Bitcoin Bombshell: FTX, $32 billion exchange on the brink of collapse

Philip Thurston/E+ via Getty Images

What the hell happened to FTX?

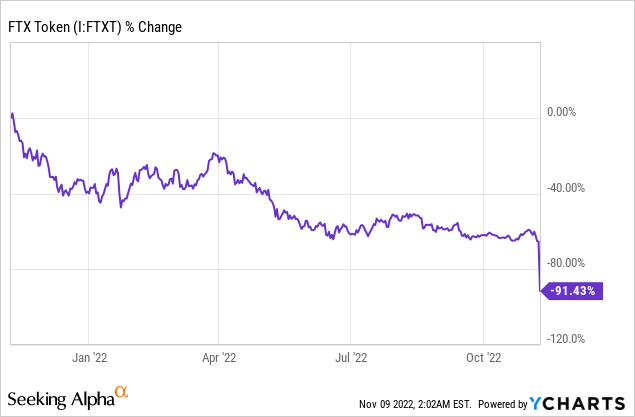

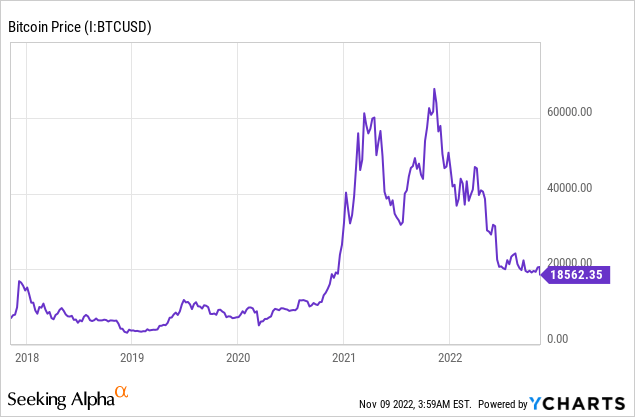

While the world was busy with US midterm elections, the crypto world was rocked by a multi-billion dollar run on the exchange FTX, previously valued at $32 billion. Bitcoin (BTC-USD) was down 14% at one point, while FTX’s token (FTT-USD) fell by 80% on relatively low volume (in my opinion) given the magnitude of the crash.

FTX is best known for its Bahamas-based billionaire founder, Sam Bankman-Fried. In the past 6 months, Sam Bankman-Fried has testified before Congress on Bitcoin regulation, bought 7.6% of Robinhood (HOOD), bailed out Voyager Digital (OTCPK: VYGVQ ) and donated nearly $40 million to various political races . But now FTX may have been a house of cards all along after depositors withdrew $6 billion and it suspended customer withdrawals. Fortunately, the small portion of FTX operating onshore in the US appears to be operating normally for now. Before this, Bankman-Fried had been compared to JP Morgan (the man, not the bank) as a savior of the industry. A potential bailout for FTX customers from rival exchange Binance (BNB-USD) is now in the works, but it is not bound to buy the company if its balance sheet gets worse than it thought, and as of Wednesday morning that looked like a distinct possibility.

So what happened? Sam Bankman-Fried (aka SBF) recently became embroiled in an increasingly bitter Twitter (TWTR) feud with Binance founder and fellow crypto-billionaire Changpeng Zhao (aka CZ). Zhao operates from Singapore and, unlike SBF, cultivates an image as more of a rebel – almost entirely eschewing the idea of regulation on land. The public feud is particularly unusual because Binance/Zhao was previously a major investor in FTX, taking ~$2 billion in FTX’s token when they were later sold.

Friends No More: Sam Bankman-Fried and Changpeng Zhao (Twitter)

Zhao and Bankman-Fried haven’t lost any love for a while now, but things seem to have heated up when Bankman-Fried seemed to hint in a tweet late last month that Zhao might not be able to come physically to the US- which I’m guessing is an allusion to the ongoing investigation of Binance for money laundering. Zhao has claimed that Bankman-Fried lobbied Congress against competitors like Binance behind their backs. But the tables soon turned. Not long after, an article came out citing leaked documents detailing the possibility that much of SBF’s assets in his parent company, Alameda Research, were tied up in highly illiquid assets while his liabilities could potentially be called, which also threatened FTX. Since then, independent analysis of the FTT token’s liquidity also paints a problematic picture.

Zhao’s answer – he would sell his stake in Bankman-Fried’s FTT token. Bankman Fried’s second-in-command then said they would buy the tokens back for $22. Zhao called the bluff and began unloading hundreds of millions of dollars worth of coins on the open market. But while SBF was a deca-billionaire on paper, his team didn’t have the cash to defend the $22 level. Not having the money to defend the bond on FTT triggered a giant bank run on FTX, with depositors reportedly pulling $6 billion in assets in just 3 days. As of yesterday, FTX has suspended withdrawals. Insane!

