Bitcoin Price and Ethereum Regain Upward Momentum; BlockFi files for bankruptcy

Despite the market’s ongoing fears, the leading cryptocurrency, Bitcoin, is on its way back above the psychological level of $16,000 on November 29. Similarly, Ethereum, the second most valuable cryptocurrency, is rising after gaining support near the $1,150 level.

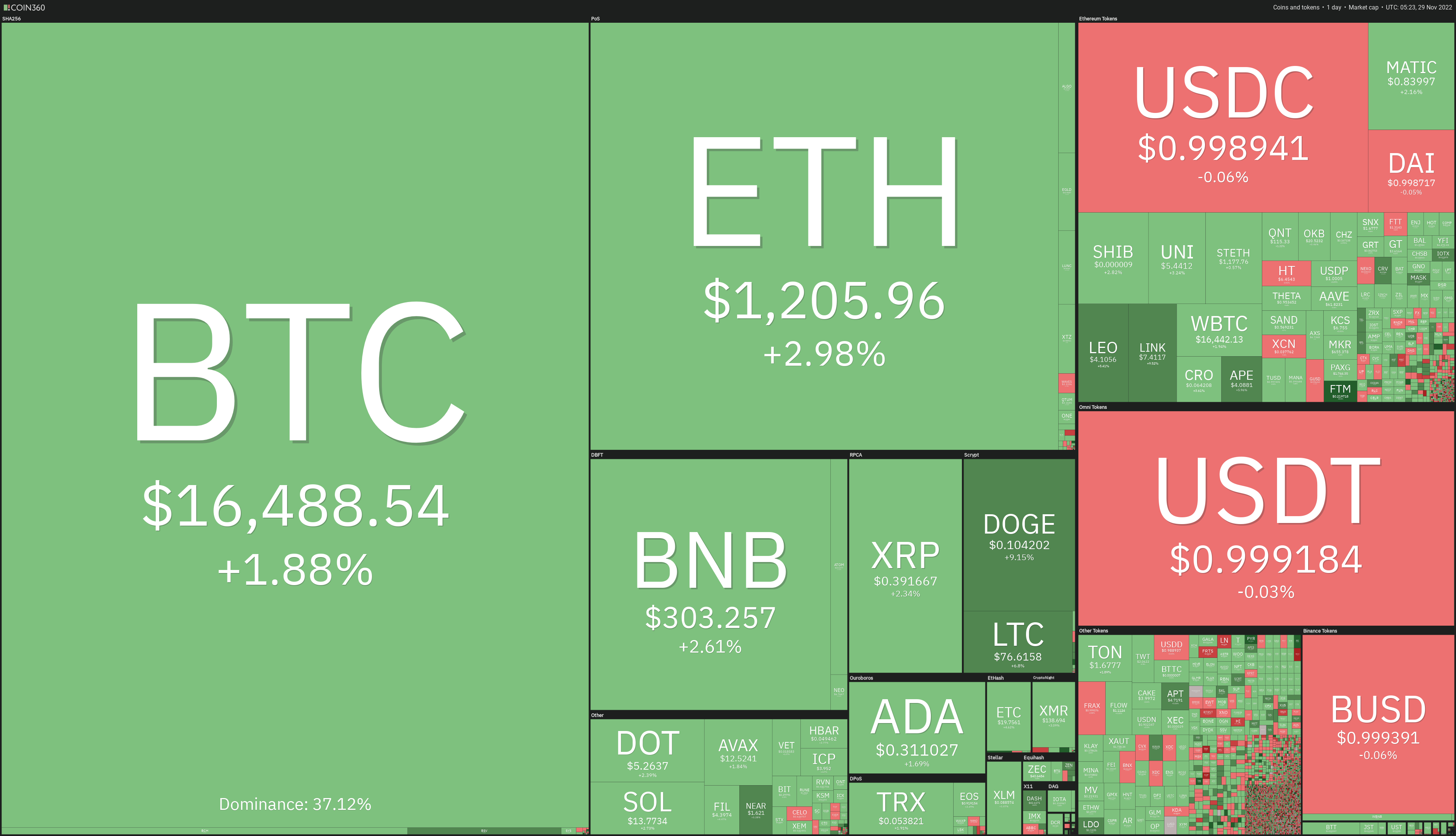

Major cryptocurrencies were trading mixed early on November 29, with the global crypto market cap rising nearly 1.0% to $822.27 billion the previous day.

In the last 24 hours, the total crypto market volume has increased by over 12.5% to $46.87 billion. The total volume in DeFi was $2.98 billion, accounting for 6% of the total 24-hour volume in the crypto market.

The total volume of all stablecoins was $45.05 billion, accounting for 96% of the total 24-hour volume of the crypto market.

Let’s take a look at the top 24-hour altcoin winners and losers.

