Indian fintech going tough in 2023; PayU India is laying off 6% of its employees

Also in this letter:

■ PayU India lays off 150 employees, about 6% of its workforce

■ Taxman seeks information from foreign gambling companies online

■ The threat of “hacktivism” will increase in 2023, experts say

Indian fintechs are gearing up for a tumultuous 2023

The operating environment is expected to get tougher for Indian fintech startups next year amid a worsening funding winter and regulatory changes in recent months, several founders and investors told us.

Headwind: With the regulatory overhang on fintechs continuing and the Reserve Bank of India (RBI) taking steps to regulate various aspects of the sector, investors are expected to remain selective in their approach, leading to potential consolidation in the coming months, these people said .

Furthermore, with the release of the new digital lending guidelines, banks and non-banking finance companies (NBFCs) have also moved away from First Loan Guarantee (FLDG) partnerships, dealing a blow to smaller fintechs by forcing them to lend to higher costs , at least five founders and executives told ET.

Adding to the challenge, the Reserve Bank of India (RBI) has been strict in granting NBFC license to fintech firms, several entrepreneurs said.

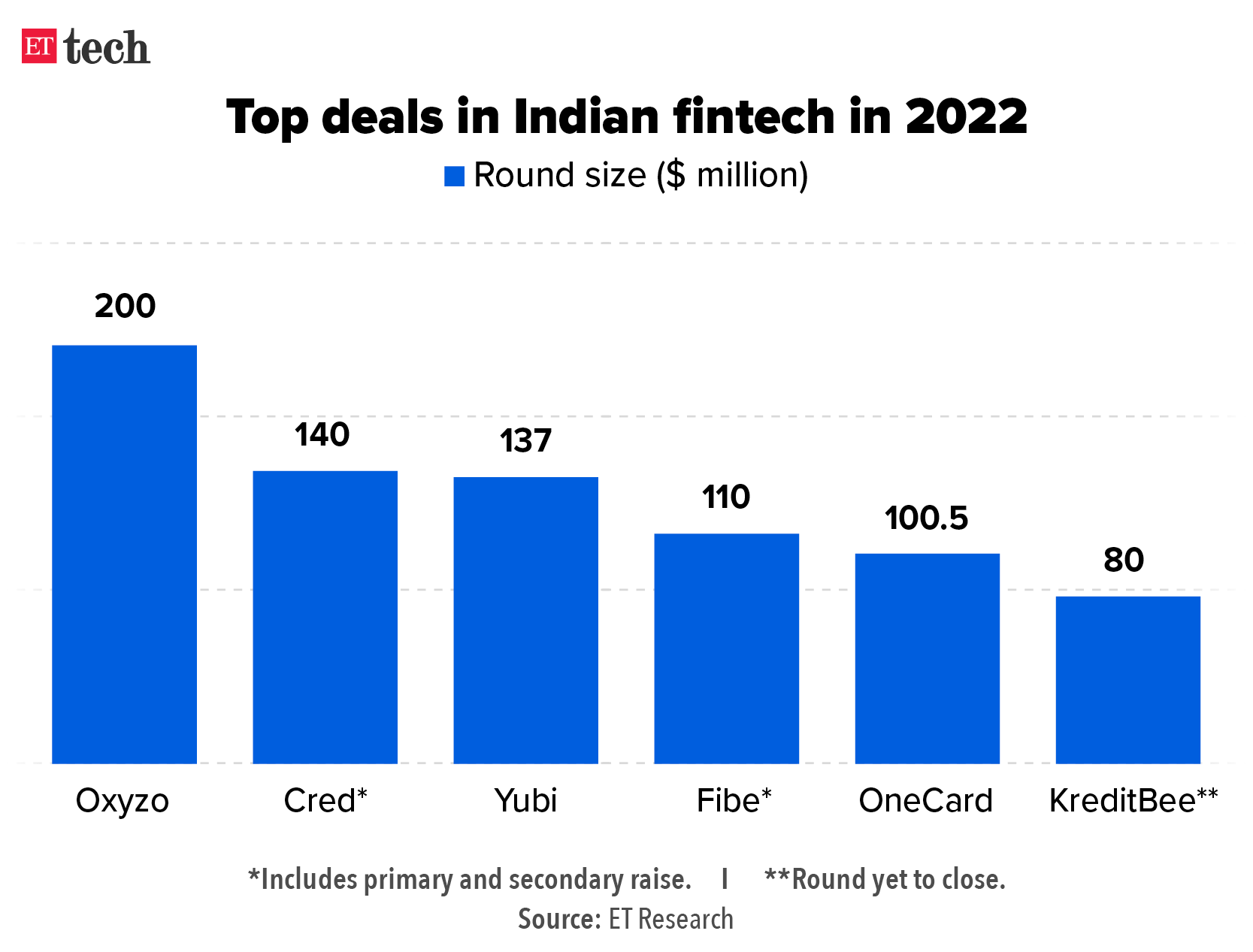

Fintech’s funding winter: According to data sourced from research firm Tracxn, funding in the Indian fintech ecosystem almost halved to approximately $5.7 billion in 2022 from $10.3 billion in 2021. However, investment in Indian fintech this year is still significantly higher than in 2020 , when the sector only raised $2.02 billion in equity financing.

Consolidation underway? We reported on November 25 that digital payments major PhonePe was close to acquiring buy-now-pay-later (BNPL) startup ZestMoney, signaling a potential consolidation wave in 2023.

