Why Bitcoin’s volatility may be part of a larger trend (technical analysis)

ersinkisacik

In August 2019, we released our first premium report on Bitcoin (BTC-USD). At the time, Bitcoin was trading between $ 10,000- $ 11,000, after bouncing over 200% in less than a year.

We thought Bitcoin had provided strong evidence of that a meaningful low goal was set, and that a new bull cycle was underway. In our premiere report, we stated that we expect a reduction to at least the $ 7800 region, and that we will wait until this happens before starting a position. More importantly, we are targeting the region of $ 65,000- $ 75,000 in the coming year.

Here is a snapshot of our 2019 report:

Diagram made by author

This was a bold call at the time – and yet the call was materialized. The same system we used to target the $ 65,000 region in 2019 is the same system we use to target the $ 88,000- $ 110,000 region in the next trend.

We work in probabilities, and therefore manage risk accordingly. As long as a possible further weakness in Bitcoin keeps the $ 14,650 level, we believe that the volatility we have experienced since November 2021 is part of a larger uptrend, with the stated targets in place.

Technical analysis and Bitcoin

Bitcoin has no revenue reports, management overhauls or supply chain disruptions that can affect the price. In other words, there is not much news that moves the crypto market, but this particular market moves all day and all night. It is human nature to assume that a news event is the cause, but this is simply not the case with crypto. Human sentiment is the primary driver of the crypto space, which is why technical analysis works particularly well.

Every time people come together in a codified arena and start trading an asset with their instinct for safety as the primary driver, patterns develop throughout price history. This is what we measure. One of the easiest patterns to measure is that an uptrend moves in 5 waves up, and then corrects in a 3-wave pattern down. When we get 5 waves up and 3 down, we repeat this pattern. As of now, since the 2018 low, we only have 4 waves in place, which means that we have one 5th wave pressure before the larger bull cycle is over.

Diagram made by author

As long as a further weakness maintains the $ 14,650 level, the layout above remains intact, targeting the $ 88,000 region at a minimum. But below $ 14,650 and the probabilities change that the current bull cycle is over. This means that the above 5-wave structure would fail, and we must see a greater reset at lower levels to start a new bull cycle. This is an important reservation for risk management of the potential for a renewed trend, and also sets up an attractive risk / reward at current prices.

Steps to confirm a low

When confirming a low, there is a specific criterion I look for. The first is whether we have a completely corrective structure in place? Corrections tend to move in 3 waves, where the last wave unfolds into a 5-wave structure, tends to be relatively dramatic and is met with very negative emotion.

Diagram made by author

As you can see above, we have a 3-wave correction where the last C-wave is a pure 5-wave structure that unfolded in a waterfall-style event. In terms of sentiment, the cryptocurrency fear / greed index has been in extreme fear for well over a month. In fact, on June 19, the reading was at 6, which is one of the lowest measurements in history.

Diagram made by author

So the first step is in place. Can we extend lower? Of course, but the structure is already quite stretched. Then I will see a pure 5-wave bounce from the low. The reason for this is that appearances move in 5 wave patterns. This is also fractal, so a small 5-wave pattern builds into a larger one, and so on until you have reached your goal. So, a micro 5 waves from a low suggests that we are starting a new trend.

Diagram made by author

As you can see above, we have 5 waves from the low in black, followed by a 3 wave retrace that keeps it low. As long as a reversal has the support of $ 19,000, the micro 5 waves from the lowest remain intact. Below $ 19,000 and that opens the door to lower lows and will also bring us closer to the critical $ 14,650 support.

So we have 5 waves up and 3 down, and this now builds into a larger 5 wave structure. If correct, we have our first major wave in place, as well as our second. The final step is that I will see an eruption over the top of the larger first wave, which is at $ 21,650. This usually looks like a cup and handle pattern, and we must see a sustained eruption over this region. A pressure above this level, and the odds begin to increase considerably that we begin the last 5th wave in the larger uptrend.

US Dollar and Bitcoin

Another interesting correlation is between the Dollar Index (DXY) and Bitcoin. Many would argue that the DXY is not a true representation of the USD, and that a trade-weighted index is more appropriate. However, the correlation is not far off, and there is much more price history in DXY to analyze than in trade-weighted dollars. For this reason, DXY provides a meaningful correlation comparison to monitor because when the dollar is strong, Bitcoin is weak and vice versa.

Diagram made by author

The chart above compares the US Dollar Index in green with Bitcoin. Notice the inverse correlation. When the USD strengthens, Bitcoin weakens, and vice versa. At the moment, DXY is in a complex topping process, and I think it is in line with the renewed trend in Bitcoin.

