Bitcoin Price Prediction When BTC Whale Transfers $230 Million To Unknown Wallet – What Happens?

Bitcoin’s recent price movement has caught the attention of crypto investors and enthusiasts as a massive transfer of BTC worth $230 million was made to an unknown wallet by a whale investor. This event has led to speculation about what the transfer could mean for Bitcoin’s price in the near future.

The crypto market has experienced significant volatility in recent weeks, and this latest development has added to the uncertainty surrounding BTC’s trajectory.

In this article, we will examine the potential factors that could affect Bitcoin’s price and provide a prediction as to where it may be headed next.

Silvergate Crypto Bank shares fall after financial viability warning

Silvergate’s shares fell nearly 50% in early trading on Thursday after the bank said it was reviewing its ability to continue as a going concern. The bank, which focuses heavily on cryptocurrencies, has been significantly affected by the recent decline in digital token prices and the collapse of Sam Bankman-Fried’s firm, which was one of Silvergate’s banking clients.

Silvergate announced Wednesday that it would not be able to file its annual report with the Securities and Exchange Commission by the March 16 deadline due to a further deterioration in its capital situation since its disastrous fourth-quarter earnings report.

The bank stated that it was “evaluating the impact of these subsequent events on its ability to remain a going concern in the 12 months following the publication of the financial statements.”

US-listed crypto exchange Coinbase said it suspended payments to and from Silvergate “in light of recent developments and out of an abundance of caution.” The exchange added that it had “small corporate exposure” to the bank and that institutional client cash transactions would be managed by other banking partners.

The news has added to the negative sentiment in the crypto industry, which has already struggled due to recent market corrections and regulatory concerns. It remains to be seen whether Silvergate’s issuances will have a significant impact on the price of Bitcoin and other cryptocurrencies.

Visa confirms commitment to crypto products despite regulatory scrutiny

Visa’s head of crypto, Cuy Sheffield, clarified that reports that Visa and Mastercard have slowed their crypto push were inaccurate, at least as far as Visa is concerned. Despite challenges and uncertainty in the crypto space, Visa believes that fiat-backed digital currencies running on public blockchains have the potential to play a significant role in the payments ecosystem.

Visa has been working in the crypto space for a while, with plans to roll out cards to 40 new countries. However, things have slowed down recently, especially after ending global credit card deals with failed crypto exchange FTX in November.

Still, Visa filed new trademark applications in October, hinting at potential plans for a crypto wallet and a metaverse product.

Bitcoin price

Currently, Bitcoin is priced at $23,411 with a 24-hour trading volume of $24.9 billion. According to CoinMarketCap, Bitcoin holds the top position with a market cap of $451 billion and it has a total supply of 21,000,000 BTC coins with a circulating supply of 19,305,393 BTC coins.

On the 4-hour chart, Bitcoin faced resistance at the critical $23,750 level, which it failed to break through. As a result, BTC experienced a bearish correction and could potentially fall towards the $23,250 or $22,800 support level. In case this support level fails, the next support level is estimated to be around $22,150.

Although the BTC/USD pair is currently in an oversold state, there is still a chance for a potential bounce back. If this condition persists, it could lead Bitcoin to break through the $23,500 resistance level and possibly reach a price of $24,250.

Buy BTC now

Bitcoin Alternatives

For investors interested in buying Bitcoin, it may be worth exploring other options that offer greater short-term growth potential. Cryptonews has conducted an in-depth analysis of the top 15 cryptocurrencies that investors should consider for 2023. Click below to learn more.

Disclaimer: The Industry Talk section contains insights from crypto industry players and is not part of the editorial content of Cryptonews.com.

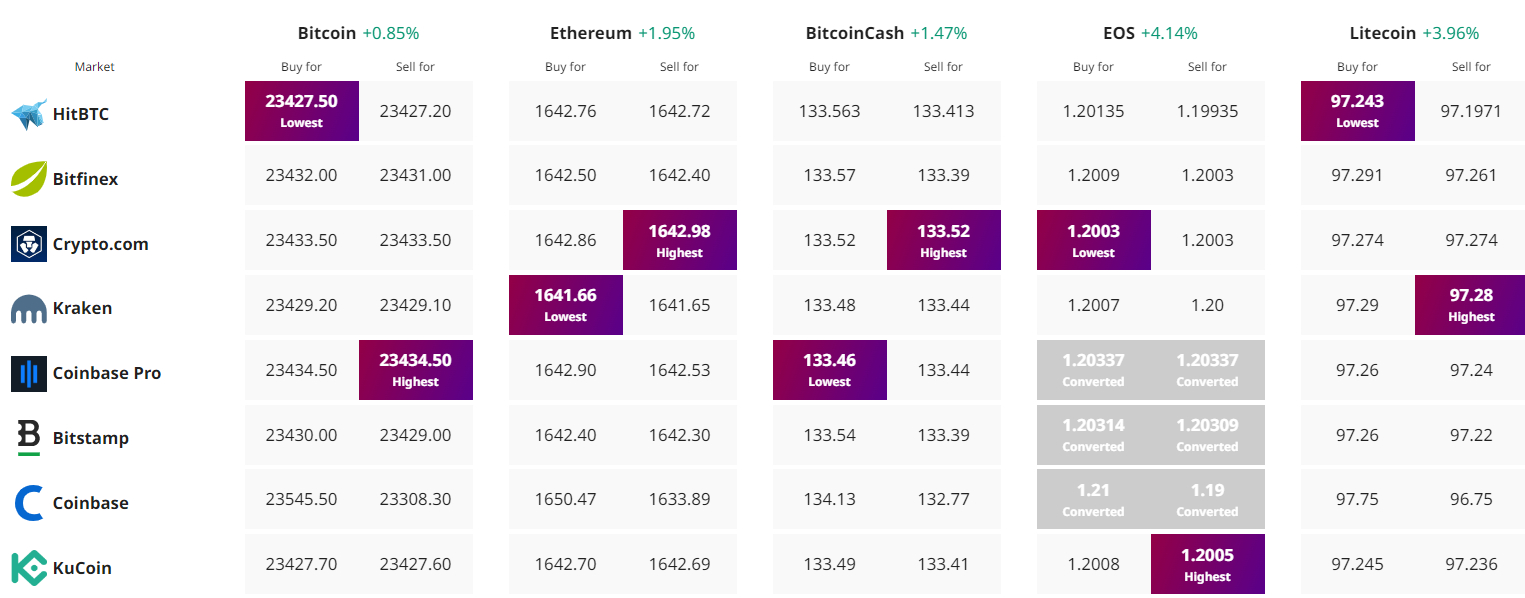

Find the best price to buy/sell cryptocurrency