Kiwis Raise $80M: Fintech Empowers Latino Migrants

Fintech startup Kiwi has raised $80 million in new funding as it continues its mission to support often underbanked Latino migrants living in the United States.

Founded in 2020, Kiwi seeks to solve common financial challenges experienced by those moving to a new country – something founders Mariano Sanz and Alexander Schachter know all too well, being first-generation migrants to the US. Latino migrants often lack credit history and are excluded from the traditional financial system, the startup says. Kiwi circumvents this problem by providing these so-called “thin borrowers” with affordable capital that allows them to build their credit profiles and manage day-to-day expenses.

The funding secured by Kiwi includes USD 4.5 million in pre-Series A funding and a USD 75 million credit facility. Despite launching just three years ago, the fintech has already built a base of over 30,000 customers and plans to grow, launching new products that will establish it as a go-to place for underbanked Latinos to access financial services services.

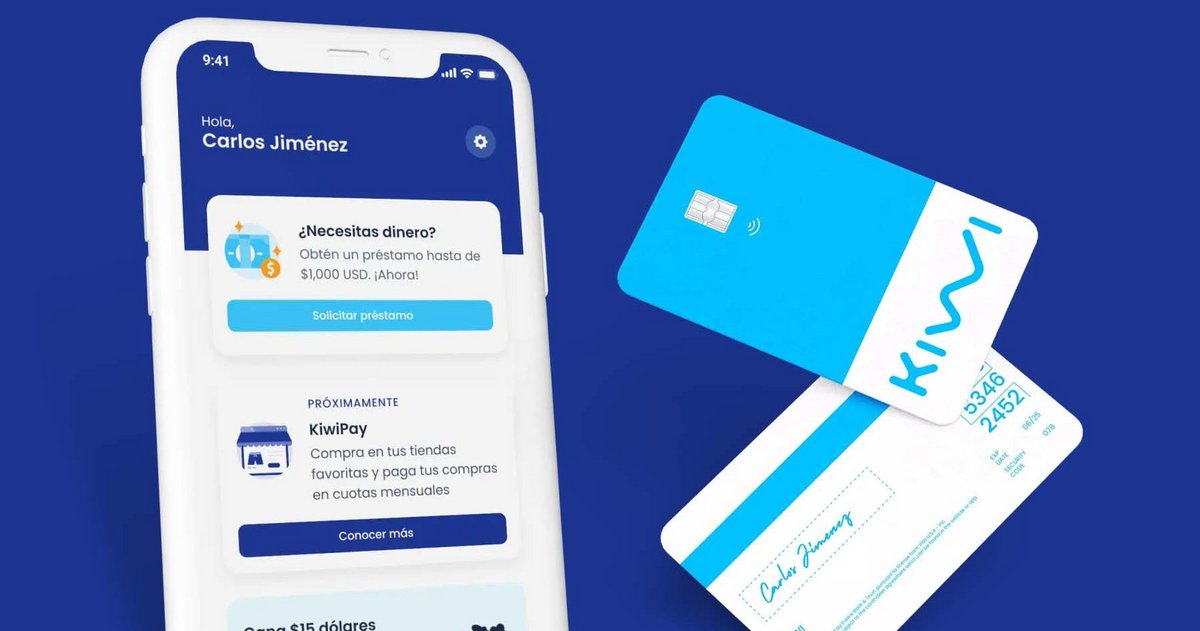

The product offering includes a credit card with a credit limit of up to USD 1,000, which allows customers to build their credit history and divide the cost of purchases into nine monthly repayments. It also provides a mobile app that allows people to keep track of their money.

Kiwis are targeting the largest minority group in America

“Our investors’ support is a testament to the value of our mission and the impact we have on our customers’ lives,” said Mariano Sanz, co-founder and CEO of Kiwi. “We are proud to equip underserved Latino immigrants with the tools and resources necessary to establish credit and secure access to capital.

“Addressing the difficulties that underbanked consumers face in joining the traditional credit system will have the most significant positive impact on their financial lives. We remain dedicated to growing and expanding our services to serve more customers across the U.S. and eventually Latin America.”

The demand is clear to see: according to market research, Latinos are both the largest and fastest growing minority group in the United States, accounting for over 18% of the country’s total population. The number of Latinos in the United States is expected to rise from 60 million to 100 million in the next few decades.

The debt financing was provided by i80 Group, an investment company that specializes in providing credit solutions to companies in the growth stage. “We are delighted to support Kiwi in their mission to promote financial inclusion among Latin American sub-banks,” said Edward Goldstein, CEO of i80 Group.

“Kiwi’s innovative approach to credit access and their strong customer reception make them a leader in the market and position them well to provide vital financial resources to people in need. We look forward to seeing their continued growth and success.”