Top Altcoin Winners and Losers

Fantom (FTM), Chainlink (LINK) and Dash (DASH) are three of the top 100 coins that have gained value in the last 24 hours. The FTM price has risen by more than 20% to $0.2196, the LINK price has grown by more than 9% to $7.40, and the DASH price has increased by almost 8%.

Chain (XCN), Huobi Token (HT) and Convex Finance (CVX) are three of the top 100 coins that lost value in the last 24 hours. While XCN has lost over 3.5% to trade at $0.037, HT is down nearly 1% to trade at $6.45. Meanwhile, CVX’s price is down over 1% to trade at $4.

BlockFi files for bankruptcy

After suffering losses due to its exposure to the dramatic collapse of the FTX exchange earlier this month, cryptocurrency lender BlockFi announced on Monday that it has filed for Chapter 11 bankruptcy protection.

By the time the papers were filed in a New Jersey court, cryptocurrency prices were already in freefall. More than 70% of Bitcoin’s value has been erased from its all-time high in 2021.

BlockFi, a New Jersey-based company formed by CFO-turned-crypto-entrepreneur Zac Prince, filed for bankruptcy, claiming that its significant exposure to FTX caused a liquidity crisis.

Monsur Hussain, Senior Director at Fitch Ratings stated:

“BlockFi’s Chapter 11 Restructuring Underlines Significant Contagion Risks Associated with the Crypto Ecosystem,”

This month, FTX, founded by Sam Bankman-Fried, filed for bankruptcy protection in the US after investors withdrew $6 billion from the platform in three days and rival exchange Binance backed out of a bailout.

China’s police track and deter zero-Covid protesters

In a display of unprecedented civil disobedience since President Xi Jinping took office a decade ago, police in China have been out in force to crush zero-Covid protests and at least one person has been arrested, according to videos on social media.

There were also allegations that several protesters who took part in the street rallies in cities around the country were subjected to telephone interviews with officials.

The arrest is believed to have taken place late on Monday in the city of Hangzhou. Social media videos from Monday night reportedly show hundreds of police barricading a large public space to prevent a public gathering.

Therefore, this keeps crypto market sentiment bearish. Let’s look at Bitcoin price prediction.

Bitcoin price

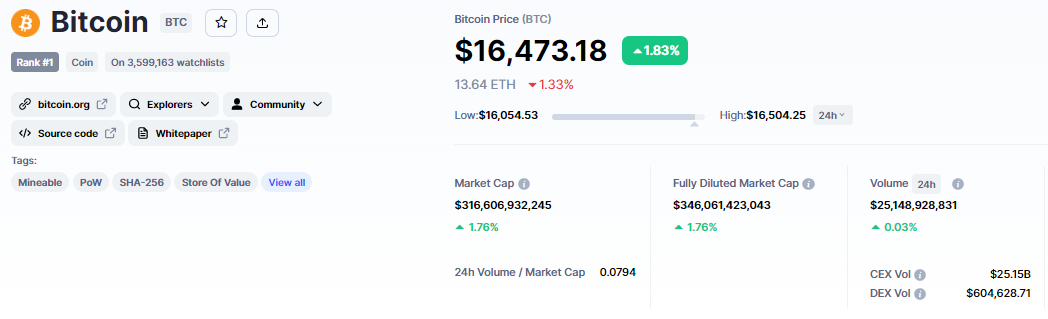

The current Bitcoin price is $16,479 and the 24-hour trading volume is $25 billion. Over the past 24 hours, the BTC/USD pair has gained nearly 2.0%, while CoinMarketCap currently ranks first with a market cap of $316 billion, up from $310 billion yesterday. It has a total supply of 21,000,000 BTC coins and a circulating supply of 19,219,543 BTC coins.

On Tuesday, BTC/USD is trading bullish after gaining support at the $16,000 psychological trading level. An upward trendline is extending support around the $16,000 level during the 4-hour time frame, and closing candles above this level has triggered a bullish recovery in Bitcoin.

On the higher side, Bitcoin’s immediate resistance is at $16,650, which is supported by a downtrend line.

Bitcoin has also formed a double top level at $16,650 and a break above this level could take BTC to $17,250 or even higher.

Leading technical indicators such as RSI and MACD have entered the buy zone, indicating the start of a buying trend. Bitcoin has just crossed the 50-day moving average of $16,250, signaling another bullish trend.

Alternatively, if Bitcoin breaks the lower symmetrical triangle pattern and closes the candle below $16,000, it is likely to be exposed to the $15,650 support zone.

