All eyes on FOMC, negative inflation could dampen hopes for crypto

- Monetary conditions have tightened and cryptocurrencies have recovered from last week’s negative inflation surprise.

- Analysts at Arcane Research predict massive volatility in the Bitcoin price due to conflicting expectations of interest rate hikes.

- Analysts maintain a bearish view on Bitcoin, predicting decline in BTC if the asset fails to hold the $18,923 level.

Crypto traders await FOMC on September 21 and there is an increase in volatility in Bitcoin and altcoin prices. Bitcoin price has fallen 15% over the past seven days as crypto traders de-risked and prepared for monetary policy.

Also read: XRP Price: What to Expect from CFTC Commissioners Meet with Brad Garlinghouse

Bitcoin price decline continues along with interest rate hikes

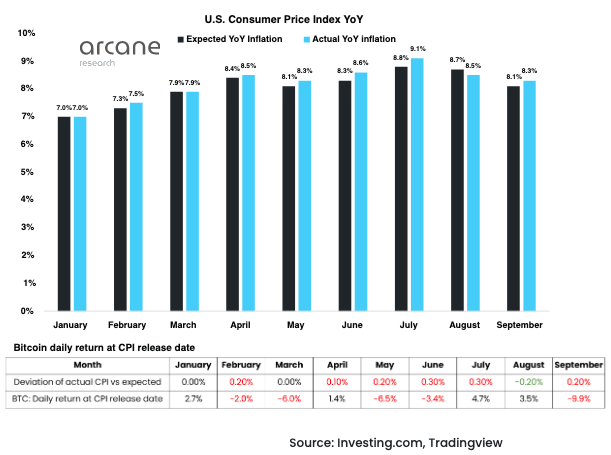

Bitcoin prices coincided with a plunge in stocks last week. The consumer price index (CPI) for August beat expectations by 0.2%, as year-on-year inflation reached 8.3%. Bitcoin price witnessed a massive decline in response to the market’s risk-averse reaction to CPI news.

American consumer price index on an annual basis

Bitcoin’s price decline last week was the worst compared to previous CPI-related declines in the asset in 2022. The brutal reaction was a result of expectations mismatch and uncertainty among investors, ahead of this week’s FOMC. Analysts at Arcane Research believe the crypto market has priced in a high interest rate increase.

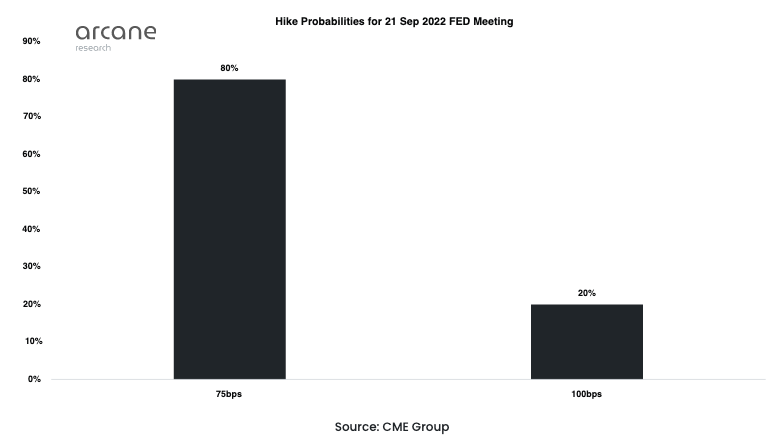

Right probabilities for September 21, 2022 FED meeting

Currently, the expectation is 75bps and there is an 80% probability of the same. However, investors are braced for a possible 100 bps increase, and this week’s decision is key to Bitcoin’s price trend. All FOMC events have resulted in Bitcoin price volatility, and analysts are warning investors to prepare for another burst of BTC volatility on September 21.

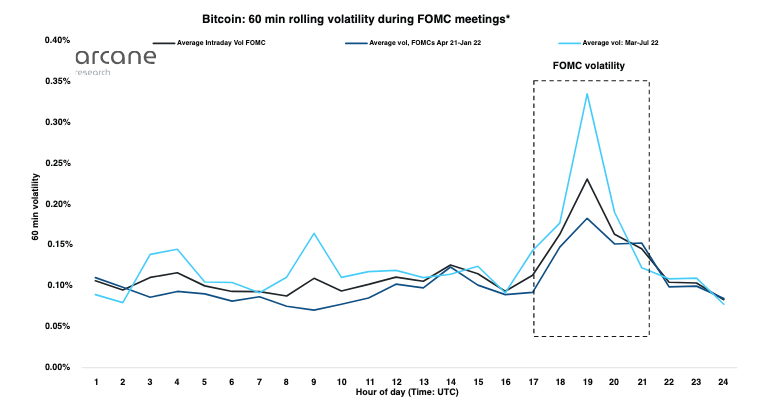

Bitcoin volatility during FOMC meetings

Bitcoin price tends to move in a highly correlated manner with the Nasdaq and S&P 500 during key macro events such as FOMC meetings.

Bitcoin Trading Strategy During FOMC Statement, Press Conference

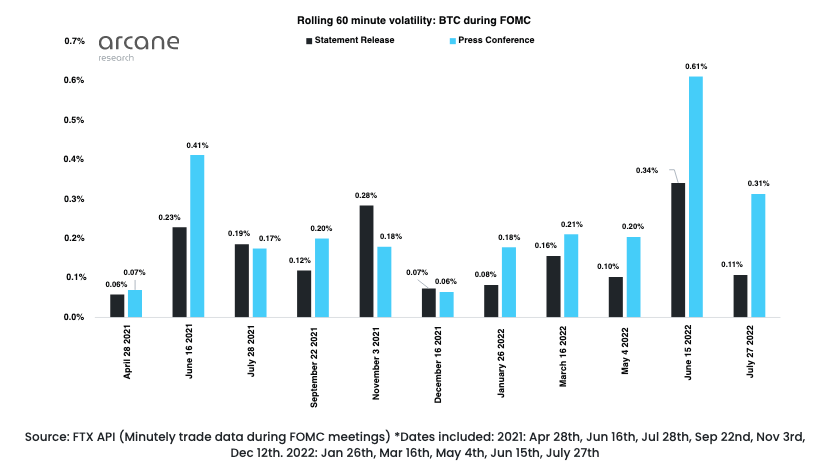

To help traders set up trades during the FOMC meeting, the researchers presented a rolling 60-minute volatility chart and concluded the effect of the FOMC statement and press conference on Bitcoin volatility.

Rolling 60 Minute Volatility: BTC Below FOMC

Active day traders are the ones most affected by FOMC-induced volatility in the Bitcoin price. Therefore, conflicting rate hike expectations for September 21 guarantee exceptionally high volatility. A 100bps interest rate hike is likely to have a negative short-term impact on the Bitcoin price, and a softer 75bps hike will reflect positively.

Over longer time frames, intraday volatility is irrelevant, but the Federal Reserve’s medium-term view and bullish cycle play a key role in determining the direction of Bitcoin’s trend reversal.

BigCheds, a cryptoanalyst and trader evaluated the Bitcoin price trend and noted that BTC needs to hold above $18,923. A drop below this price level implies a bearish trend reversal in the Bitcoin price.

BTC-USD exchange rate chart