Grayscale Bitcoin Trust: Will They Win the ETF Case? And when? (GBTC)

The Aeon

Grayscale Bitcoin Trust (OTC:GBTC) holds Bitcoin for investors in its trust. It trades at a significant discount to NAV, as it is currently a relatively high fee and complex way to own Bitcoin, and currently there is no way to close the discount. However, shades of gray has proposed converting the Trust into an ETF that would collapse any discount, though the SEC blocked that plan, and GBTC is appealing the decision.

Here, for example, is an ETF with a 2%+ fee that is traded on NAV. Trading very close to NAV is a function of the ETF creation/redemption structure and should occur regardless of the fee structure or underlying assets.

The courts will rule on Grayscale’s case, perhaps in the summer of 2023. I’ve written about this trade before, but now I want to get into more quantitative details about win/loss probabilities, base rates and times. Please refer to previous article for a more general overview and quick reaction on the day of the oral argument, if necessary.

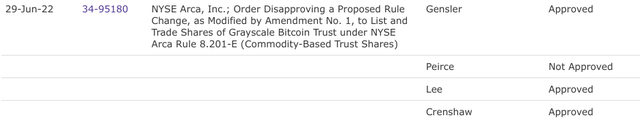

The SEC was not unanimous in its decision on the Bitcoin ETF

First, it is interesting that SEC Commissioner Hester Peirce did not approve the ruling that did not approve the spot Bitcoin ETF. Peirce does not agree with the other commissioners reasonably often, so this is certainly not unique behavior. Still, it’s interesting that even the SEC isn’t entirely on board with its decision to block a spot Bitcoin ETF. It suggests that perhaps even the SEC can see cracks in its own position.

Peirce disagrees with other SEC commissioners (SEC Commission votes:

The SEC loses in court

Historical data suggests that the SEC may well lose the case against Grayscale. A wonderful resource here is Cornerstone Research, they analyze the enforcement actions of the SEC and the SEC releases its own report. Overall, the SEC tends to win about 70% to 80% of its lawsuits, depending on the period studied.

However, this data is not exactly comparable to the Bitcoin ETF case that Grayscale brings here, because many of these cases are related to things like insider trading prosecutions or the Foreign Corrupt Practices Act. These are cases the SEC chooses to litigate rather than dismiss or settle.

Decisions about how to regulate cryptocurrency are a different animal, and Grayscale is bringing this case to court, not the SEC, and doing so at a time when criticism of the SEC for its handling of crypto is mounting.

Still, the SEC can certainly lose in court, just not very often. The SEC has lost cases related to Wal-Mart and a case about computer fees. These are arguably more similar to the Grayscale case in terms of challenging the SEC’s regulatory actions. So the SEC doesn’t lose much in court, but that’s because of the selection effect in the cases it brings to trial.

For the spot Bitcoin ETF case, it is Grayscale, not the SEC, that is bringing this to court and is using a former attorney to do so. That could tip the odds in Grayscale’s favor. At the same time, the SEC’s overall approach to crypto regulation has come under attack from the Senate. Of course, there are political undertones here, but senators pick their battles and the SEC’s crypto regulation has arguably been inconsistent and vague. Politics should not directly affect the Court, but there are undoubtedly others who see the same inconsistencies in the SEC’s actions that the Court could address.

The Strength of Shades of Grey’s Argument

Grayscale seems to have a very strong legal argument. Yes, regulators have a lot of autonomy to regulate their field, by design. However, there are some safeguards against arbitrary regulation. This may be the strongest pillar in Grayscale’s case.

It seems arbitrary for the SEC to have approved Bitcoin futures ETFs like the ProShares Bitcoin Strategy ETF (BITO) and not to approve Grayscale’s proposed Bitcoin spot ETF. That’s because if you’re concerned about “fraudulent and manipulative practices” in the Bitcoin spot market, which the SEC clearly is, then it’s pretty hard to argue that the futures market is okay and the spot market isn’t, because ultimately any futures market. literally becomes the spot market at the end of the contract’s life.

The technical point that can help the SEC

A technical point in favor of the SEC (you can read their first argument here) is that Bitcoin futures are operated by the CME group. It’s a platform the SEC has a strong relationship with for what it calls “surveillance sharing.” This means that the SEC can get direct information from that exchange about who is trading Bitcoin futures, as a way to spot the culprits if market manipulation is occurring.

With spot Bitcoin, almost by design, the SEC does not have the same ability to track market participants and their trades. If there is manipulation, the SEC may not know who to go after.

Again, Grayscale argues that the creation of a spot Bitcoin ETF gives the SEC more insight into who is trading Bitcoin, not less, as more Bitcoin-related liquidity will trade via the NYSE. However, this technical argument is likely what will help the SEC prevail. Also, for what it’s worth, other spot Bitcoin ETFs trade on other non-US exchanges and are apparently fine, as well as many “direct” Bitcoin offerings from entities that the SEC regulates.

The judges – One appears before

Sri Srinivasan, Neomi Rao and Harry Edwards will decide the case. Both parties essentially need at least 2 judges in support to win (ie a 3-0 vote or a 2-1 vote). From her questioning during oral argument, Rao appears to lend some support to Grayscale’s case. That’s encouraging, but at least one other judge would need to align with her, and that’s less clear. We’ll come back to that when we run the numbers below.

