Bitcoin could rise above 40% by the end of the year; Here are 3 stocks that come in handy

Bitcoin may have cemented its status as “digital gold”, but another widely stated purpose has not yet been triggered. The danger of crypto is intended to be a hedge against inflation, but recent times have shown that rising inflation has not given way. In fact, Bitcoin’s performance has followed the lead in the stock market, and reflecting the broad decline in 2022, bitcoin’s price has fallen over 70% since the peak in November last year.

That said, the “death of bitcoin” has been announced countless times before, and one thing bitcoin has been good at doing over its decade-plus history is getting back to the end.

While Deutsche Bank’s Marion Labor does not expect last year’s peak to be achieved in the short term, Using S&P 500 shares as a reference, and given the effect of higher interest rates, the senior strategist believes that by the end of the year, the price of bitcoin could climb back to $ 28,000 – a 45% increase from the current level. And where the BTC price goes, so do the prices of stocks that operate in the ecosystem.

With this in mind, we searched the TipRanks database and found three names that are set to take advantage of a potential increase in the value of bitcoin. They all operate in the BTC mining area, they are considered strong acquisitions by the analyst community, and they offer a lot of upside potential in the coming year. Here’s the lowdown.

Nuclear science (CORZ)

Let’s first take a look at Core Scientific, one of the galleons in high-performance, net carbon-neutral blockchain infrastructure and digital asset extraction.

Outstanding mining aside – for its own mining operations last year, the company mined 5,700 BTC, the largest annual transport ever by a listed company (Core mines for its customers as well) – the company stands out due to a number of unique selling points. Core has its own infrastructure and data centers, which to reduce risk are geographically spread across Texas, North Dakota, Oklahoma, North Carolina, Kentucky and Georgia. And to monitor the miners and increase efficiency, the company has developed its own software, Minder. Furthermore, to find more opportunities in blockchain, the company also has its own R&D team.

As mentioned above, 2021 production surpassed all rivals, and the good news is that the company is still on track to beat that performance in 2022.

In the most recent quarterly report – for 1Q22 – revenue grew 254.9% year-on-year to reach $ 192.52 million, even though the figure came just outside the $ 196.67 consensus estimate. That said, adj. The $ 0.31 EPS beat the Streets $ 0.09 call. Mining revenue from digital assets reached $ 133 million compared to $ 9.63 million for the same period 12 months ago, while hosting revenue from customers came in at $ 27.34 million compared to $ 8.4 million in 1Q21.

But when bitcoin hits the slides, bitcoin miners are naturally also affected. The CORZ stock has not been immune to the bearish trend; since they were listed via the SPAC route in january, the shares have lost 84% of their value.

That said, Cowen analyst Stephen Glagola believes the company is “well positioned to navigate the current environment” and believes it is head and shoulders above the competition.

“We view Core Scientific as the best operator in the bitcoin mining industry due to the combination of its industry-leading BTC production and large-scale operations, low jurisdictional risk with geographic diversification across the United States, and an experienced management team with a strong track record in operations and capital allocation. , “wrote Glagola.

“Although ownership of mining rigs and computer infrastructure provides increased on-site and infrastructure capx costs versus an asset-light model, Core benefits from its economies of scale in production and resulting impact per local / business expenses.” analyst added.

Consequently, Glagola considers CORZ to be a better performance (ie purchase), while the price target of $ 3.10 allows for 12-month gains of 105%. (To see Glagola’s track record, click here)

There are some nice gains, but they pale in comparison to Glagola’s colleagues’ expectations. The Street’s average target is $ 8.22, suggesting that stocks will climb 444% higher over a one-year time frame. In terms of valuation, all 5 recent analyst reviews are positive, giving the stock a strong buy consensus rating. (See CORZ stock forecast on TipRanks)

Marathon Digital Holdings (MARA)

Now let’s look at Marathon Digital Holdings. This bitcoin miner has set itself the goal of becoming North America’s largest mining operation, while having one of the lowest energy costs.

The company has agreements with external service providers to connect their own mining equipment to electricity and the internet. The company’s miners are located in Texas, South Dakota, Nebraska and Montana. Most are based on a 105 MW power plant in Hardin, Montana and at the company’s Texas plant – hosted by Compute North.

The company is still working to fully distribute its fleet, and as the mining fleet expands, the company’s EH / s hash rate should increase. That said, Marathon has seen its expansion plans hit by headwinds recently – literally.

Due to a storm that passed through Hardin, MT back in June, the company’s mining operations in the area have been without power. Marathon recently said that by the first week of July, the miners will be back online, but in reduced capacity for now.

Current problems aside, Chardan analyst Brian Dobson estimates that the number of miners will reach ~ 200,000 by 2023E, while the “large influx” of rigs over the next year should push the company’s hashrate to ~ 24 EH / s with 2H23E – up from 3.6 EH / s in January this year.

