Payments plummet as irrationally as Crypto Exuberance

Crypto has had a very bad year, with bitcoin’s 70% price collapse which has put it in better shape than many of the other 10 largest cryptocurrencies, which are down 75% to 90%.

This puts them in much the same shape as many companies in payment and purchase now, pay later (BNPL), which has also seen their stock prices plummet in the last 12 months.

However, a more problematic question arises: Why is it that companies like PayPal, Block and Affirm Holdings – which all have proven business plans, revenues, solid customer bases and clear regulatory requirements to follow – do not do it better than cryptocurrencies as with a truly remarkable Except for Ethereum, have none of these things?

Read more: Blockchain Series: What is Ethereum? The blockchain that moved crypto beyond currency

Now to be sure, it’s not an apples-to-apples comparison, or even apples to oranges. Even cryptocurrencies with strong development foundations are still decentralized projects with large goals, but serious credibility problems ranging from inability to scale to huge hacks and collapses – and it is before the increasingly hostile regulatory vacuum that politicians and regulators fill.

But both industries have one thing in common: They make payments. After all, talking about bitcoin as an investment token as opposed to a payment currency – the creator’s intended use was peer-to-peer payments without a reliable third party – virtually all cryptocurrencies on all blockchains are tools for settling transactions.

Payment pain

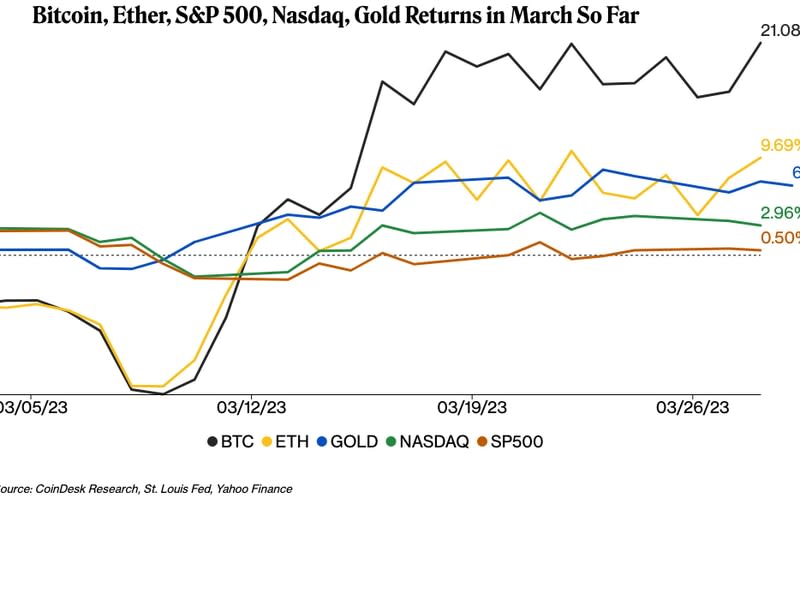

To some extent, both payment companies and cryptocurrencies have had the same overall problem over the last 12 months – specifically a growing sense that the end of a long bull market that even survived several years of pandemic-induced disruption is in its dying days and a deep recession is coming. And a large sale of technology stocks usually does not help.

For payment players, the huge cuts in valuation over the past six months are a puzzle, since valuations that are now more or less at levels before COVID-19 suggest that the digital tailwind was temporary. An analysis that uses revised census data shows how wrong that thinking is.

See also: Revised census data show that the e-commerce share did not plummet after all

Although consumers may cut back, the price they pay for goods and services continues to rise, increasing transaction volumes. The increase in retail trade in June was more about the effect of inflation on prices, rather than consumers buying more things.

Crypto Conundrum

The thing with crypto price collapse is that it is much easier to understand. Without opulence, a product whose core value proposition is at best years of, a more difficult sale in a period of decline.

That’s the thing. While the actual uses of blockchain are growing, and there are signs that large finances are using the tools of decentralized finance (DeFi), there is not really much there yet.

Related: Crypto Basics Series: The Tokenomics of Crypto

DeFi, as Gary Gensler, chairman of the Securities and Exchange Commission, noted last week, sees 95% of activity plowed into other DeFi projects, to the point that it is close to a closed system, despite signs that things like cryptocurrencies are moving out into reality. world.

And the real underlying business issue for almost all cryptocurrencies is that as their blockchains grow more and more successful, there will be more and more demands for a deliberately limited number of tokens required for any use or transaction. Which is fine, but with as many as 10,000 blockchains out there, there’s a lot of competition – even though the token’s maximum ceiling did not tend to be in the billions or trillions.

While Ethereum is widely used and more than a few real businesses are working with other blockchains – Ripple’s cross-border payment network, for example – these blockchains are not in danger of seeing tokens handed over for transactional use anytime soon.

For all PYMNTS Crypto coverage, subscribe to the daily Crypto newsletter.

——————————

NEW PYMNTS DATA: HOW TOOLS AND CONSUMER FINANCING COMPANIES CAN IMPROVE THE BILL PAYING EXPERIENCE

About: More than half of energy and consumer finance companies have the ability to process all monthly bill payments digitally. The kicker? Only 12% of them do. Digital Payments Edge, a PYMNTS and ACI Worldwide partnership, examined 207 billing and debt collection experts at these companies to find out why it is still elusive to go completely digital.