Definitely fintech: “Fintech is the driver of everything we can think of”

“I’m a big fintech evangelist,” said Ronen Assia, Managing Partner of venture group Team8 and co-founder of social investment platform eToro proudly in an interview with CTech about the state of fintech in Israel. “I’ve been in the field for 16 years and am a big believer that fintech is only going to get stronger as money is at the epicenter of everything we do. In a capitalist society, fintech is the driver of pretty much everything we can think of.”

Israel is home to some of the world’s most famous unicorns, and nearly one in five is estimated to be fintech-related. Why?

“First of all, I think Israelis love challenging problems and fintech is a very challenging domain. If you think about the growth of Israeli technology in general that started from very deep enterprise software and you think about the challenges of fintech, they are quite similar. How do you make good infrastructure for an entire domain? How do you tackle challenges in very large organizations? Selling to a Fortune 500 company is no different than integrating with a big bank. So I think as Israelis we like to tackle big, bold challenges – and not just make more “fun” lightweight applications.

2 See the gallery

Ronen Assia – Managing Partner, Team8

(Ron Kedmi)

“The other thing is that when we look at innovation globally and think about all the big players that came to Israel to set up here, it breeds a whole new generation of entrepreneurs who learned and fell in love with the fintech domain and that in turn creates more opportunities for more companies to spin off from it – a whole fintech ecosystem that has been built up in Israel over the years.”

Assia cited the example of PayPal entering the Israeli market after acquiring the Israeli start-up company Fraud Sciences in 2008. According to Assia, after the acquisition PayPal had around 150 people working for the company in Israel, but since then PayPal’s Israel division has become one of the company’s largest in the world. “The knowledge and experience acquired by the large number of PayPal employees in Israel as the local branch has grown back into the Israeli ecosystem, which is very important,” explained Assia. “It’s not just about cultivating from within, but external companies establishing themselves in Israel.”

When it comes to raising the next generation of fintech entrepreneurs, it has to start early, right?

“It definitely has to start early. Consider organizations such as the IDF’s intelligence units (including 8200), which paved the way for all cyber innovation. There are many departments within the IDF that also deal with how money moves globally. This also leads to more innovation. It is not only about Israel being a cyber security empire, but about looking at other domains such as telco, fintech and all kinds of enterprise software. It is also where a lot of innovation comes from.”

