Nike, D&G, Tiffany top list of brands earning revenue from NFTs

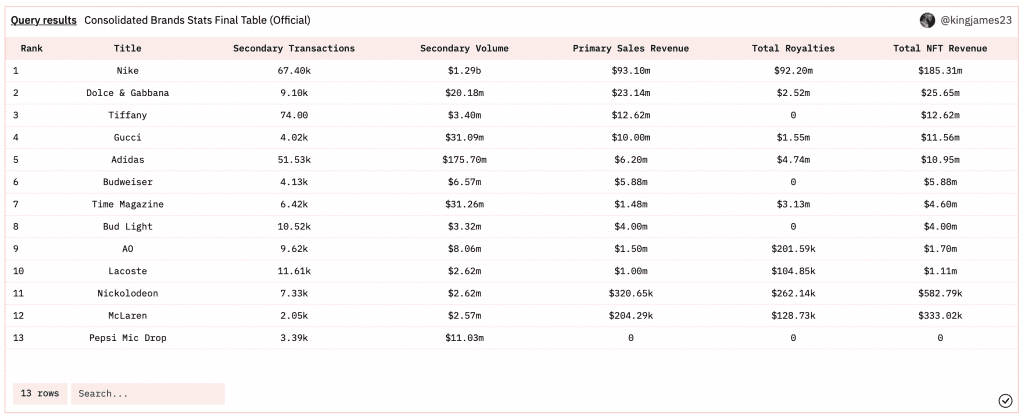

Nike, Dolce & Gabbana and Tiffany & Co. landed at the top of a list of major brands that generate revenue from non-fungible tokens (“NFTs”). According to new data from Dune Analytics, which sheds light on the primary sales revenue, secondary transactions and royalties associated with some of the early brands participating in the NFT space, Nike has generated a total of $185.31 million in revenue from NFT. collections, namely those from RTFKT, the digitally native brand it acquired in December 2021. (Noah Levine, who compiled the data, notes that Nike revenue includes RTFKT’s CloneX NFT sales and pre-acquisition royalties, as it “more accurately reflects the overall performance.”) In addition to primary revenue, Nike has a large number in terms of primary sales revenue ($93.1 million), secondary transactions (67.4,000), secondary volume ($1.29 billion) and total royalties ($92, 21 million).

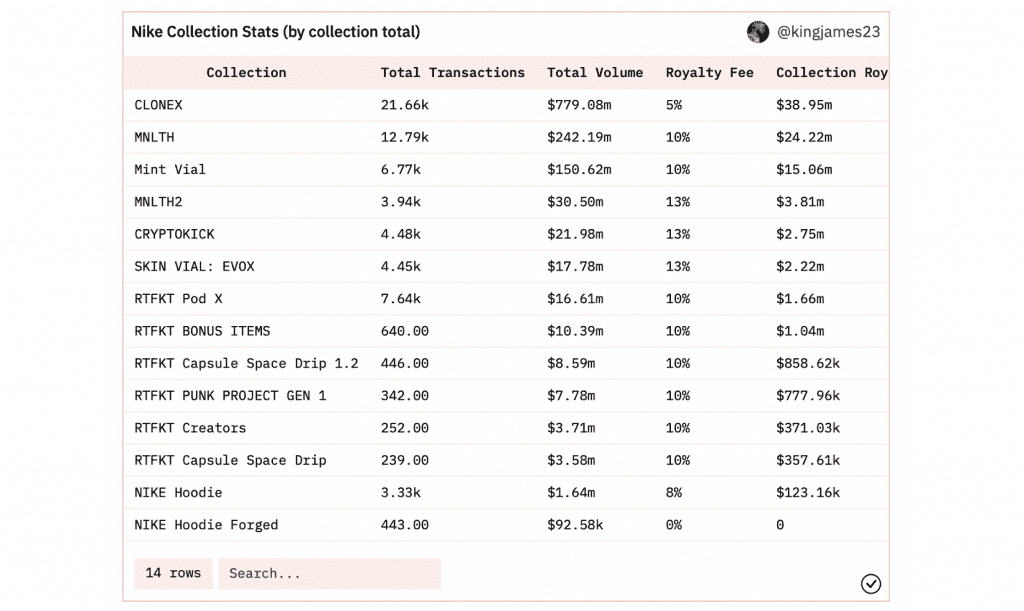

Of the individual Nike/RTFKT collections that have generated the most revenue to date, the CloneX NFTs top the list, with a primary sales volume of $779.08 million based on a total of 21.66,000 transactions, and $38.95 million in royalties due to a 5 percent royalty fee on subsequent transactions. This is followed by RTFKT’s MNLTH collection, which was released in April and led to 12.79K transactions and $242.19 million in volume, along with $24.22 million in royalties (based on a 10 percent fee.)

