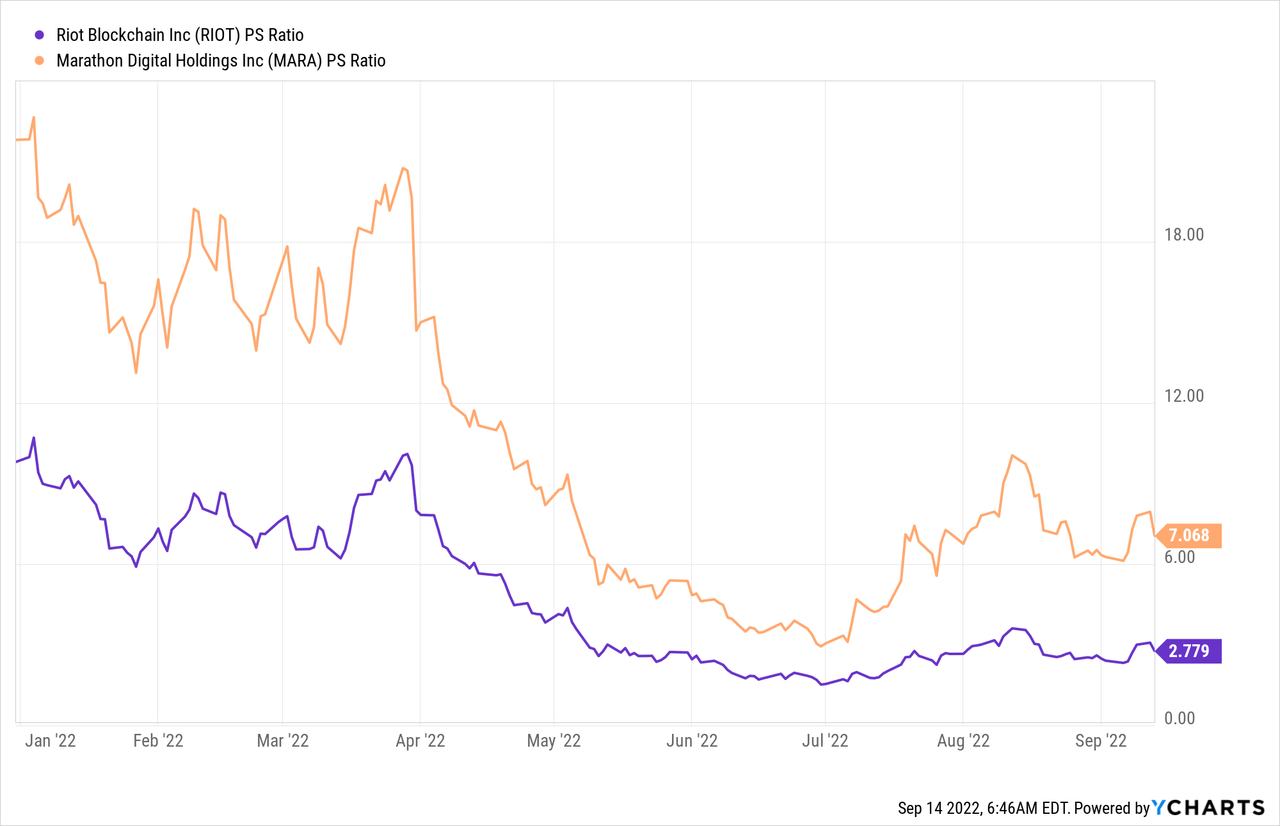

Riot trades at a price-to-sales ratio of 2.77, which is cheaper than Marathon Digital’s ( MARA ) 7 P/S ratio.

Of course, more investors are buying MARA shares because the company has almost 4,000 more Bitcoins on its balance sheet (10,311 as of August 31, 2022).

My opinion on Riot Blockchain

Riot produced some solid Bitcoin output in August 2022 during the current crypto bear market. Riot produced 374 Bitcoin (down 17% year-over-year) and earned $3 million in power credits that can be converted to Bitcoin.

Riot produced twice as much Bitcoin as its main competitor Marathon Digital Holdings, but the company has made some crucial mistakes in my opinion.

August 2022 Bitcoin production of the largest listed miners

| Company | August 2022 BTC Produced |

| Riot Blockchain (RIOT) | 374 |

| Marathon Digital Holdings (MARA) | 184 |

| Nuclear Science (CORZ) | 1,334 |

Source: Author, from company records

Riot sold 355 Bitcoin in August 2022 for a total of $7.7 million to bolster its balance sheet. The company had about $270.5 million in cash as of Q2 2022.

Riot’s constant decision to sell Bitcoin is probably the only reason I don’t own RIOT stock.

Bitcoin is the most important asset class of the future in my opinion, and I prefer to invest in companies that use a long-term HODL strategy.

Selling Bitcoin at current market prices doesn’t make sense because of all the fear and panic surrounding the crypto markets.

While Riot has an impressive output, I wish management would use more creative ways to raise capital, such as selling stock or taking on low-interest debt while Bitcoin prices are depressed.

Risk factors

Riot has several potential problems to face if things don’t go as planned.

- Bitcoin prices may be depressed over the next 6 months and Riot’s cash flow will be affected by the crypto bear market.

- Selling Bitcoin will cost the company a lot of money in the long run if Bitcoin soars past $100,000 into the 6 figures. Management may regret dumping a long-term hard resource for short-term gains.

- Riot can dilute shareholders through stock offerings to raise money in the future. Dilution is only a good option if a company HODLs using Bitcoin like MicroStrategy (MSTR) or Marathon Digital do.

- Inflation fears could force the company to delay the scaling of its mining facility, which would lead to lower production of Bitcoin.

- Energy prices may increase and decrease Riot’s Bitcoin production margins in the future.

Conclusion

Riot Blockchain is not my favorite Bitcoin mining stock to hold because I don’t like companies that sell Bitcoin to fund their operations. Every time you sell Bitcoin for US dollars, you are showing investors that you are long fiat currency and short Bitcoin.

However, I like Riot’s increasing production and give them a solid buy rating at these current price levels.

If crypto markets recover in 2023, Riot Blockchain is a solid stock to buy when others are scared right now.