“As a result,” says the analyst, “MARA can control ~ 8.5% of the global hash rate by 2023E, generating a monthly run of 2300 BTC.”

That’s not the only aspect Dobson likes about Marathon.

“The company’s strategy to HODL, or hold, coins (+9,673 coins and rising) makes for a compelling way to indirectly own cryptocurrencies for investors who cannot directly own the category,” Dobson noted. “We are positive for Bitcoin transformative prospects in the long term, but expect volatility to persist in the short term.”

This volatility has caused equities to pull sharply into 2022 – down 83% so far this year, although Dobson sees many gains ahead. Together with a buy rating, analyst MARA gives a price target of $ 19, suggesting 243% upside in a year. (To see Dobson’s track record, click here)

In general, other analysts are even more optimistic; The average price target is $ 25.88, suggesting that stocks will climb 367% higher in the coming year. In terms of valuation, based on 6 purchases vs. 2 hold, the stock requires a strong buy consensus rating. (See MARA share forecast on TipRanks)

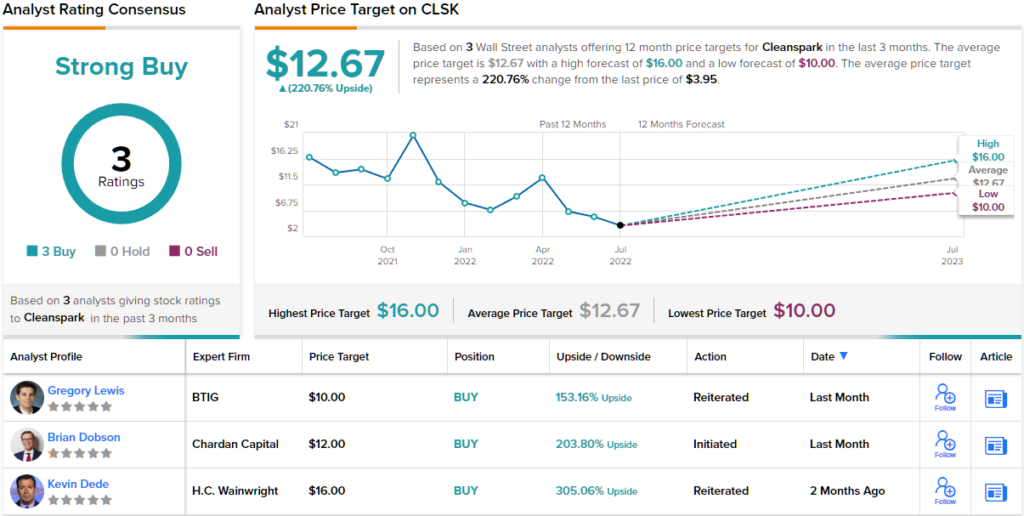

Cleanspark (CLSK)

CleanSpark is an interesting case, as the company seized the opportunity in mining and holding bitcoin and underwent a major transformation to do so. CleanSpark once offered integrated microgrid solutions, so it put another feather in its cap: it started extracting bitcoin, and now the mining business has taken over the previous one and is generating the bulk of the revenue.

And as Bitcoin mining has increased (the company has only generated BTC mining revenues since December 2020), revenues have increased dramatically. The latest results, for FQ2 (March quarter), saw revenue quadruple to $ 41.6 million from $ 8.1 million in the same period a year ago. Adjusted EBITDA also improved significantly to $ 22.5 million from the $ 1.9 million shown in F2Q21, Although the company posted a net loss of $ 171,000 in the quarter, a step back after generating a profit of $ 7.4 million in the same period a year ago and $ 14.5 million in F1Q22.

Chardan’s Brian Dobson notes that there have been reports in the industry indicating that some smaller private companies are having financial problems. This applies in particular to smaller mining companies that may not be able to finance current orders without prior approval from the host company. Due to lack of hosting plugs this can be a problem. But this may be good news for CleanSpark.

“In our view,” said the analyst, “this could play in CLSK’s favor. We anticipate that incumbents with easy access to infrastructure will be able to acquire mining rigs at significant discounts. This could prove to be an incremental positive for the company’s margin. expects CLSK’s rig numbers to increase to over 73,000 by the end of FY2023E, resulting in global hash rates. “

As such, Dobson CLSK shares are considering a purchase and supporting it with a price target of $ 12. The implication for investors? Potential upside of 204% from today’s level.

Two other analysts have recently assessed CLSK’s prospects, and they are also positive, which makes the consensus view here a strong buy. The average price target is also bullish; to $ 12.67 there is room for ~ 221% upside in the coming year. (See CleanSpark stock forecast on TipRanks)

To find great ideas for stock trading at attractive values, visit TipRanks ‘Best Stocks to Buy, a recently launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the analyst in question.s. The content is intended for informational purposes only. It is very important to do your own analysis before making an investment.