Chinese Government’s Bitcoin Holdings Outperform Microstrategy Despite Crypto Ban

The Chinese government currently holds more Bitcoin holdings than MicroStrategy as a result of the funds it seized from the PlusToken Ponzi scheme.

The Chinese government has more Bitcoin than MicroStrategy after it seized 194,775 BTC during the infamous PlusToken scam.

The total value of Bitcoin holdings is around $3.9 billion.

In addition to Bitcoin, authorities also seized 833,083 ETH, 1.4 million LTC, 27.6 million EOS, 74,167 DASH, 487 million XRP, 6 billion DOGE, 79,581 BCH and 213,724 USDT. In total, the government has over $5 billion worth of crypto assets.

China’s Bitcoin Holdings Top Even MicroStrategy

This means that the Chinese government has over 1% of the total bitcoins in circulation. However, the current status of this holding is not known. There is no information if this has been sold or any update from the authorities at all.

The crypto assets were seized during the infamous PlusToken scam, which was a Ponzi scheme costing between $2 and $2.9 billion at the time. A Chinese court has highlighted that the seized tokens “would be dealt with according to laws” and “dispossessed to the treasury”.

There is some concern in the market that the country could affect the price of bitcoin and the market if it sold the assets. The concerns are similar to concerns that Mt. Gox rehabilitation plan will deliver 140,000 BTC to creditors. However, that concern has been allayed.

But in this case, China may dump a large amount of bitcoin, which will negatively affect the market. However, this remains speculation.

PlusToken – One of the largest cryptoponzis

The PlusToken Ponzi scheme started in 2018, saying it would offer monthly payments to cryptocurrency wallet users. Most of the users were based in China and South Korea.

The Ponzi scheme was run by several individuals who were arrested in various countries, including Vanuatu, Cambodia, Vietnam and Malaysia. 27 of them were sentenced to 11 years in prison. There were over 100 members in the scam.

The sales during the Ponzi scheme were believed to have had a negative effect on bitcoin and the market. Accounts linked to the scam often moved large amounts of tokens as ether, sparking fear in the market.

Funds linked to PlusToken are still in motion

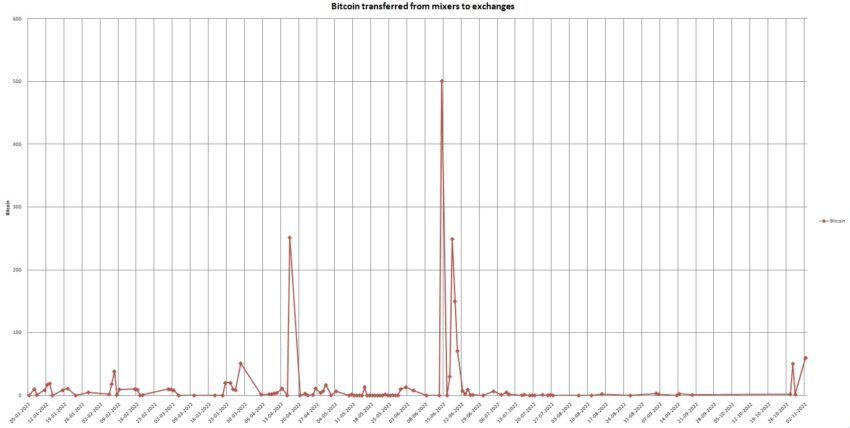

Firms such as CryptoQuant have analyzed how funds from PlusToken have moved. Primitive Crypto founder Dovey Wan also said it was sent to exchanges such as Bittrex and Huobi. CryptoQuant used multi-hop graph traversal to identify the relevant wallets.

But in what is a surprising development, funds are still moving. 60 BTC was moved from a mixer to exchanges on November 2nd and 50 BTC on October 28th. 750 BTC was also moved in June 2022.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.