Ethereum price

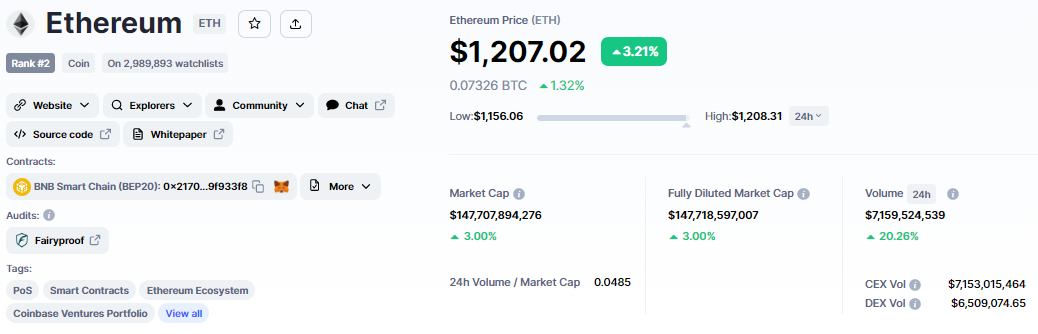

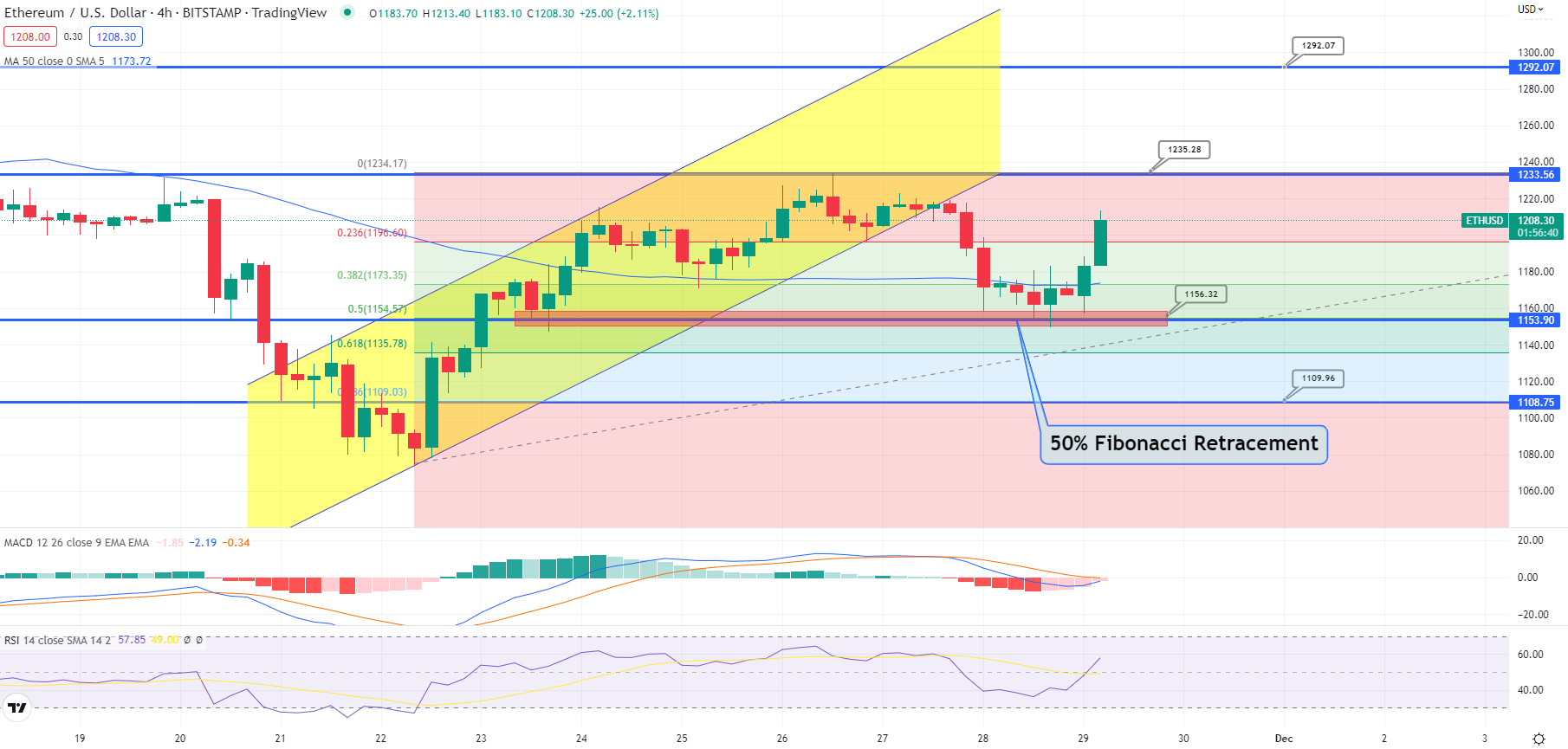

The current price of Ethereum is $1,207, with a 24-hour trading volume of $7 billion. In the last 24 hours, Ethereum has risen almost 4%. CoinMarketCap currently ranks #2, with a market cap of $147 billion. It has a circulating supply of 122,373,866 ETH coins.

