Bitcoin’s Role in Multipolar Currency Era

As the war in Ukraine rages on and the US takes an aggressive approach to China and Bitcoin, the two countries are actively trying to erode the US dollar’s status as the anchor of the international financial system.

The US dollar remains America’s last superpower, giving it unprecedented economic and political influence. Yet Russia and China’s efforts to diversify away from it have significant implications.

The decline of US dollar dominance

During the recent summit between Vladimir Putin and Xi Jinping, the Russian president supported the use of the Chinese yuan for settlements between Russia and countries in Asia, Africa and Latin America. Central banks around the world are holding fewer US dollars in reserve, and trade between Russia and China is increasingly settled in yuan.

The coalition of advanced economies formed by the Biden administration in its economic battle against Russia creates challenges for countries that want to move away from the US dollar and adopt other stable currencies, such as the euro or pound.

The European Union’s efforts to strengthen the euro’s international role, spurred by Trump’s withdrawal from the Iran nuclear deal in 2018, have yet to bear fruit due to lingering doubts about the euro’s future.

China’s efforts to expand the yuan’s role internationally have also faced roadblocks. The value of the currency is still influenced by the whims of the government rather than market forces. Liberalization of China’s financial sector could make the yuan a true competitor to the US dollar. But this would require a shift toward market-oriented policies that contradict Xi Jinping’s domestic goals.

Exploring options: International payment systems

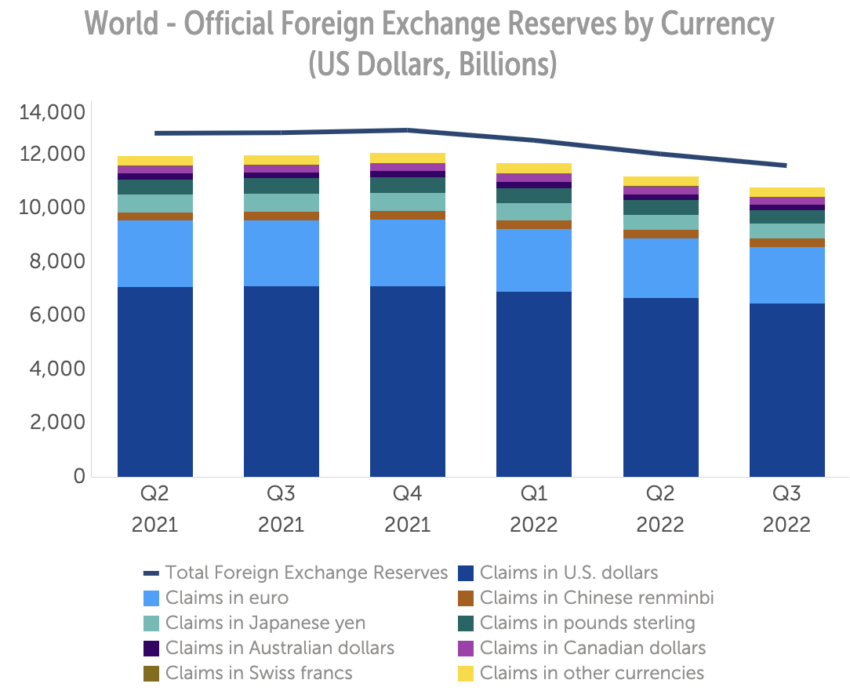

Despite the US dollar’s entrenched dominance, its share of global central bank reserves has fallen from around 70% two decades ago to below 60% today, with the decline continuing.

Countries are increasingly exploring alternatives. Europe and China are working on international payment systems outside the US dollar-dominated SWIFT. Saudi Arabia is considering pricing its oil in yuan. And India settles most of its oil purchases from Russia in non-dollar currencies. Meanwhile, digital currencies such as China’s central bank digital currency may offer another path.

Although the US dollar is unlikely to be replaced by a single alternative, it may experience a slow decline due to these multiple alternatives.

Author and investor Ruchir Sharma notes that for the first time in memory, the US dollar has weakened, rather than strengthened, during an international financial crisis. Should the US dollar’s unique status disappear, the US will face an unprecedented bill.

Politicians have become accustomed to spending without worrying about deficits and relying on the Federal Reserve’s balance sheet expansion.

The role of Bitcoin in a multipolar currency world

With countries like Russia and China attempting to undermine the US dollar’s dominance, the evolving global economic landscape presents an opportunity for cryptos like Bitcoin to play an increasingly important role.

As the world moves towards a multipolar currency environment, Bitcoin’s decentralized and borderless nature could offer attractive alternatives to nations looking to reduce their dependence on the US dollar.

Bitcoin’s potential impact on the international financial system lies in its ability to facilitate transactions without relying on central authorities. This makes it particularly attractive to nations that wish to bypass traditional financial channels and maintain their economic sovereignty. In addition, Bitcoin’s transparent and decentralized ledger can provide a level of trust and security that may be lacking in government-controlled currencies.

In recent years, countries facing economic sanctions or currency crises have turned to Bitcoin. They have been able to circumvent restrictions and preserve their purchasing power.

For example, during the recent protests in Nigeria, when the government tried to block access to funds, Bitcoin provided an alternative means of support. In Venezuela, in the midst of hyperinflation, people have turned to Bitcoin as a store of value.

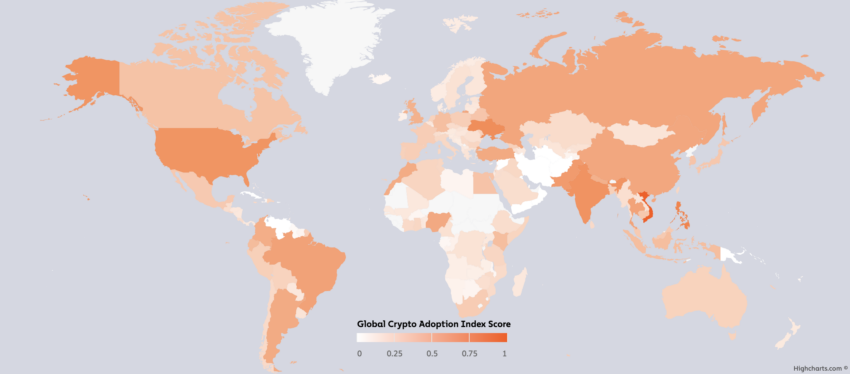

The growing use of Bitcoin, fueled by technological advances such as the Lightning Network, could further enable seamless cross-border transactions and reduce reliance on traditional banking infrastructure. This will empower millions of people who currently lack access to financial services. Especially in regions like Africa, where a significant part of the population remains unbanked.

However, it is important to recognize the challenges associated with Bitcoin’s adoption as a mainstream currency.

Factors such as price volatility, scalability and energy consumption are still obstacles to overcome. In addition, regulatory frameworks must be adapted to accommodate the use of crypto. They must also address issues of money laundering, tax evasion and investor protection.

The US must prepare for this shift towards a multipolar currency environment. Countries are already exploring various options to protect themselves from becoming the next Russia. Failure to adapt to these changes could leave the United States facing the consequences of economic complacency.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.