BTC and ETH Fall 5% – Time to Buckle Up or Just a Bump in the Road?

Bitcoin (BTC), the world’s most valuable cryptocurrency, has performed remarkably well in recent months. Although Bitcoin’s recent gains appear to be slowing down a bit as it fell below the $30,000 barrier early Thursday morning.

However, the reason can be attributed to the release of the latest UK inflation figures, which were above expectations. Meanwhile, the possible interest rate hikes by the US Fed as well as the US SEC’s increased crackdown on crypto firms were seen as another key factor that has put pressure on BTC prices.

Furthermore, Ethereum, the second most valuable cryptocurrency, fell more than 5 percent to $1,956. Apart from this, other popular altcoins including the likes of Ethereum (ETH), Dogecoin (DOGE), Ripple (XRP) and Litecoin (LTC) are experiencing multiple losses on the day. BTT proved to be the biggest gainer of the lot, with a 24-hour gain of over 8 percent.

Unexpected Rise in UK Inflation in March: Potential Impact on Bitcoin Price

Britain’s inflation rate remained unexpectedly high at 10% in March, putting a further strain on households due to rising food and energy bills. This news indicates that central banks may have to raise borrowing costs to curb inflation.

The Office for National Statistics (ONS) reported that UK consumer price inflation (CPI) fell from 10.4% in February to 10.1% in March. This was still significantly higher than the 9.8% forecast by economists polled by Reuters and the 9.2% predicted by the Bank of England (BoE) in February.

However, the increase in inflation is likely to lead to a decrease in demand for Bitcoin (BTC), as investors may turn to more stable traditional investments during economic uncertainty. On the other hand, some investors may consider Bitcoin as a hedge against inflation, resulting in increased demand and increasing its price.

St. Louis Fed President’s Comments on US Economy and Interest Rates: Possible Effect on Bitcoin Price

St. Louis Federal Reserve President James Bullard has recently urged the US central bank to continue raising interest rates in light of persistent inflation and a growing economy. His comments clearly contradict the belief that the US is headed for a recession or banking crisis.

Bullard, a member of the Federal Reserve, believes that a strong labor market leads to increased consumer spending, which is a crucial part of the economy. However, some experts are concerned that his position could lead to a negative impact on the price of Bitcoin.

This is because when interest rates rise, it strengthens the US dollar, making other currencies, including bitcoin, relatively weaker. Therefore, if the dollar increases in strength due to an increase in interest rates, investors may shift their focus away from Bitcoin and towards traditional investments

Thus, the stronger dollar will mean that the value of Bitcoin, which has gained popularity as a safe haven, may go down.

Bitcoin price

After falling to $28,555, Bitcoin entered the oversold zone, with key technical indicators such as RSI and MACD confirming. The four-hour trend line supports Bitcoin at this level, and a hammer candle suggests a weakening of bearish sentiment.

A potential bounce could see Bitcoin reach a 23.6% Fibonacci retracement at $29,000, and if breached, it could rise to $29,250 (38.2% retracement).

If the uptrend persists, Bitcoin could reach the 61.8% retracement level at $29,700, but a double-top pattern near $30,000 could pose a challenge. If prices fall below the $28,555 support, further selling could push Bitcoin to around $27,500.

Buy BTC now

Ethereum price

Ethereum, the second largest cryptocurrency, is witnessing a bearish trend after breaking $1,950. If Ethereum closes above $1,950, it could trigger an uptrend with the potential to reach $2,050 or even $2,120.

However, if Ethereum does not close above the $1,925 level, the price may fall to $1,925.

Buy ETH now

Top 15 Cryptocurrencies to Watch in 2023

Stay updated on the latest ICO projects and altcoins by consulting the expertly curated list of the 15 most promising cryptocurrencies to watch in 2023, as recommended by industry specialists at Industry Talk and Cryptonews.

Disclaimer: The Industry Talk section contains insights from crypto industry players and is not part of the editorial content of Cryptonews.com.

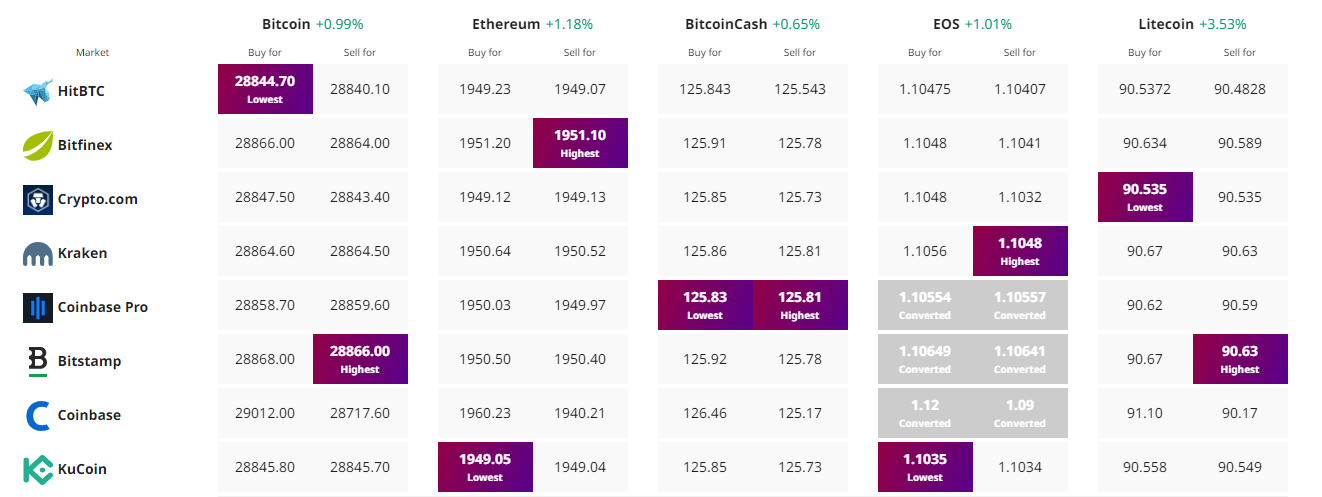

Find the best price to buy/sell cryptocurrency