And not having the money here creates the rebuttable assumption that despite being hailed as a financial genius by the media, Bankman-Fried’s empire may have been fueled largely by risky gambles with depositors’ money. This is a really bad look, especially considering the wild spending on acquisitions, political contributions and sponsorships of the NBA, MLB and Formula 1 racing. SBF even tried to co-invest in Elon Musk for the Twitter purchase, but was turned down by Musk. FTX recently raised $420 million from investors, led by the Ontario Teacher’s Pension Fund. That money is probably gone forever. Bloomberg has estimated in a back-end calculation that 94% of Bankman-Fried’s net worth is now “depleted”. So what will happen to FTX? Bankman-Fried went silent on Twitter after days of vocal defense of FTX. After being slammed with withdrawals, SBF tweeted that Binance is entering a “strategic transaction” with FTX to buy the offshore part of FTX which represents the vast majority of the company’s total operations.

Binance Bailout: Will Binance Buy FTX?

Probably. But then again, maybe not.

The wording of the tweet and the thread below it with a “big thank you” make it seem like an apology was demanded by CZ’s team. Strategic transaction in this case means a fire sale like the one where Bear Stearns was bought for $2 per share after trading for $150. SBF bailed out BlockFi and Voyager Digital this summer for pennies on the dollar, and now the hunter has been replaced. How much is FTX worth? A few months ago, it was valued at $32 billion. Now it could be worth zero if not bailed out, or it could be worth whatever Binance agrees to pay for it.

So is this legal? It probably wouldn’t be in the US, at least not for banks or broker-dealers. Spreading rumors about competing banks threatens the entire system. But in the offshore crypto world, people tend to be based in jurisdictions that take a more relaxed view of this sort of thing as long as the money is flowing.

In some ways, this is genius for Zhao because he called a competitor’s bluff on having liquidity and essentially got FTX’s business for free. The deal is so good for Zhao that he can now do due diligence and either re-trade or pull out of the deal if he finds that the financials are worse than expected. Remember, the 2008 inter-firm shotgun wedding nearly brought down several banks, most notably Bank of America (BAC) after they absorbed Countrywide Financial. But in other ways it is problematic. Binance is the largest crypto exchange in the world. This means that if Binance later runs into trouble, there is no one to save it. Bankman-Fried famously said in July that all the shoes had dropped. Barely more than 100 days later, it was FTX’s shoes that were to drop. The irony is thick here. Were their assets really that concentrated in a bunch of altcoins and their liabilities in US dollars? I guess we will find out more soon.

How does the FTX scandal affect Bitcoin?

SBF probably owns a lot of Bitcoin, so he’s going to be a forced seller.

That is going to put a lot of pressure on BTC in the coming days. He owns a lot of Robinhood as well, so it will probably be on the selling block. He’ll probably also dump US Treasuries (the Treasuries can handle that) and a bunch of other random assets. I would assume that FTT will suffer the same fate as Terra (LUNA-USD) and that it will be worth close to zero.

It is a very important difference that can be lost in large numbers around possible insolvency and bailout for FTX. Bitcoin is a decentralized algorithm that allows people to store value on the blockchain. The vast majority of these slick “innovations”, charismatic founders and pyramid schemes reinforce the enormous success that Bitcoin has had in offering an alternative to central bank currency. By and large, altcoins are not the real deal. Seeking Alpha contributor Lyn Alden Schwartzer recently called them “clown goats.”

I will give them credit – a lot of these guys are slick. Although there is not yet any clear and convincing evidence that anything criminal is happening on FTX, crypto hustlers defrauded pension funds, defrauded Congress in some cases, and as with BlockFi, defrauded me and my friends, although luckily I cashed out mine before the crisis. There are many legitimate opportunities to add value to the world, but crypto seems like it may have attracted some of the shadiest people. This is not inherently Bitcoin’s fault – recently we have seen how Bitcoin has lent a lifeline to groups of people living under Lebanon’s collapsing government. A recent one CNBC piece profiled a 22-year-old who runs a Bitcoin mining operation of hydropower, solar panels and fuel. When done right, Bitcoin is a tool for freedom. When mistakes are made, Bitcoin is exchanged to buy playing chips at the altcoin casino. The last few months have made it abundantly clear that there needs to be reform on the crypto exchange side (to prevent hacks and exchange implosions), and also on the regulatory side. This effort is ongoing.

The bottom line

Massive crypto exchange FTX is on the brink of collapse, suspended withdrawals, and awaits rescue via a fire sale to competitor Binance. High-profile investors like big Silicon Valley venture firms and public pension funds are likely to lose a ton of money on FTX. You can bet that criminal and civil investigations have probably already started in the US and in other countries into how FTX collapsed. Another shoe has dropped in the altcoin world, and it probably won’t be the last. I see further failures with altcoins and stablecoins possibly representing an opportunity to buy Bitcoin for those who believe in its long-term potential. But these events are a very clear warning sign for investors to get out of stablecoins and altcoins before it’s too late. Bitcoin will come back, but the money in these crazy DeFi schemes and altcoins is likely to end up in a tragic game of musical chairs.

What do you think? Feel free to share your thoughts, comments or insights you have into the FTX situation below!