Ethereum volatility likely on the horizon as options expire

A large amount of Bitcoin and Ethereum options contracts are about to expire. Moreover, these events often cause price volatility for the underlying assets.

There has been a significant shift in derivatives trading activity, with Ethereum options trading surpassing Bitcoins.

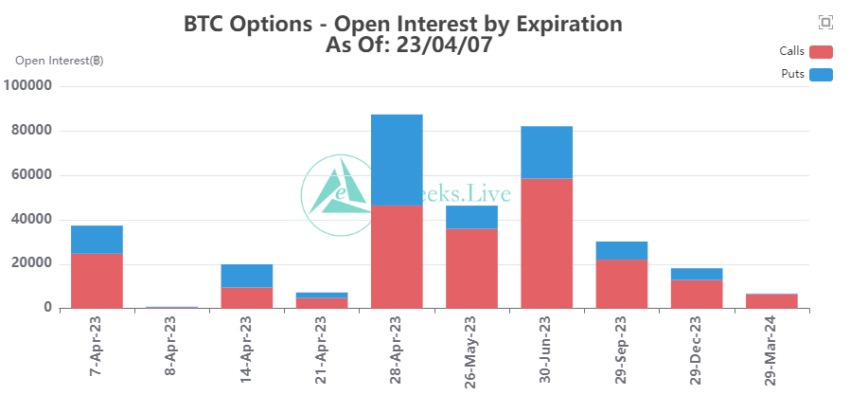

37,000 Bitcoin options are about to expire with a face value of just over $1 billion. However, this number is overshadowed by the 256,000 Ethereum options that also expire this month. Their nominal value is a whopping 4.8 billion dollars.

Industry analyst Colin Wu commented on the massive shift in derivatives trading.

“Shanghai Upgrade Coming, Ethereum Options Trading Outpaces Bitcoins For First Time In More Than A Month.”

Ethereum options expire

Ethereum options are derivative contracts that allow traders to speculate on the price of ETH. They allow traders to buy or sell Ethereum at a specific price, the strike price, on a specific expiration date. They are also more flexible than futures which have fixed expiry dates.

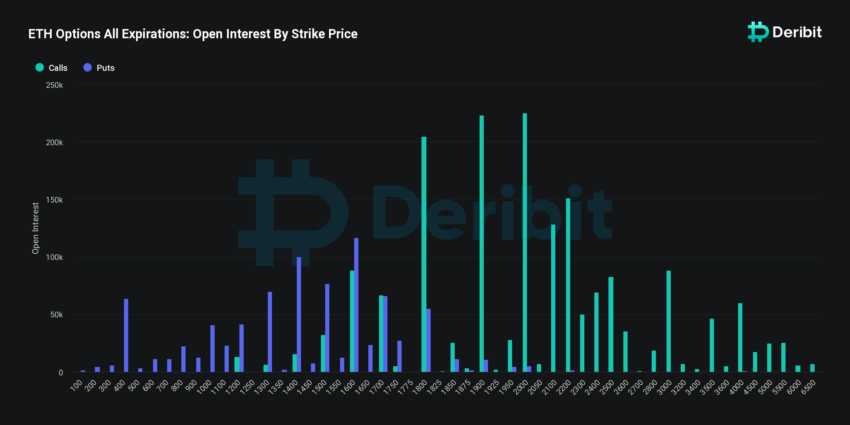

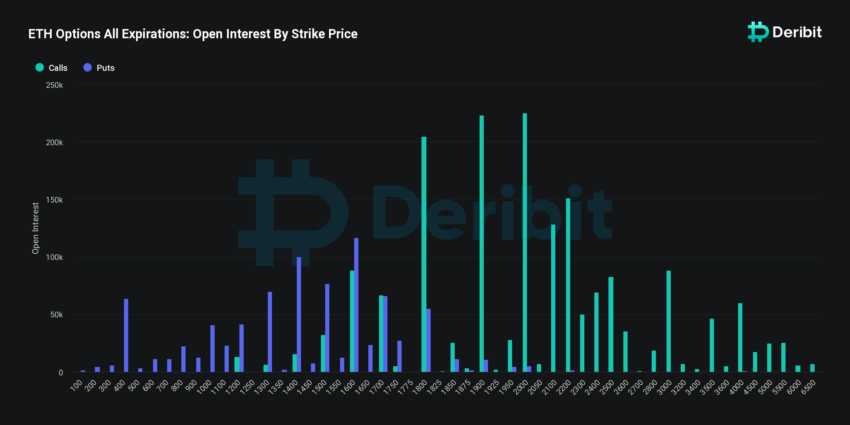

According to Deribit, Ethereum Open Interest (OI) stands at nearly 2.6 million open contracts that have not yet been settled.

Furthermore, there is a put/call ratio of 1.09 for Ethereum. The put/call ratio is calculated by dividing the number of traded put options (short) by the number of traded (long) option contracts. A number higher than 1 is bearish as more traders buy short (sell) contracts than long (buy).

The maximum pain point for Ethereum options is $1,800. This describes the strike price with the most open contracts. It is also the price at which the asset would cause economic losses to the largest number of option holders at expiration.

For Bitcoin options, things look a bit more bullish with a put/call ratio of 0.51. This suggests that more long contracts are bought than short contracts.

Additionally, BTC max pain price is $28,000, quite close to where the asset is currently trading.

Crypto Market Outlook

Crypto markets have remained flat on the day, with a total capitalization of around $1.2 trillion. Furthermore, there has been very little movement in the crypto top ten apart from Dogecoin (DOGE), which has dumped 8.6% following Elon Musk’s Twitter intervention.

Ethereum is currently trading hands at $1,870, cooling off from mid-week and a seven-month high of $1,920.

Further downward pressure may be applied when all of these Ethereum options contracts begin to expire this month.

Disclaimer

In line with Trust Project guidelines, this price analysis article is intended for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, objective reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions.