A year ago, El Salvador became the first country to make Bitcoin legal tender – alongside the US dollar, which the Central American country adopted in 2001 to replace its own currency, the colón.

President Nayib Bukele, a cryptocurrency enthusiast, promoted the initiative as one that would bring several economic benefits.

Making Bitcoin legal tender, he said, would attract foreign investment, generate jobs and help “push humanity at least a little bit in the right direction.”

His ambitions extended to building an entire “Bitcoin city” – a tax-free haven financed by issuing $1 billion in government bonds. The plan was to use half of the bond proceeds on the city, and the other half to buy Bitcoin, with the supposed surplus then used to pay back the bondholders.

Salvador Melendez/AP

Now, a year later, there is more than enough evidence to conclude that Bukele – who has also called himself “the world’s coolest dictator” in response to criticism of his creeping authoritarianism – had no idea what he was doing.

This bold economic experiment has proven to be an almost complete failure.

Make Bitcoin legal tender

Making Bitcoin legal tender meant much more than allowing Bitcoin to be used for transactions. It was already possible, as it is in most (but far from all) countries.

If a Salvadoran wanted to pay for something in bitcoins, and the recipient was willing to accept them, they could.

But Bukele wanted more. Making bitcoins legal tender meant a payee had to accept them. As 2021 Legislation stated, “every economic operator must accept Bitcoin as payment when it is offered to him by the acquirer of a good or service”.

Read more: Could Bitcoin be a real currency? What’s wrong with El Salvador’s plan

To encourage Bitcoin uptake, the government created an app called “Chivo Wallet” (“chivo” is slang for “cool”) to trade bitcoins for dollars without transaction fees. It also came preloaded with $30 as a bonus (median weekly income is about $360).

Despite the law and these incentives, Bitcoin has not been embraced.

Met with little enthusiasm

A nationally representative survey of 1,800 Salvadoran households in February indicated that only 20% of the population used the Chivo Wallet for Bitcoin transactions. More than twice as many people downloaded the app, but only to charge US$30.

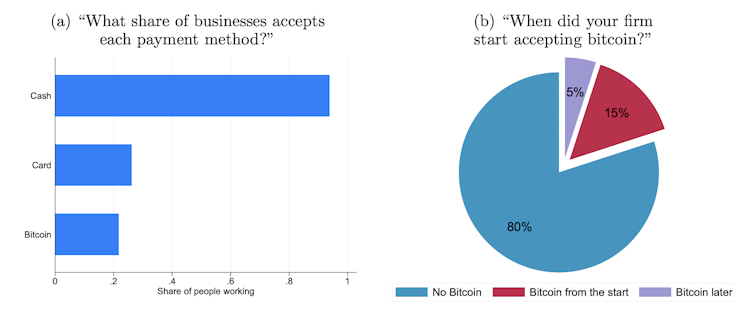

Among respondents who identified themselves as business owners, only 20% said they accepted bitcoins as payment. These were typically large companies (among the top 10% companies by size).

Business approval of Bitcoin in El Salvador

NBER Working Paper 29968, CC BY

A survey for the El Salvador Chamber of Commerce in March found that only 14% of businesses transacted with Bitcoin.

Make big losses

Fortunately for the Salvadorans, nothing has come of the $1 billion Bitcoin bond scheme. But the Bukele government has still spent more than $100 million buying bitcoins – which are now worth less than $50 million.

When Bukele announced his plans in July 2021, Bitcoin’s value was approximately $35,000. When the law went into effect on September 7, 2021, it was around $45,000. Two months later, it peaked at $64,400.

Now it is traded for around 20,000 dollars.

Bukele has made self-congratulatory tweets about “buying the dip”, but almost all bitcoins bought by the government have been for more than US$30,000, at an average price of more than US$40,000.

A year ago, Bukele encouraged his citizens to keep their money in bitcoins. For anyone who did, the losses would be devastating.

Incorrect analyses

Bukele’s misunderstanding of Bitcoin – and economics more generally – has been demonstrated repeatedly.

In June 2021 tweeted: “Bitcoin has a market value of $680 billion. If 1% of it is invested in El Salvador, it will increase our GDP by 25%.

This suggests that he seemed to believe that Bitcoin was some kind of investment fund. It also showed that he did not understand GDP. Foreign investment is not part of GDP. There has been no increase in foreign investment or GDP.

In January 2022 chirping he claimed a “giant price increase is only a matter of time” because there will only be 21 million bitcoins while there are 50 million millionaires in the world. “Imagine when every one of them decides they will own at least ONE #Bitcoin,” he proclaimed. Bitcoin’s value has since halved.

The rest of the world is not impressed

The Bitcoin plan has negatively affected El Salvador’s credit rating and relationship with the International Monetary Fund. With investors more cautious about lending to the country, local borrowers have had to offer higher interest rates.

In January, the IMF urged El Salvador to reverse Bitcoin’s legal lender status due to the “significant risk to financial and market integrity, financial stability and consumer protection”. Bitcoin is notorious for its use in fraud and other illegal activities, as well as its volatility.

Buccle tweeted a dismissive response involving a Simpsons-themed meme.

TwitterCC BY

This seems particularly hasty, given that El Salvador has sought a loan of more than $1 billion from the IMF.

International credit rating agency Fitch has downgraded El Salvador’s credit rating this year, citing concerns about its Bitcoin policy.

Read more: Cryptocurrencies are great for gambling – but lousy at freeing our money from big central banks

No other country with its own currency, not even those like Zimbabwe and Venezuela with discredited currencies, has followed suit and made Bitcoin legal tender.

Given El Salvador’s record, that’s a unique willingness.