Bitcoin Price Prediction As $10 Billion Trading Volume Comes In – Where Is BTC Heading Now?

Bitcoin and Ethereum, two of the biggest digital currencies, have been making headlines lately as their values continue to rise. It has recently crossed the $30,000 mark, while Ethereum, which is the second largest cryptocurrency globally, has hit a multi-month high of $2,000.

Ethereum (ETH) has experienced an increase in price following the successful completion of the Shanghai and Capella (Shapella) upgrades. This bullish sentiment has driven the price of Ether to reach a year-to-date high of $2,123 on April 14.

Ethereum’s decentralized finance (DeFi) ecosystem has experienced a 30% increase in daily fees as a result of the update, causing the Ethereum proof of stake (PoS) token economy to become deflationary. This has caused a 32% increase in revenue in the last 24 hours.

Thus, the successful upgrade and the positive growth of the DeFi ecosystem has contributed to the increase in ETH prices. However, there are still concerns about regulation and privacy that could affect the cryptocurrency’s value in the future.

The effect of Ether staking and dominance on ETH price among macro factors

Despite some withdrawals from the Ethereum ecosystem, there has been an increase in Ether deposits, indicating positive signs for the future of Ethereum.

Also, the reduction in the gap between the average stake and the current Ether price means that a majority of the Ethereum ecosystem’s holdings could soon be in profit.

Both Bitcoin and Ether prices are up, but Ether is gaining dominance over Bitcoin and altcoins. However, some analysts believe that a fall in the Ether price is still possible due to factors such as potential US industrial shutdowns and inflation-induced interest rate hikes.

It is worth mentioning that the FedWatch tool still expects the Federal Reserve to raise interest rates at the May 3 Fed meeting.

Despite these near-term headwinds to price growth potential, factors such as positive regulatory clarity and easing interest rate hikes were seen as key factors helping ETH hold its bid. Therefore, Ether’s price volatility is likely to continue.

US Stablecoin Framework Draft Bill Released: Potential Impact on the Crypto Industry

The US House of Representatives has released a bill that could have implications for stablecoin issuers like Tether and Circle. However, the bill proposes a framework for stablecoins and would require non-bank issuers to register with the Federal Reserve.

However, the new US bill proposes heavy fines and prison terms for stablecoin issuers who fail to register, and a two-year ban on issuing stablecoins that are not backed by real assets. The bill could affect the broader cryptocurrency market by increasing regulation and scrutiny, potentially affecting investor sentiment.

However, some experts believe it could also lead to greater adoption of cryptocurrencies by institutional investors seeking regulatory clarity. It remains to be seen how this bill will affect cryptocurrency prices in the short term, but investors should be aware of the potential risks and opportunities.

US Retail Sales Fall Affects Bitcoin Price

On the flip side, US retail sales fell in March, indicating a slowdown in the economy. However, the Federal Reserve is expected to raise interest rates in May, prompting traders to favor traditional investments such as stocks over Bitcoin. This was seen as a key factor keeping a lid on any further gains in the BTC price.

Consequently, Bitcoin’s price has fallen by 0.31% in the last 24 hours. There is uncertainty in the market due to potential inflation, which may be higher than expected, leading investors to be cautious.

