Bitcoin Derivative Reserve Rises, More Volatility Soon?

On-chain data shows that the currency reserve for Bitcoin derivatives has increased recently, a sign that the crypto may face more volatility in the near future.

Bitcoin Derivatives Exchange Reserve observes lift in the last two days

As pointed out by an analyst in a CryptoQuant post, conditions appear to be brewing in the BTC market that could lead to higher price volatility.

The “derivative exchange reserve” is an indicator that measures the total amount of Bitcoin currently sitting in the wallets of all derivatives exchanges.

When the value of this metric goes up, it means that investors are depositing their coins on these exchanges right now. Since BTC going up on derivatives generally leads to an increase in leverage, such a trend could result in higher volatility in the price of the crypto.

On the other hand, the value of the indicator registering a decline suggests that coins are leaving derivatives exchanges as holders withdraw them. This kind of trend could precede a calmer BTC price.

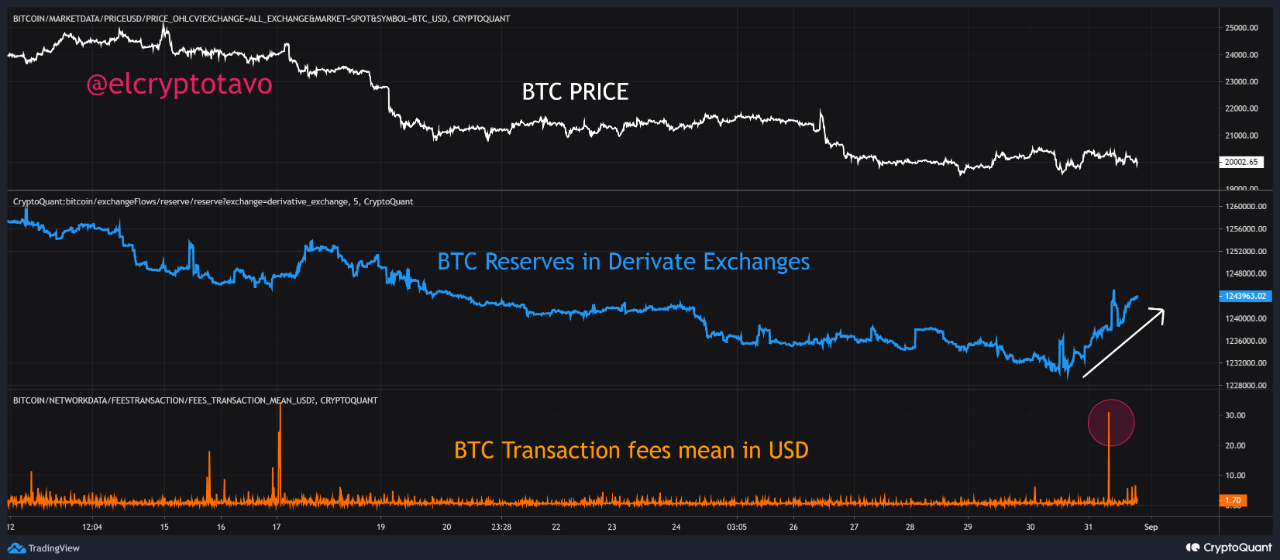

Now, here’s a chart showing the trend in Bitcoin derivatives currency reserve over the past few weeks:

The value of the metric seems to have climbed up in recent days | Source: CryptoQuant

As you can see in the graph above, the currency reserve for Bitcoin derivatives has seen some upward movement over the past couple of days. This shows that leverage in the market is now increasing.

The chart also includes data for the average value of the BTC transaction fees (in USD), and it appears that this metric has also seen an increase over the past day, suggesting that there has been some major movement in the market.

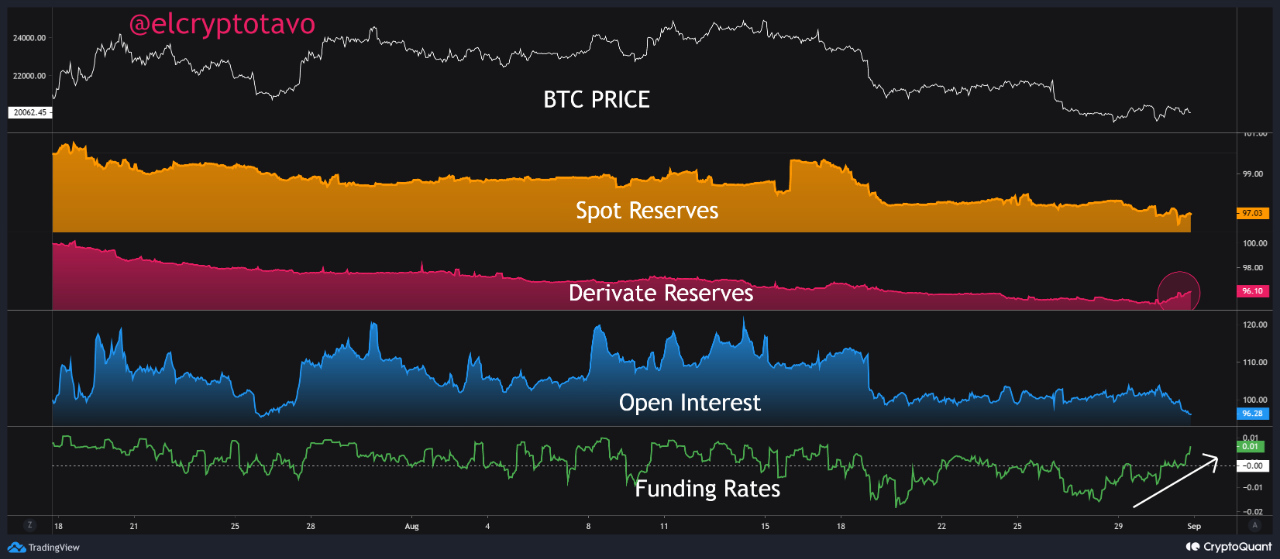

Below is another graph, this time including the trend of the BTC funding rates:

The funding rates have gone up over the past day | Source: CryptoQuant

As can be seen from the chart, funding rates have jumped to positive values with this increase in the derivative reserve.

This means that the investors sending coins to these exchanges have opened up long contracts, thus shifting the market balance into a long-dominant environment.

In the past, the combination of positive funding rates along with a high derivative reserve has usually meant high volatility in the short term for Bitcoin, with the price generally falling.

BTC price

At the time of writing, Bitcoin’s price is hovering around $20k, down 8% in the last week.

Looks like the value of the crypto has been moving sideways during the last few days | Source: BTCUSD on TradingView

Featured image from Yiğit Ali Atasoy on Unsplash.com, charts from TradingView.com, CryptoQuant.com