Ethereum has recovered in the 4-hour time frame after completing a 50% Fibonacci retracement to $1150. Above this, Ethereum formed a bullish engulfing candle, which signals a bullish trend.

Furthermore, the ETH/USD pair has crossed above the 50-day simple moving average (SMA) around $1,170, suggesting that ETH has a good chance to head north towards the $1,235 double top resistance level.

Increased demand for ETH could allow it to break through this level and reach $1,295 or even higher.

Alternatively, failure to break above the $1,235 resistance level could trigger selling at the $1,150 or $1,135 Fibonacci retracement levels, which mark the 50% and 61.8% Fibonacci retracement levels, respectively.

Pre-sale cryptocurrency with huge potential gains

Dash 2 Trade (D2T)

Dash 2 Trade is an Ethereum-based trading intelligence platform that provides real-time analytics and social data to traders of all skill levels, enabling them to make better informed decisions. The platform will go live in the first quarter of 2023, providing investors with information to help them make proactive trading decisions.

Dash 2 Trade, a platform for crypto trading intelligence and signals, has piqued investor interest after raising $7 million in just over a month. As a result, the D2T team has decided to cancel the project at Stage 4 and lower the hard cap goal to $13.4 million.

Dash 2 Trade has also been a success, with two exchanges (LBank and BitMart) promising to list the D2T token after the presale ends. 1 D2T is currently worth 0.0513 USDT, but by the end of the sale this will increase to $0.0533.

D2T has so far raised over $7.4 million by selling more than 84% of its tokens.

Visit Dash 2 Trade now

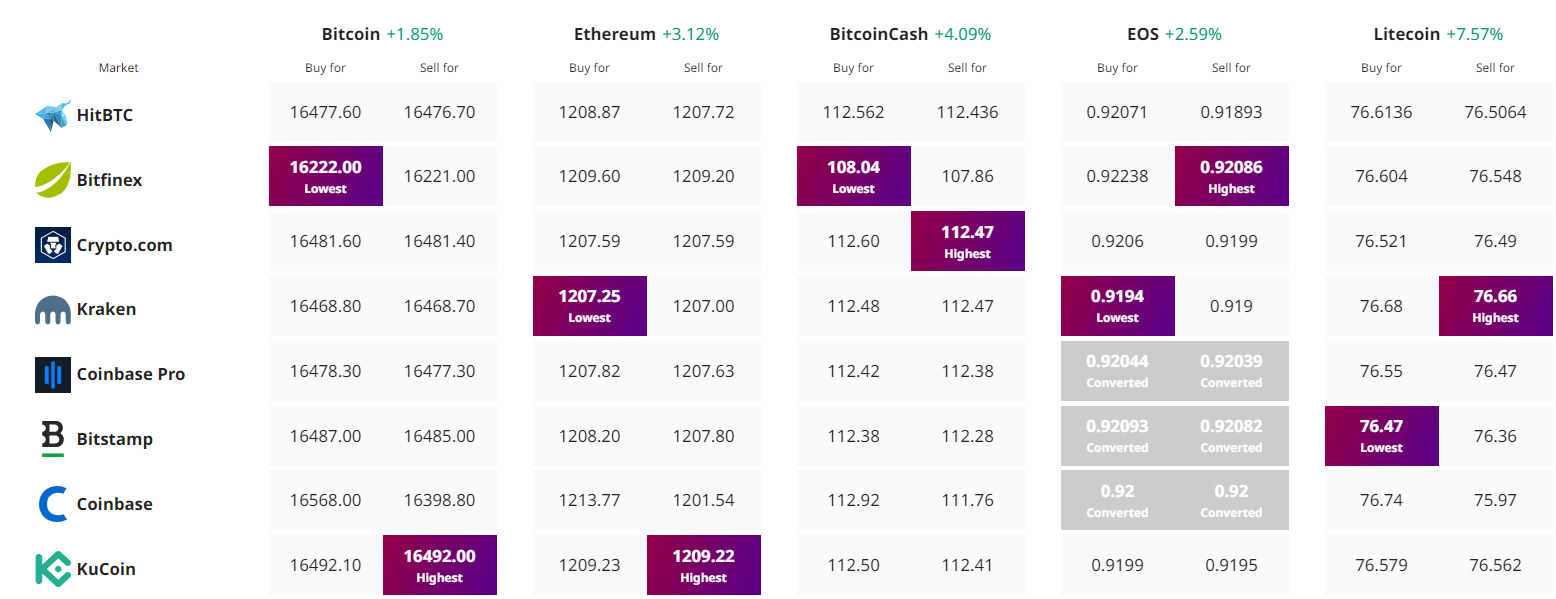

Find the best price to buy/sell cryptocurrency