Bitcoin Price Prediction When BTC Explodes 9.5% In 24 Hours – What’s Happening?

Bitcoin (BTC) and Ethereum (ETH) managed to regain the $22,000 level on Monday, suggesting some stability in the cryptocurrency market. After falling to its lowest level since January, Bitcoin has crossed the $22,000 mark and has seen a 10% gain on the day.

Ethereum has followed a similar trajectory and is now trading above $1,600. However, this positive development was mainly due to news of the government’s efforts to protect Silicon Valley Bank depositors.

On the other hand, the improvements in market sentiment were also supported by the weakening of the US dollar. It is worth remembering that the employment data from February showed a slowdown in wage growth, indicating a reduction in inflationary pressures.

Therefore, the Federal Reserve may keep an eye on interest rate hikes, and the demand for US dollars may decrease.

Crypto market cap recovers as Bitcoin and other Altcoins rise

Over the weekend, the global cryptocurrency market rebounded to reach $1.02 trillion after a sharp decline. The government’s recent announcement to protect all depositors’ money in Silicon Valley Bank was considered a significant factor that positively affected the entire crypto market. On Monday, Bitcoin, the world’s oldest and most valuable cryptocurrency, held steady within the $22,000 range.

The recent recovery of the crypto market cap and the increase in the value of Bitcoin and other altcoins shows the resilience of the industry. However, the future of the market depends on regulatory clarity and stability. The absence of clear regulations and supervision has led to uncertainty and risk that can hinder the growth and adoption of the industry.

Therefore, the crypto industry must work with regulators to establish a framework that can guarantee safety and stability in the market. This framework should address concerns such as investor protection, market manipulation, money laundering and cyber security. By implementing clear regulations and supervision, the industry can attract more investors and companies, and drive innovation and growth.

Silicon Valley Bank and Circle face significant challenges

It is also important to note that two major US financial institutions have faced significant obstacles in the crypto industry. Silicon Valley Bank, which provides banking services to a number of crypto companies, recently experienced restrictions on withdrawals and transfers due to concerns about its liquidity position.

However, following the government’s announcement to protect all depositors, account holders were given full access to their funds on Monday.

Meanwhile, Circle, a peer-to-peer payment technology company, has struggled with the failure of its central bank partner, Signature Bank, highlighting the dependence of the stablecoin ecosystem on some centralized entities.

These issues highlight the risks and weaknesses of the cryptocurrency sector and highlight the need for transparent laws and oversight to guarantee market stability.

Nevertheless, the absence of specific laws and regulations has left the sector vulnerable to fraud, money laundering and other illegal activities. Therefore, the crypto industry must engage with authorities to establish a framework that ensures the safety and stability of the market.

Weaker US Dollar Sparks Bullish Run in Bitcoin

The general bullish bias against the US dollar has also been identified as a key factor supporting the BTC price. The cryptocurrency market experienced a positive trend as the dollar fell significantly against a basket of currencies.

Traders expect the Federal Reserve to raise interest rates by only 25 basis points, leading to a decline in the value of the US dollar.

Investors are buying cryptocurrencies like Bitcoin (BTC) as a hedge against inflation, expecting the Federal Reserve to take a more dovish approach amid mounting economic challenges.

This trend of investors buying cryptocurrencies is expected to continue as they seek to protect their assets from the impact of inflation.

Bitcoin price

Bitcoin has crossed the $23,150 resistance level. If it had broken below this level, it could have triggered selling pressure and led to a further decline towards the $21,750 or $19,200 level.

On the other hand, the first hurdle for Bitcoin is at the resistance level of $25,200. If Bitcoin breaks above this level, it could trigger buying pressure and potentially push the price towards the $25.50 level.

If the bullish momentum continues, there is a chance that Bitcoin could even reach the $25,150 mark.

Buy BTC now

Top 15 Cryptocurrencies to Watch in 2023

Take a look at Industry Talk’s handpicked list of the top 15 altcoins to watch in 2023, curated by Cryptonews. The list is regularly updated with fresh ICO projects and altcoins, so remember to check back often for the latest developments.

Disclaimer: The Industry Talk section contains insights from crypto industry players and is not part of the editorial content of Cryptonews.com.

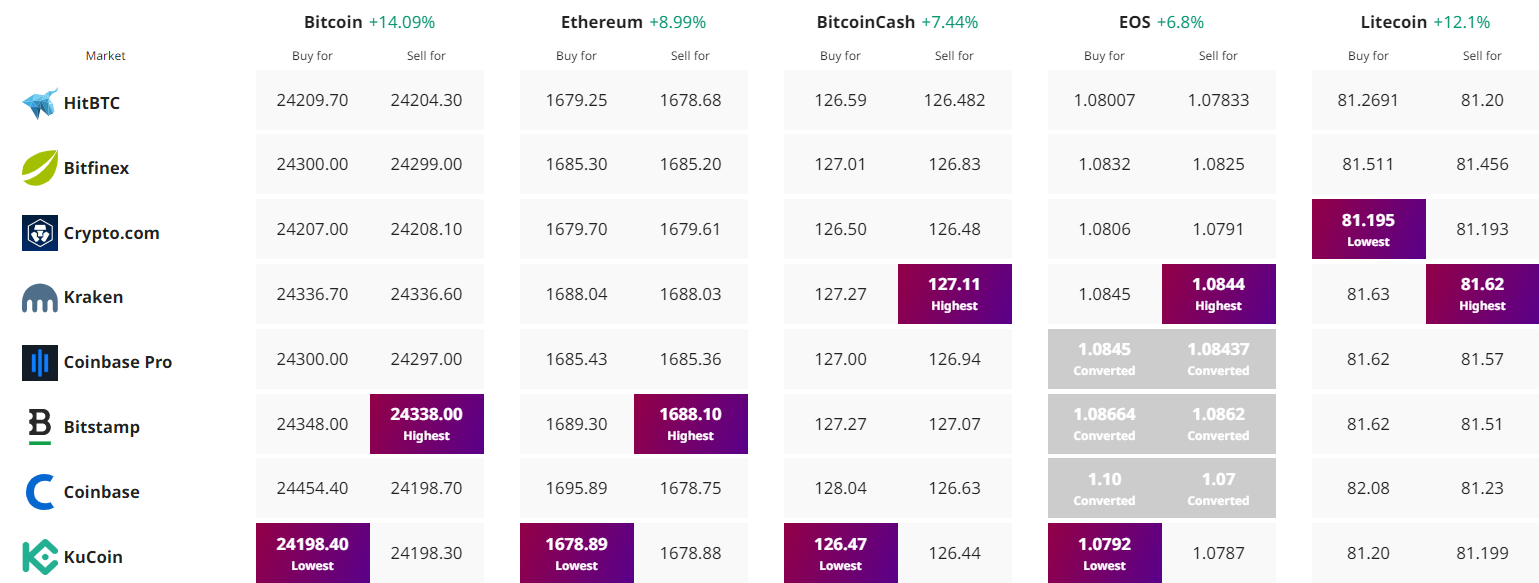

Find the best price to buy/sell cryptocurrency