Time for an opinion – summer 2023

Looking at previous cases involving the SEC, a ruling between July and September seems most likely. It is based on looking at similar cases involving the SEC and the courts and the gap between oral argument (held in March 2023 in this case) and an opinion. The CEO of Grayscale has said to expect a decision before the end of Q3, which I think like a lot of CEOs, is baking in some conservatism as a decision could come earlier, but he doesn’t want to make a statement that is contradicted by events.

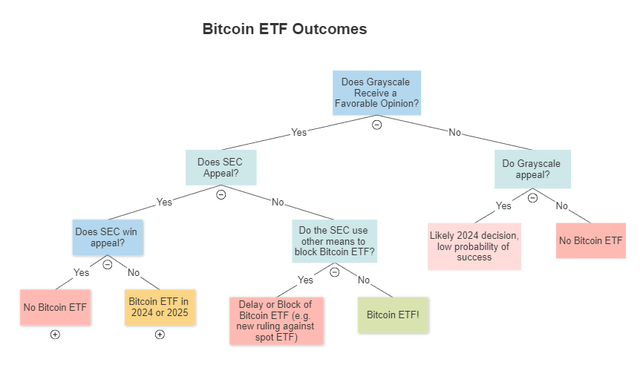

However, an appeals process can delay any final decision by up to a year, and this has implications for the investment case. The biggest question is whether Grayscale receives a favorable opinion, but the second question is whether the SEC would then appeal that decision.

Potential outcomes

Potential Case Outcomes (Author’s Analysis)

So for us to see a Bitcoin ETF in the summer, Grayscale must win the case and the SEC must not appeal. Other outcomes mean that the discount to NAV will continue for at least one year or possibly indefinitely.

Probability of winning the case

Now we will estimate the result in different ways

| Method | evaluation | Probability of grayscale favorable opinion |

| Previous SEC legal outcomes | Historically, the SEC often wins in court, although these types of cases are less proven for the SEC vs. say insider trading, so the lower end of the historical range takes | 30% |

| Assessment of judges’ questions during oral proceedings | One judge Rao appears in favor, others less clear, need 2 judges for a positive opinion. 50% chance that another judge disagrees, and if both disagree Grayscale loses. (ie 1 – (50% x 50%) | 75% |

| The strength of legal argument | It seems difficult to argue that a spot market can be manipulated and that the futures market will not be (as the SEC claims). Their technical argument about market surveillance may prevail, but the court may well want to hold the SEC in check here as they seem “arbitrary” in their behavior and are definitely on the fringes of consistent behavior | 70% |

| Simple average of the three methods above | Average over three values | 58% |

So even if Grayscale wins, will the SEC use an appeal or other means to block a Bitcoin ETF? I think this is possible, but given all the heat the SEC is getting over crypto regulation, I don’t know if the spot Bitcoin ETF is a hill they want to die on when a futures Bitcoin ETF already exists. Therefore, I think there is only a 25% chance that the SEC will pursue this further if they lose the case. I’m also assuming for simplicity that shades of gray don’t win on appeal if the initial opinion goes against them.

Therefore: 58% x 75% (ie 1-25%) = 43.5% chance of spot Bitcoin ETF (note: false precision, obviously)

Outcome for GBTC

| Outcome | Go back to the investors | Logic |

| Spot Bitcoin ETF | +67% | Current 40% discount to NAV collapses to 0% (how ETFs work) |

| No Spot Bitcoin ETF (Current Trust Structure) | -17% | Current 40% discount to NAV increases to 50% (biggest historical NAV discount is 47%, assume there is some selling as a Bitcoin trust is basically an orphan security when there are many better/cheaper ways to own Bitcoin ) |

Weighted average result +19%

| Probability | Return | Probability-weighted return | |

| Find Bitcoin | 43.5% | +67% | +29% |

| No Spot Bitcoin | 56.5% | -17% | -9% |

| Weighted outcome | +19% |

Conclusion

This is an interesting, uncorrelated setup. The expectation of an estimated 19% return over the next few months seems tempting, which is why this is among my biggest positions at the moment. Of course, that said, if the above model turns out to be accurate, you’re still more likely to lose moneybut the upside more than outweighs that risk in expected value.

Risks

- Bitcoin is an extremely volatile asset historically, it has gone up almost 50% YTD, and such fluctuations are not uncommon. Even if the above analysis comes out positive, you can lose money because Bitcoin falls in value during the investment period. Or indeed, Bitcoin price fluctuations can make a negative result even worse

- Although the expected value is favorable here, it is still more likely to lose money than to make money if the above analysis is correct

- The above analysis attempts to quantify qualitative variables, which can be risky and create an illusion of false precision

- There are other edge cases that have not been considered in the analysis above. For example, one is that shades of gray receive a positive opinion but adhere to a trust structure regardless

- Many legal decisions are slow, and it is possible that legal delays here could make the expected return unattractive on a time-weighted basis

- If Grayscale receives an unfavorable opinion, many participants in this trade may sell out, causing GBTC to trade further below NAV than historically

- There is also a risk that Bitcoin held by GBTC will be stolen or otherwise lost, or that Bitcoin will become technically obsolete

Editor’s note: This article was submitted as part of Seeking Alpha’s Best Investment Idea For A Potential Recession contest, which runs through April 28. This competition is open to all users and contributors; click here to find out more and submit your article today!

Editor’s Note: This article discusses one or more securities that are not traded on a major US exchange. Be aware of the risks associated with these stocks.