Bitcoin traders are betting on $30,000 even as momentum wanes

(Bloomberg) — Crypto investors are scooping up calls betting on a Bitcoin rebound to $30,000, even as momentum in the digital asset market.

Most read from Bloomberg

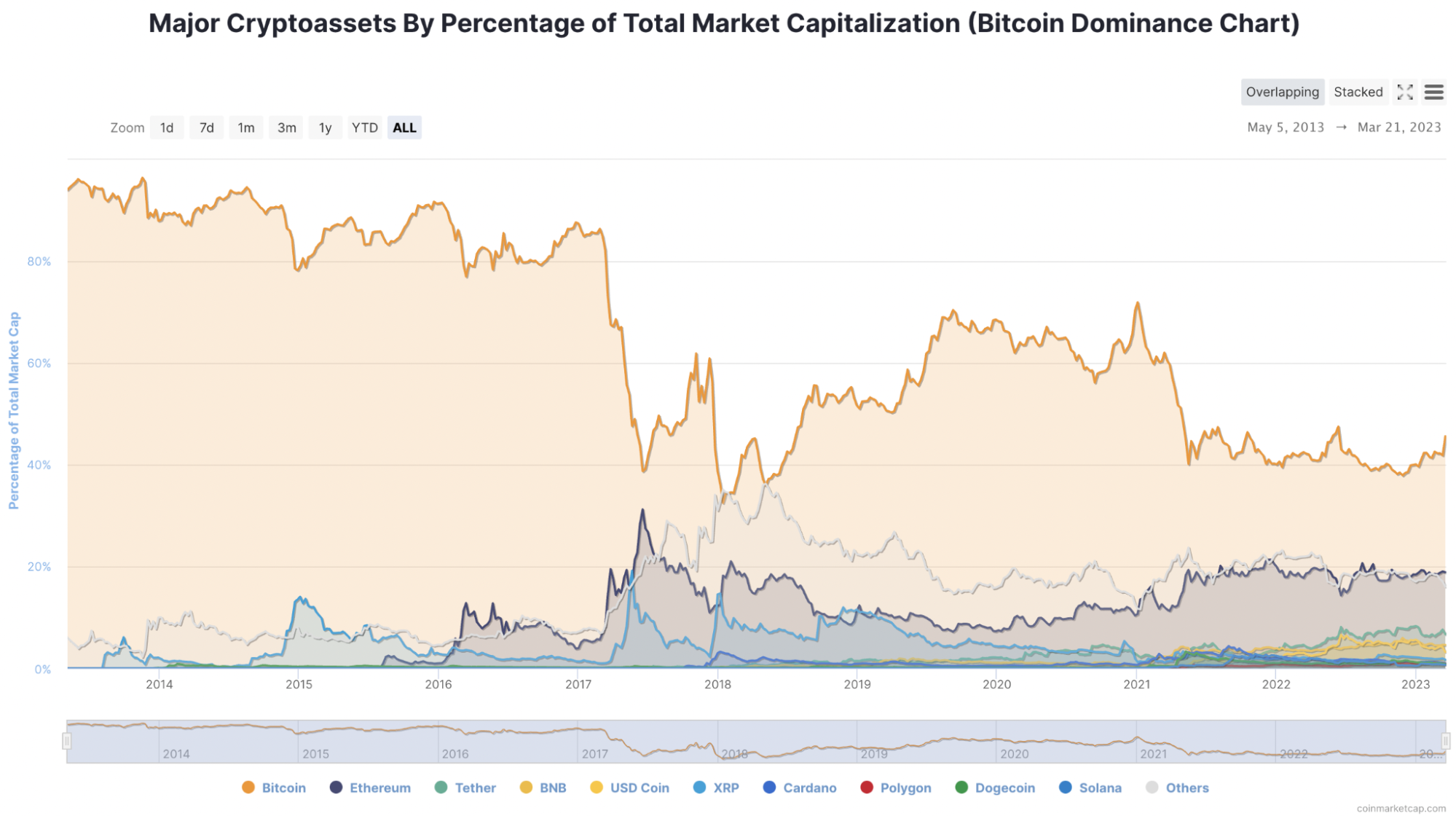

Open Bitcoin options rose in February to $9 billion, according to Bloomberg Intelligence’s Jamie Coutts, citing Glassnode data. The last time it was at this level, the coin had traded around $45,000, while it is currently hovering around $23,700. That’s the biggest 14-day rate of change in history, and is a record high as a percentage of market capitalization, he said.

“Too much leverage has been brought into this asset in the short term,” Coutts tweeted. Bitcoin was up 2.5% as of 10:15 a.m. in London on Wednesday.

Meanwhile, most of the open interest consists of calls with a strike price of $30,000, meaning investors are betting that Bitcoin can reach that level. “This implies a lot of leverage in the market – but strangely, implied volatility is much lower than the last time OI was at this level, suggesting weaker trader interest,” said Noelle Acheson, author of the “Crypto Is Macro Now” newsletter.

Although Bitcoin and other cryptocurrencies had a banner start to the year, with the biggest digital asset surging 39% in January, gains have not been as easy to come by in recent weeks. The coin, along with other riskier assets such as stocks, has fallen since mid-February as investors begin betting that the Federal Reserve will keep interest rates higher for longer.

To be sure, high options open interest may not necessarily mean more leverage in the market. “Options can be directionally agnostic,” said Darius Sit, founder and chief investment officer at crypto options trading firm QCP Capital.

It was in the middle of the rally this year, with Bitcoin testing $24,000 as well as $25,000, that the market saw a flood of out-of-the-money upside calls, said Christopher Newhouse, a crypto derivatives trader at GSR, a crypto native. market maker in spot and options markets. That’s because traders were hoping for a definitive break above $25,000. Bitcoin had crossed that level on February 16, although it has declined since then, data compiled by Bloomberg show.

“These OTM plays during February failed to pay off (as of now) as traders bought these OTM options with elevated levels of implied volatility, (which has been steadily declining while price has remained range bound), leading to that the buyers of these strikes lose both from a long-term volatility perspective and a long-term spot price perspective, he said.

(Updates the Bitcoin price in the second, third paragraph.)

Most read from Bloomberg Businessweek

©2023 Bloomberg LP