Can Bitcoin be used as real money?

Bitcoin is popular and it can be assumed that many investors may have weighed the possibility of parking some money in it. Many may have decided not to, but there are also some staunch supporters, also referred to as “hodlers”. But all this makes Bitcoin and later cryptocurrencies like Ether speculative assets. Was this why Bitcoin’s creator/s introduced this blockchain-based ‘currency’ in 2009?

There is a reason why cryptocurrencies have ‘currency’ in their name. The first half, crypto, refers to cryptography or the technique of storing information and data. Creators like Satoshi Nakamoto of Bitcoin wanted cryptography-backed virtual currencies to be used as money. Even big-ticket backers like Elon Musk have also subscribed to this idea, and Tesla has experimented with using Bitcoin and Dogecoin as payment methods. But can an investor holding Bitcoin be sure that it is accepted as money anywhere in the world? Let’s explore.

Bitcoin as money or speculative asset or both

In a whitepaper, believed to be written by Nakamoto, Bitcoin is proposed as a “peer-to-peer version of electronic cash”. It talks about “online payments” and also how Bitcoin can eliminate the need for a financial institution that usually acts as an intermediary between a payer and a payee. In the document, there is also a mention of how peers will support the Bitcoin transaction network and how incentives will accrue to them in return. The paper has a heavy title on the idea of using Bitcoin as money, and notably, words like investment or asset do not appear in it.

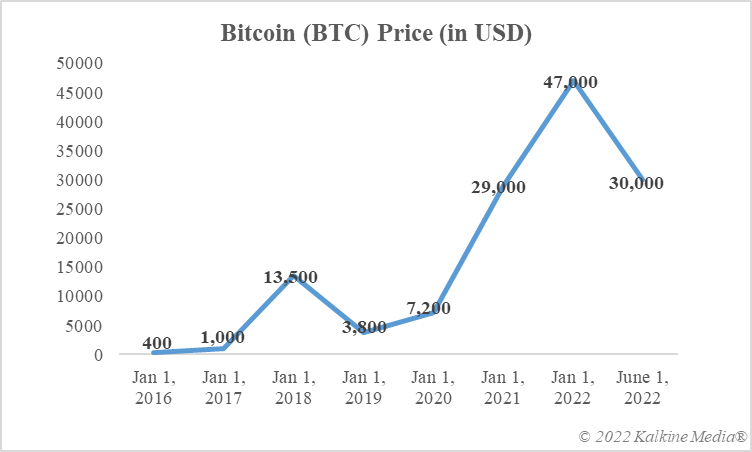

However, it seems that over time, many have ignored the original idea and intention of Satoshi Nakamoto. Today, instead of being a widely adopted means of payment or money, Bitcoin has ended up more of a speculative asset that is traded for capital gains. It is sometimes compared to listed stocks, at times to gold, but at the same time, the intense price volatility of Bitcoin makes it a very risky asset for its supporters.

That said, a few countries have begun experimenting with using Bitcoin as legal tender. El Salvador, a small economy in Central America, and the Central African Republic, one of the world’s poorest nations, use Bitcoin as legal tender. This theoretically means that merchants in these two nations will readily accept Bitcoin from any payer. However, the situation on the ground may be different. This is because many sellers are wary of the unpredictability of Bitcoin, which makes it less attractive as a store of value like the US dollar or Australian dollar.

Stated data of CoinMarketCap.com

Where can Bitcoin be used as money?

Bitcoin’s use as money depends more on a payee than a payer. The payee is usually a merchant who sells goods or a service. In particular, when airBaltic approved the booking of tickets with Bitcoin in 2014, it became the first airline in the world to do so. Recently, there were news reports that Emirates, the UAE’s most prominent airline, may soon add Bitcoin as a payment method for customers. Major airlines, whether in the US or Australia, have yet to experiment with the use of Bitcoin as a payment method.

Tesla, the electric car company run by billionaire Elon Musk, first announced acceptance of Bitcoin as a payment method, but soon dropped the idea. Tesla later declared that it would accept Dogecoin, a meme cryptocurrency, for the purchase of the items. In Australia, retail brand OTR, which operates fuel and convenience stores, has recently started accepting Bitcoin. All over the world, the scene is almost the same – Bitcoin is accepted as money only by a handful of businesses. In some countries, such as China and Turkey, payment in Bitcoin or other cryptocurrency is completely prohibited.

Any business that accepts Bitcoin today may tomorrow decide to go back, just like how Tesla changed its stance last year. In other cases, a business may even expand its scope. For example, airBaltic now accepts some other cryptocurrencies, including Ether and Dogecoin, for ticket booking. Separately, there are Bitcoin ATMs in countries such as the United States and Australia. But these act more as a means of buying the cryptocurrency using fiat currencies like USD or AUD and holding Bitcoin as a speculative asset.

The bottom line

Money issued and controlled by any central bank, such as the Fed or the Reserve Bank of Australia, is the most readily accepted form of payment in today’s financial world. This money is also called fiat currency and is considered a reliable store of value. Bitcoin, on the other hand, can increase or lose value sharply over a short period of time. This is why most countries and companies are not keen on using it in payments. A few companies here and there have independently experimented with Bitcoin. For now, Bitcoin has very limited uses as money and a very long way to go to become what Satoshi Nakamoto envisioned – electronic cash.

Risk Disclosure: Trading cryptocurrencies involves high risks, including the risk of losing part or all of your investment amount, and may not be suitable for all investors. The prices of cryptocurrencies are extremely volatile and may be affected by external factors such as economic, regulatory or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) are subject to change. Before deciding to trade in financial instruments or cryptocurrencies, you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience and risk appetite, and seek professional advice where necessary. Kalkine Media does not and cannot represent or warrant that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept responsibility for any loss or damage resulting from your trading or your reliance on the information shared on this website.