Diagram made by author

The chart above shows the DXY signaling its first weekly divergence since the last peak. When you see that the price is higher, while the momentum indicator below makes a lower high, it tends to signal that the momentum is decreasing. This tends to go in front of peaks, which are emerging now.

Relative strength index

Relative Strength Index (“RSI”) is a way to measure buying / selling pressure within a trend. In other words, it is a way of measuring the health of a trend and can give early warning signs of a reversal.

On a weekly chart, Bitcoin recently hit the best-selling conditions since 2011. Historically, when bitcoin’s RSI moves below 30, it tends to indicate that a major low is being put in place. In June, Bitcoin’s weekly RSI reached 25, which is lower than the 2017 bubble that burst and the subsequent 84% drop that followed.

This is important because what we have is a negative RSI reversal pattern that is happening on a large scale. This is when the RSI makes a lower low, while the price makes a higher low. This pattern tends to occur in uptrend, which I think Bitcoin is in an upward trend to a large extent.

Diagram made by author

These are all positive signals, but Bitcoin still has a lot of work to do to signal that a meaningful low is in place. For example, the price has history, and so does the RSI. The weekly RSI tends to be around the 54 region. Most uptrends will hold this region and turn up again, while the opposite is the case in downtrends.

Diagram made by author

Notice the blue arrows above. These are cases where falls within a larger uptrend keep the 54 region at RSI, and then turn up again. These are the best regions to buy dip. On the other hand, in periods of significant weakness, the 54 region acts as resistance. The 54 region would turn into areas where you would sell the grouse.

Notice how the last red arrow marked the resistance just before the major waterfall event occurred in Bitcoin’s recent downturn. This level must be regained before any renewed strength can be shrugged off as just a bear market. Right now, bitcoin’s weekly RSI is a little over 30, so it has a lot of work to do.

In conclusion, as long as we maintain above $ 14,650, the larger structure suggests that Bitcoin has an even higher pressure in the current bull cycle. With the USD starting to show signs of peaking, this is in line with the technical signals we see in Bitcoin, which indicates that a trend reversal is underway.

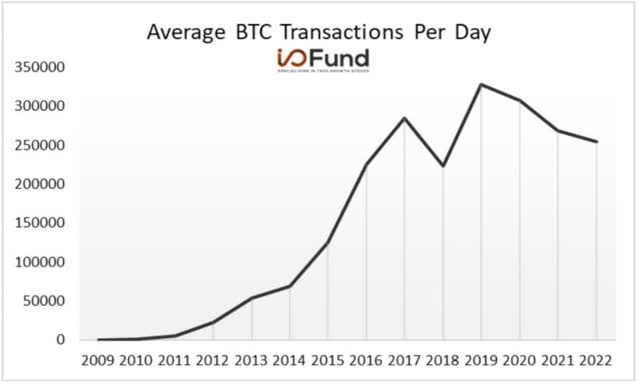

Furthermore, it is important to recognize how much Bitcoin has scaled at the end of 2020 – 2022. Bitcoin was last traded in the $ 19,000 region in December 2020, as well as December 2017. While the focus has recently been on BTC’s price decline, it is important to keep in perspective that over the last 10+ years, BTC transactions and adoption have been in a steady upward trend with minor withdrawals along the way.

Diagram made by author

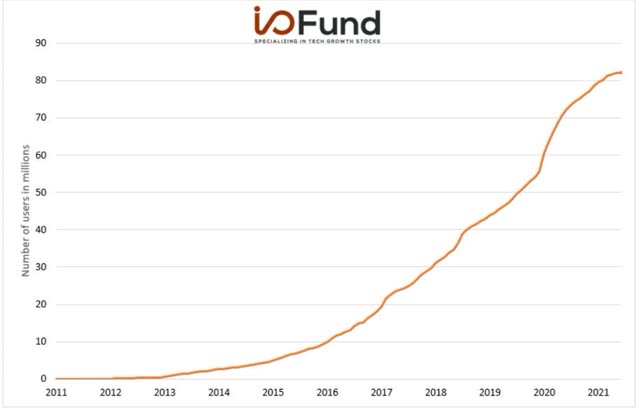

We can also see that user adoption is increasing by monitoring the number of Bitcoin wallets in circulation.

Diagram made by author

Therefore, despite the huge fears in the market, we believe that Bitcoin can maintain a higher price than its previous all-time high if the technology we outlined above remains intact. As mentioned, it is important to recognize that the probabilities favor a 5th wave pressure higher. This comes from the heels of a very stretched and completely corrective structure and feeling that is especially worse than the 2018 low. If Bitcoin can break above the $ 21,650 level, and maintain a push over this region, the odds will further favor the start of a final 5th wave pressure higher.