“The regulatory landscape has made several practices such as FLDG unavailable to fintechs. This combined with the funding winter following globally means that the coming year is likely to see a dampening in terms of funding. Investors are expected to become more selective. There will be consolidation in the market, an increase in collaborative models with regulated entities and the exit of firms with weaker footholds, says Kunal Pande, partner, KPMG in India.

PayU India is laying off 150 employees, about 6% of its workforce

PayU India, the payments and fintech business of Prosus, has laid off 150 people or about 6% of its workforce as teams are being reorganized locally, ET has learnt.

Prosus is the investment arm of South African multinational Naspers, among the biggest backers of Indian internet start-ups including Swiggy, Byju’s and Meesho, among many others.

Details: A person familiar with the matter said the layoffs are spread across various teams and mainly affected PayU India’s unit Wibmo, a digital payment security and mobile payment technology firm it bought in 2019 for $70 million.

PayU India’s fintech businesses include Wibmo, LazyPay and Citrus Pay.

Statement: “Considering our highest strategic priorities, we are reorganizing teams across some businesses in India … Close to 150 employees, which is less than 6% of our total workforce, will be affected by the organizational realignment,” said a spokesperson for PayU. The company has no “plans for any major downsizing”, the spokesperson added.

Regulatory challenges: Earlier this year, the RBI said prepaid payment instruments (PPIs) should not be charged against lines of credit. This prompted PayU India’s lending arm LazyPay to make changes to its card offering, LazyCard. In July, we reported that LazyPay had to suspend its buy-now-pay-later (BNPL) payment product LazyPlus UPI amid increasing regulatory scrutiny of card-based credit fintech firms.

BillDesk deal canned: In October, Prosus finalized its $4.7 billion acquisition of online payment portal firm BillDesk by PayU Payments, which was first announced in August 2021. It decided to pull out barely a month after the Competition Commission of India (CCI) approved the outlines of the deal .

Skattemann seeks information from foreign online gaming companies

About half a dozen online gaming companies in Malta, the UK and Gibraltar have been contacted by Indian tax authorities to gather information about the number of users from India and the amounts they have spent.

What is the problem? Generally, importers of services pay GST on reverse charge basis.

However, in case of import of electronic information and database access or retrieval services (OIDAR) by unregistered, non-taxable recipients, the supplier outside India is liable for tax payment.

Thanks to the low value and high volume of the transactions, it is practically impossible to trace and identify citizens who send money abroad to bet or play on online platforms.

Penalty: Unlike the Rs 20 lakh threshold for collection of GST on domestic entities, tax applies to various cross-border services without any cut-off. A penalty of 15% can be imposed if the tax department believes that GST was “intentionally avoided”.

TODAY’S TWEET

The threat of “hacktivism” will increase in 2023, experts say

The threat of “hacktivism” – cyber attacks on government bodies motivated by political or social reasons – is set to increase in 2023, experts said, citing growing geopolitical and social conflicts. They asked for the strengthening of security measures around critical infrastructure.

On the way up: Hacktivism, while not a new phenomenon, has become more organized and sophisticated following the conflict between Ukraine and Russia, according to Check Point.

Over the past few months, various government agencies in India have been subjected to such cyber attacks. Some of these were triggered by disparaging remarks about the Prophet Muhammad. This prompted reactions from a group, DragonForce Malaysia, which targeted more than 70 government institutions in the largest attack of its kind in India.

Earlier this month, another group, Team Mysterious Bangladesh, claimed to have compromised the website of India’s Central Board of Higher Education.

Governments under attack: According to Check Point, governments are the second most targeted sector in the world. In the third quarter of this year, governments were on the receiving end of 1,564 weekly attacks on average, representing a 20% year-on-year increase, with governments in India reporting 3,354 attacks per organization per week over the past six months.

Shift towards cost cutting in contract negotiations with customers: Genpact CEO

Around two-thirds of deal talks with customers are now related to reducing costs amid macroeconomic uncertainty, a stark contrast to the situation over the past three years, said the CEO of Genpact, one of the world’s top business process management (BPM) firms. ) companies.

The big flip: Until around seven years ago, up to 70% of BPM customer spend would be skewed towards cost savings, with the remainder going towards growth, risk and resilience management solutions. Over the past three years, this equation has flipped due to pandemic-driven demand, NV Tyagarajan told us.

“If I now look at our demand outlook today versus 12 months ago, one of the biggest changes that has happened is many of our customers and their industries are concerned about a slowing world in terms of growth,” he said.

Customers are also worried about inflation even though it may be lower than a month ago. “But it’s still higher than in the past, and interest rates are higher. Therefore, costs become much more important today than they were a year ago,” said the head of the NYSE-listed company.

Other top stories by our reporters

Top teams at Google are looking for the right “data” solutions: A first-class team at the tech giant Google not only finds ways and means to democratize access to information, but also to make it more intuitive by using cutting-edge solutions. Read on to find out more.

Meet CTOs at the forefront of change at Wipro and Kotak Mahindra Bank: While one is a rare breed in the technological landscape, the other is trying to future-proof a financial company through an end-to-end technology transformation.

Global elections we read

■ Elon Musk’s finances complicated by falling fortune, Twitter pressure (WSJ)

■ Everyone uses Google Photos wrong (wired)

■ 2022’s Most Spectacular, Horrifying and Sad NFT Disasters (Rest of the World)