Bitcoin Falls 1.7% As Fed Speech Turns Hawkish

CME’s Fedwatch tool increased its prediction that the Federal Reserve will raise the federal funds rate by 50 basis points at the meeting of the Open Markets Committee later this month following a speech by Federal Reserve Chairman Jerome Powell.

Speaking at the semi-annual monetary policy report before the Senate Banking, Housing and Urban Affairs Committee, Powell reiterated the central bank’s intention to continue raising interest rates at FOMC meetings in the coming months, with a possibility of accelerated tightening if the US economy shows no signs of cooling.

The Federal Reserve is prepared to increase interest rate hikes

Powell said the latest economic data came in “stronger than expected,” meaning the Federal Reserve may continue to raise interest rates beyond its original target.

“Should the totality of the data indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes,” he confirmed.

After Powell’s opening comments, Bitcoin fell about 1.7% to below $21,934 before recovering to $22,277.

On the other hand, ETH, the second largest cryptocurrency, fell by about 1% from $1,565.46 to $1,544.45.

Traditional markets saw the Dow Jones Industrial Average fall 1.4%, while the S&P 500 fell around 1.2%.

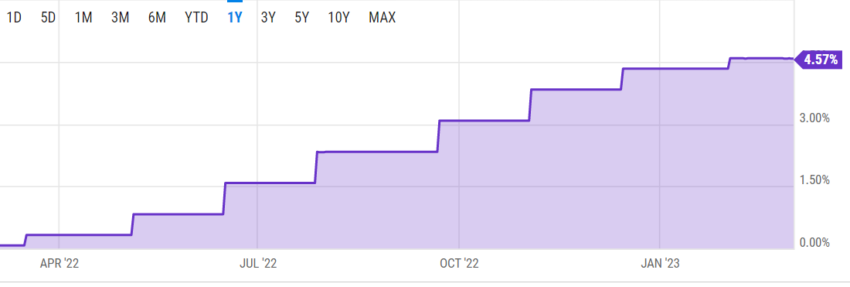

The Federal Reserve uses interest rates to, among other things, adjust imbalances in supply and demand that contribute to rising prices. It has raised interest rates by 4.5% basis points over the past year to cool a red-hot US economy drained of pandemic stimulus money and rising demand caused by disruptions to global supply chains.

The Federal Reserve uses several measures, including the Consumer Price Index, the Personal Consumption Expenditure Index and US employment data, to determine how changes in monetary policy affect prices for ordinary Americans.

Senate banking chief blames inflation on rising wage demand

Powell confirmed that a tight labor market, evidenced by an unemployment rate of 3.4% in January 2023, remains a significant challenge to reducing prices. He also confirms that there were 1.9 jobs in December 2022. Higher wage demands push prices higher as companies pass on increased labor costs to consumers.

Senate Banking Chairman Sherrod Brown shares the view of UBS Bank’s Chief Economist for Global Wealth Management Paul Donovan, blaming rising prices on loopholes that allow companies to expand profit margins and raise wages.

The central bank is awaiting February 2023 employment data due later this week, which tracks the health of the US labor market.

The ADP nonfarm payrolls change, which measures the month-to-month change in payroll information for 400,000 U.S. business clients, is due March 8, 2023. Data from this report is usually a reliable predictor of U.S. nonfarm payrolls, out three days later.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

Sponsored

Sponsored

Disclaimer

BeInCrypto has reached out to the company or person involved in the story for an official statement on the latest development, but has yet to hear back.