Bitcoin miners sell BTC and rig to cope with high energy prices

Bitcoin miners are having a tough time this year as an energy price crisis eats away at their profits while hashrate and difficulty continue to rise.

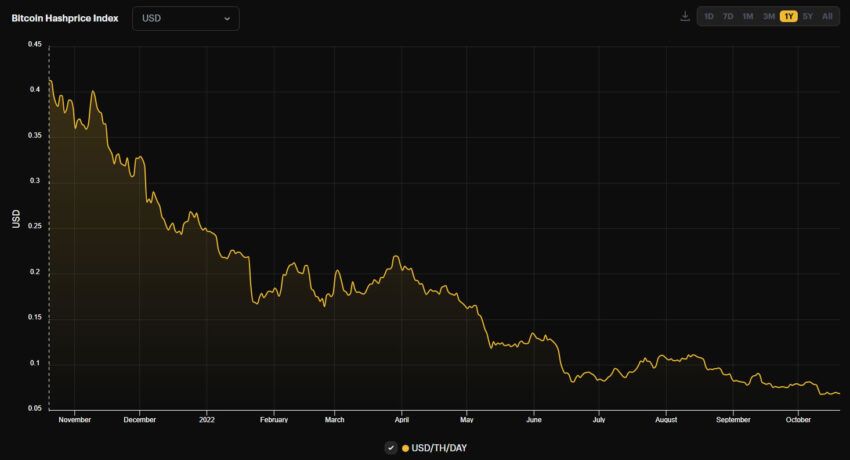

In its third quarterly report published on October 19, Bitcoin mining portal Hashrate Index revealed the extent to which miners suffered during the downturn.

Hashprice, which is a measure of market value allocated per unit of hash power in dollars per terahash per second per day ($/TH/s/d), has fallen 83.5% since the same time last year.

The index, which measures the calculation over time, reports that hash price, also known as mining profitability, has fallen from $0.412/THs/day in October 2021 to $0.068 today.

Energy price increases hurt

Throughout the third quarter, public mining companies “continued to mine rigs and BTC to finance operations and pay down debt,” the report noted. It added that distressed asset sales began to emerge and the first major mining bankruptcy occurred. Compute North, the second largest BTC mining hosting provider in the US, filed for bankruptcy in September.

The falling profitability is directly attributed to rising energy prices and falling BTC prices.

The average cost of industrial electricity in the US has increased by 25% from $75 per megawatt hour to $94 per MWh from July 2021 to July 2022, the report revealed. Some states, such as Texas and Georgia, saw even steeper increases of around 65% during the period.

Bitcoin mining researcher Jaran Mellerud compared the cost of producing one BTC in Texas one year ago to today.

The report added that the majority of hosting providers in the US are “bumping up to breakeven thresholds”. This seems true, even for newer generation mining hardware like the Bitmain Antminer S19j Pro.

Cash-strapped miners continued to liquidate Bitcoins in the third quarter, although sales slowed toward the end of the period. For the first time since May, public miners sold fewer BTC than their monthly output in both August and September, it said.

Bitcoin mining hashrate and difficulty levels

These power issues have been compounded by recent network hash rate and difficulty records. This has made it mathematically more difficult to mine the next block.

According to BitInfoCharts, the average hashrate (often called network horsepower) is 271.5 exahashes per second (EH/s). This is an increase of 66.5% since the same time last year. It reached a record high of 295 EH/s on October 11.

The difficulty value, which measures competition among miners seeking to solve the network’s next block, is also at an all-time high of 35.6T. Both metrics, when at their peak, make it much more difficult to mine Bitcoins for both companies and mining pools.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.