Multicoin Capital Says More Pain Ahead, How Will Bitcoin Price React?

- The Securities Commission of The Bahamas (SCB) stated that it had transferred assets from FTX’s subsidiary, FTX Digital Markets, to another digital wallet.

- The investment company Multicoin Capital believes that the crypto market will deteriorate further.

The Bitcoin (BTC) price is currently trading at $16,850 and needs to achieve a 34% rally to climb back to the mid-June price of $22,500.

The FTX exchange’s position continues to deteriorate as the bankrupt firm faces more scrutiny from regulators. The consequences of the stock exchange’s collapse have led to serious disruptions in the crypto market. In the wake of this situation, Bitcoin holders may decide to protect their investments by selling them out at this price level.

FTX’s problems run deeper

FTX was in the crosshairs of the Securities Commission of the Bahamas (SCB) earlier this week. As reported by FXStreet, the regulator joined forces with the Financial Crimes Investigation Branch to investigate FTX’s misconduct. The development came after FTX stated that it would begin facilitating the withdrawal of Bahamian funds at the behest of SCB, which the commission soon refuted.

However, recent revelations show that SCB had already taken action against the exchange days before the investigation began. In an announcement on November 17, the regulator stated that it took control of FTX Digital Markets (FDM) assets by transferring them to a digital wallet controlled by SCB. The commission stated that they did so to keep assets safe and protect customers’ interests.

The move makes sense as FDM’s management of its assets had become worrying, and the same was also confirmed by the stock exchange’s liquidators. According to court documents, the Joint Provisional Liquidators suggested that the bankruptcy exchange may have committed serious fraud and mismanagement.

This makes things worse for FTX and the crypto market as well, a sentiment shared by investment firm Multicoin Capital. The crypto venture firm informed its investors in a letter on Thursday that further falls are expected before the market recovers.

Multicoin went on to state that the fund had already dropped 55% this month as they had too many assets on FTX. The fund believes it may be able to recover some of its funds, but the ongoing bankruptcy proceedings will make that difficult. Furthermore, Multicoin believes that the situation could worsen, and says:

“Many trading businesses will be wiped out and closed.”

Bitcoin price rise may not be fruitful

The Bitcoin price is currently trading at $16,833, but the volatile movement could take the king coin in either direction.

If the buying pressure remains consistent, the Bitcoin price could break its immediate resistance at $17,199 to initiate a rise to mark $17,729. However, a rally to the mid-June price ($22,590) requires a 34.43% rally, which would require Bitcoin to reverse the $18,730-$19,229 ineffectiveness marked as the Fair Value Gap (FVG) to support.

June lows, which were once the support level for the Bitcoin price, now represent a selling opportunity for stranded investors. Since BTC has remained below the $22,590 mark for about three months now, any instance of recovery will motivate these investors to seek a break-even paradise.

BTCUSD 4 Hour Chart

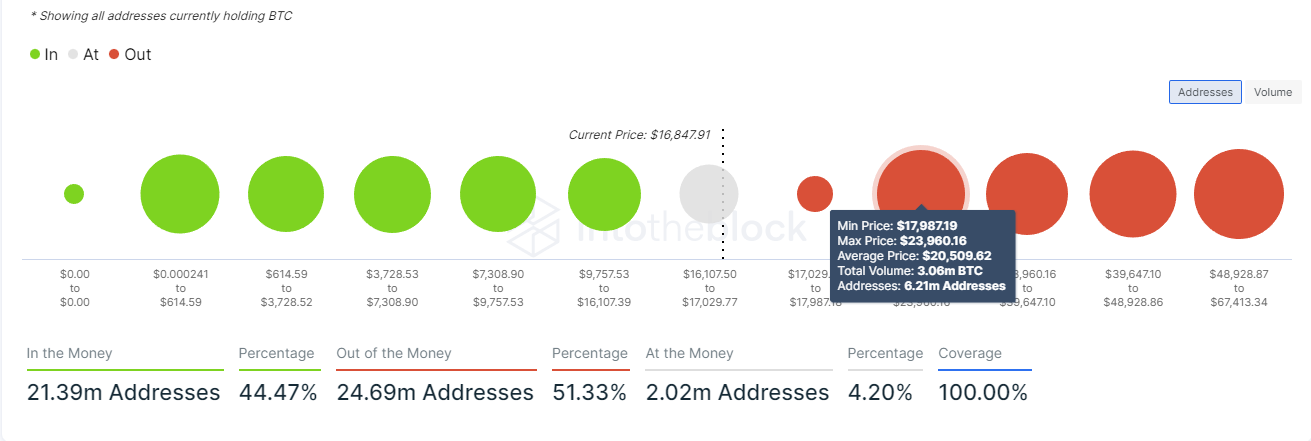

Based on IntoTheBlock’s Global In/Out of the Money (GIOM). the price range between $17,900 and $23,900 contains approximately 6.21 million addresses that bought over 3.06 million BTC at an average price of $20,509. These holders are currently sitting “Out of the Money” and are likely to sell their holdings if the Bitcoin price reaches breakeven levels, triggering a reversal.

This outlook is crucial to understanding market sentiment and coincides with the outdated outlook from Multicoin Capital following FTX’s collapse.

Bitcoin between $17,900 and $23,900

On the other hand, if the Bitcoin price does not recover at all and declines further, it will retest the $16,215 support level. Drawdown from here could see BTC mark the critical support at $15,791, and lose, which could invalidate the bullish thesis, pushing the royal coin towards the $15,000 lows.

.jpg?width=1200&width=1200&auto=webp&quality=75)