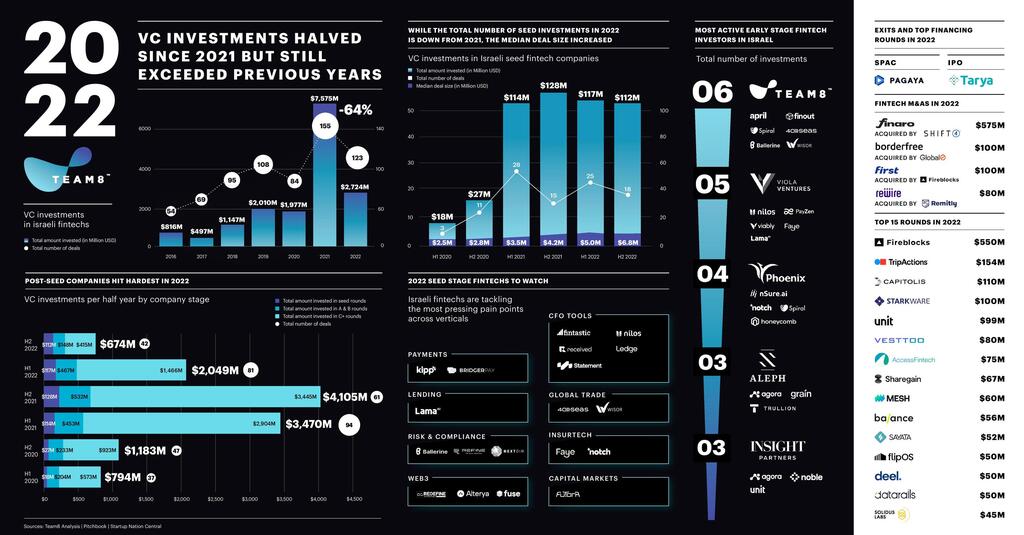

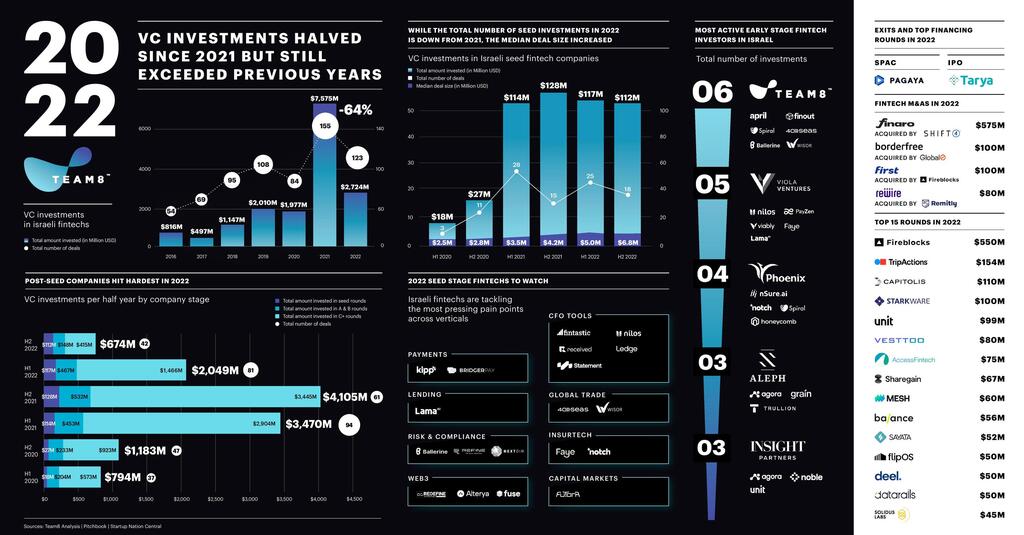

Fintech: Behind the numbers

According to Team8, while the total investment in Israeli fintech decreased between 2021 and 2022, the volume of investments made during the last 12 months still exceeds the records of the previous years, reaching $2.72 billion spread over 123 transactions. Additionally, the average deal volume in 2022 was approximately $22 million, not far from the 2020 average of $23.5 million. However, the amount invested in A and B rounds decreased by 38% between 2021 and 2022, while investments in C+ rounds decreased by 70%. According to Team8’s data, Seed-stage companies have attracted relative interest from investors over the past two years and have maintained a stable range of $112-128 million in investments in the first half of 2021-2022.

2 See the gallery

Team8 infographic

(Team 8)

Get behind these numbers. What do they reflect?

“In general, over the last couple of months it seems like everyone was a bit pessimistic, but if you look at the actual numbers, I think everyone would quietly agree that 2021 was an outlier, a year of hyper growth and ‘cheap’ money . So if you remove the year 2021, the charts obviously look a lot better. If you look at the net numbers, we’re still on a good track. But if you dig a little deeper, you’ll find that there’s more desire in the market to engage in early-stage investments than late-stage investments, and that’s because growth companies have to adapt to today’s macro environment. But overall, investors still believe that there will be more innovation and more companies that will emerge. The appetite is still there.”

Can you give an example?

“Perhaps an analogy will help. If you’re a farmer and you’ve suffered through a bad year in terms of weather, you’re not only worried about your current crop, but you’re also worried about what will happen to your crops in the coming year .In our fintech world, the Seed-stage investment is essentially just like the farmer’s crop for the coming years, as our findings show that seed-stage investment has not been affected as other parts of the economy have, and the median investment size has even increased , I think it’s safe to say that new companies will continue to be established and funded, and we’ll see a whole new slate – or crop – of potential unicorns growing out of the Israeli fintech industry for the next couple of years. important is that we continue to sow the seeds.”

To what do you attribute Team8’s success in this area?

“Part of our ‘secret sauce’ is being able to work with talented entrepreneurs as early as we can in the very first idea stage. We discuss with them what it is we want to create, what are the exciting opportunities in the market, what what’s hot and what’s not, what’s moving the economy, etc. When we do that, we help cultivate – or use the agricultural analogy ‘nurture’ ‘ or ‘grow’ – the next generation of entrepreneurs. We don’t just invest in companies that already is at a certain stage, we also work with entrepreneurs at their earliest stages before they are “a company”. I think that is one way we play an important role in the Israeli ecosystem since we do our work so early. It is like with cherry tomatoes, the seeds are actually more valuable than the actual end product, so we grow them.”

Due to concerns about the pending legal reforms, some leading companies, including a few in the fintech industry, have pulled their money out of Israel. How will this affect Israel’s fintech industry at all?

“To be honest, in my opinion, the issue of companies pulling their funds out of Israel is small compared to what we should really be focusing on. The big ‘fear factor’ is if investors start pulling their money out. Which means exclusively something for foreign investors is the economic impact. They care about their financial returns. Therefore, any action taken that could harm the Israeli economy must be done with extreme caution.”

Looking ahead to the future, can the ‘startup nation’ become the fintech nation’?

“In 2023, if you think about how our money is managed and moved and dispensed and with everything that’s happening with the macro climate of interest rates, it’s become more important than ever to continue and innovate in the field, and I think we’ll continue to see more innovation , more companies being created in space, and more unicorns coming out of Israel, so we are definitely on our way to becoming a “fintech nation”.