Second on the overall list is Dolce & Gabbana, which made headlines – and set records – in October 2021 for the launch of Collezione Genesi, a nine-part collection of fashion NFTs and physical garments that sold for the equivalent of nearly 5.7 million dollars. The Italian fashion brand has since expanded its NFT offerings, allowing it to generate $25.65 million in total NFT-related revenue, of which $23.14 million comes in the form of primary sales revenue and $2.52 million in royalties (on 9.11,000 transactions). And not to be overlooked, Tiffany & Co. ended up. at No. 3, with $12.62 million in primary sales revenue. This number is the result of the 250 NFTs that the LVMH-owned jewelry company offered and sold to CryptoPunk’s NFT holders this month for 30 ETH each. According to the Dune data, Tiffany & Co. does not generate royalties for secondary sales; the secondary volume for Tiffany & Co. However, NFTs are worth $3.4 million based on 74 secondary transactions.

The second highest ranked luxury brand on the list is Gucci at number 4 ($11.56 million in total NFT revenue), followed by adidas at number 5 ($10.95 million), which generated the bulk of this revenue from the collaboration ” Into the Metaverse” NFT project with Bored Ape Yacht Club, gmoney and PUNKS Comic last year. Budweiser took the number 6 spot ($5.88 million), Time Magazine at 7 ($4.60 million), Bud Light at 8 ($4 million), AO at 9 ($1.7 million), and Lacoste at 10 ($1, 11 million). Nickelodeon, the car manufacturer McLaren and Pepsi round off the list of 13 companies.

The revenue gains these companies are achieving in the web3 space are striking, as they are among some of the early examples of big brands wading into NFTs and successfully creating communities in this realm – both via expensive NFT offerings and those that are free for mint too.

Community building is no small part of the picture here, and may actually be more critical to brands when it comes to their NFT projects than the immediate revenue – at least at this stage. After all, $11.56 million in NFT-related revenue pales in comparison to the $11.07 billion in total revenue that Gucci generated in 2021, driven primarily by fashion and leather goods. The same goes for Nike, for example, with even the $185.31 million it generated from selling NFTs significantly exceeded by the $44.5 billion in sales — of mostly physical goods — it did in 2021 .

“I would argue that [revenue] is not the most important metric” for brands offering NFTs, digital marketing and data strategists Samuel van Deth stated in connection with the newly released data. “The impact on overall brand awareness, engagement, loyalty and customer lifetime revenue are probably the biggest reasons brands invest here.”

Both Nike and Gucci are good examples of how far brands striving for the metaverse can be embraced; Nike CEO John revealed in March that “a total of 6.7 million players from 224 countries have visited NIKELAND,” the Swoosh experience that Nike launched with the metaverse platform Roblox in mid-November 2021. Since then, the number of “visits” has passed 19 .9 million, according to Roblox.

At the same time, Gucci similarly experienced success with its “Gucci Garden” in Roblox, which reportedly drew more than 20 million Roblox players to visit the pop-up during the two-week virtual event in Spring 2021. (The virtual event also made headlines as proving the potential strength of the secondary market for virtual goods, as at least one of the virtual bee-embroidered Gucci Dionysus bags that the brand offered in its virtual store on Roblox had a resale price of 350,000 Robux – or about $4,115, which is more than $3,400 the retail value assigned to the bag by the Kering-owned fashion brand.)

In May, Gucci joined the likes of Nike and launched a more permanent experience on the platform called Gucci Town, which currently boasts over 33.4 million “visits”.

Taken together, the demand for these (and other) companies’ NFTs and the speed with which consumers are interacting with their virtual worlds on platforms like Roblox seem to demonstrate the reach that these ventures can have for companies and their efforts to engage with consumers—particularly of Gen- Z and Gen Alpha demographics – in this burgeoning medium. The reach of the virtual world and corresponding brand experiences goes far beyond the physical, enabling companies to not only reach more people, but to operate without any of the constraints that the ‘real’ world places on them – be it production capacity or need to limit distribution (or carefully configure prices) to maintain their images of exclusivity.

With the level of interaction – and successful brand awareness activities – at play and the potential for incremental revenue both now and down the line, it seems that NFTs and metaverse ventures more generally will continue to serve as an attractive medium for companies in the fashion, luxury , and beyond.