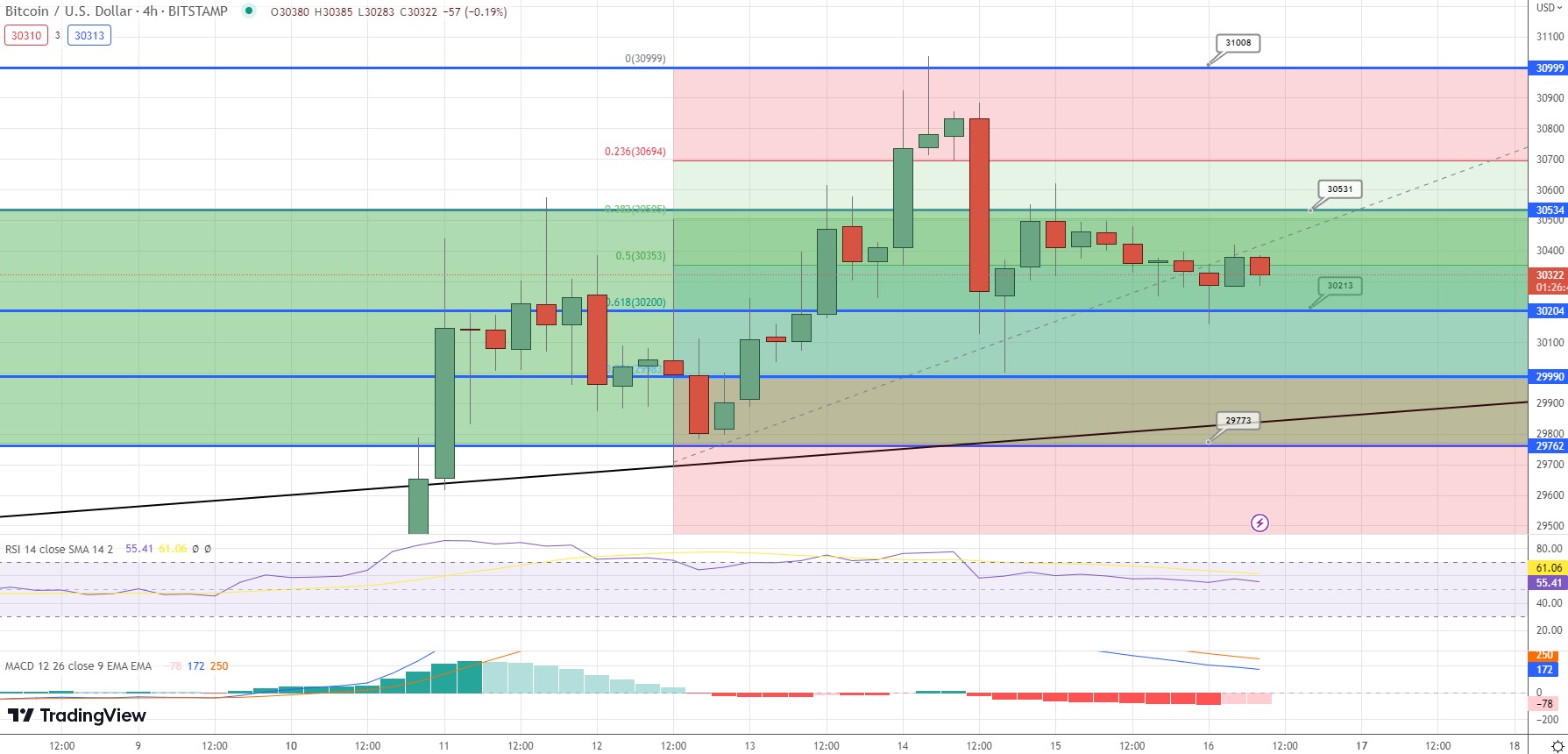

Bitcoin price

On Sunday, Bitcoin traded sideways, maintaining a narrow range between the $30,200 and $30,500 mark. On the upside, a bullish crossover above the $30,500 level has the potential to lead the BTC price towards the next resistance area of $30,700 or $31,000.

On the downside, a bearish breakout below the $30,200 level could expose the BTC price to the $29,900 or $29,700 levels.

Looking at the leading technical indicators, such as RSI and MACD, both show convergence, with one showing a bullish bias and the other showing a bearish bias. This analysis is written in English.

Buy BTC now

Top 15 Cryptocurrencies to Watch in 2023

To stay updated with the latest ICO projects and altcoins, it is often recommended to consult the expert-curated list of the 15 best cryptocurrencies to watch in 2023.

By doing so, you will be better informed about new trends and opportunities within the crypto market.

Disclaimer: The Industry Talk section contains insights from crypto industry players and is not part of the editorial content of Cryptonews.com.

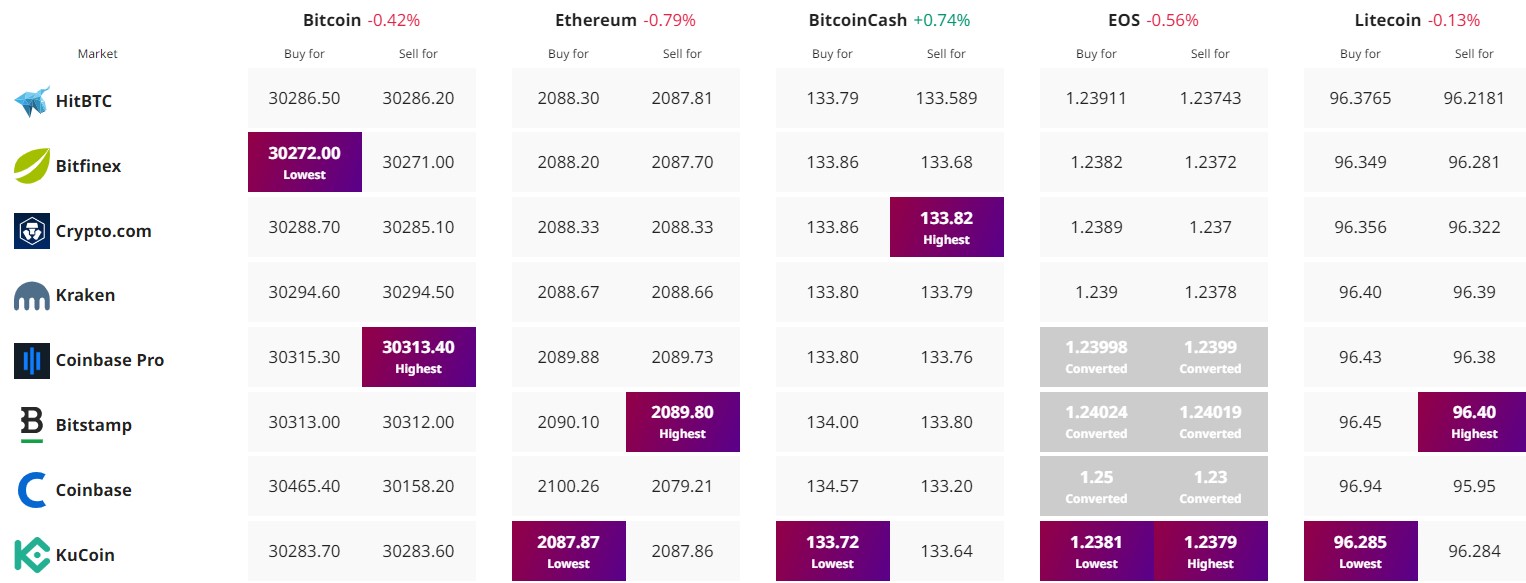

Find the best price to buy/sell cryptocurrency