Bitcoin Miner Reserves Drop to Annual Lows, BTC Selloff Continues

Bitcoin miner reserves are shrinking as miners sell more of their assets to cover their expenses, according to on-chain analysis.

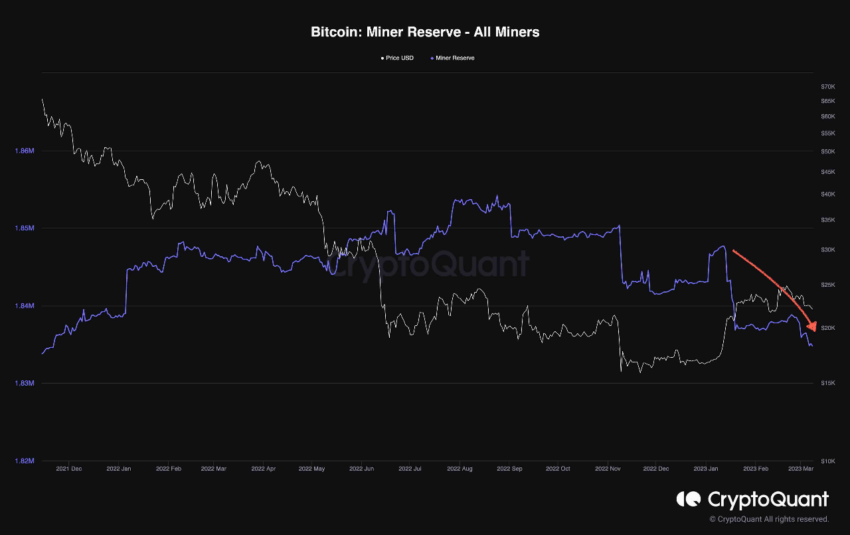

The amount of Bitcoin held by miners has been in decline this year, with a sharper drop observed in March. The data was revealed by research firm CryptoQuant in the chain on March 9.

According to the chart, Bitcoin miner reserves are now at their lowest levels since October 2021. They have fallen to 1.83 million BTC.

Miner selling patterns have a profound impact on the rest of the market due to the number of assets they hold.

“Despite many on-chain metrics indicating bullish signs during the recent bullish phase of the market, the mining reserve metric has entered a bearish trend and hit new annual lows.”

Bitcoin Miner Profit Taking

Miners have used the recent bullish momentum and 45% increase in BTC prices this year to take profits. This will also be used to balance expenses that have been high recently due to an increase in global energy prices.

Furthermore, CryptoQuant advised caution for the coming weeks.

“This selling behavior could end up in a medium-term bearish sentiment in the market. As a result, it is better to manage risk in the coming weeks.”

The firm’s Miner Position Index (MPI) shows withdrawal peaks in January and again in early March. MPI is a measure of BTC outflows to exchanges from miner wallets relative to their one-year moving average. In addition, the latter two have coincided with falling prices.

Bitcoin miners are currently facing tough network conditions as the hashrate and difficulty are near peak levels. The average hash rate is currently around 10% of its March 2 record high of 314 EH/s (exahashes per second). Meanwhile, the mining difficulty is at a peak level of 43T.

As a result, Bitcoin miners face a lot of competition in addition to expensive energy bills and high semiconductor prices.

Bearish pressure setup

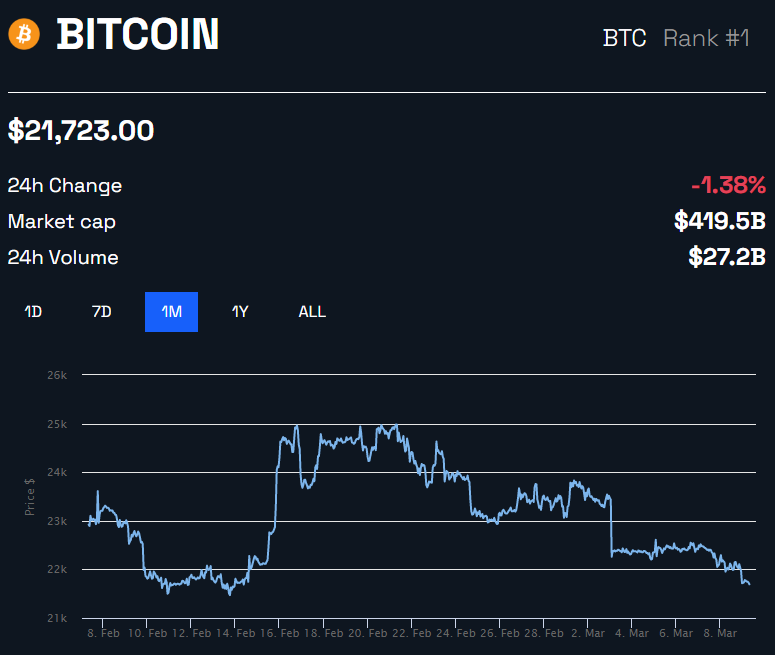

Bitcoin prices have fallen to their lowest levels since mid-February today. The asset fell 2% in the last 12 hours and now sits at around $21,723 at press time.

Furthermore, BTC has lost 13% since the 2023 high of $25,000 on February 21st.

In addition to selling pressure from the Bitcoin miner cohort, Silvergate’s voluntary liquidation, further Fed rate hikes and the ongoing US war on crypto paint a bearish picture for BTC and its brethren in the near term.

Sponsored

Sponsored

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.