Bitcoin exchanges exceed $1B daily, while Ethereum sees net inflows

Analysis of Bitcoin and Ethereum exchange flows revealed conflicting activity for the top two tokens, with the market leader establishing clear dominance in holding long-term.

Exchange flows are the number of tokens deposited or withdrawn into or out of an exchange wallet. A popular on-chain metric to assess this is the Exchange Net Position Change.

Exchange inflows are generally considered bearish, as the primary reason for moving tokens to an exchange is to sell the token. In contrast, outgoing exchanges are generally considered bullish, as withdrawals of tokens are usually for long-term holding.

Examining the flow of tokens in and out of exchanges makes it possible to determine bearish or bullish investor sentiment.

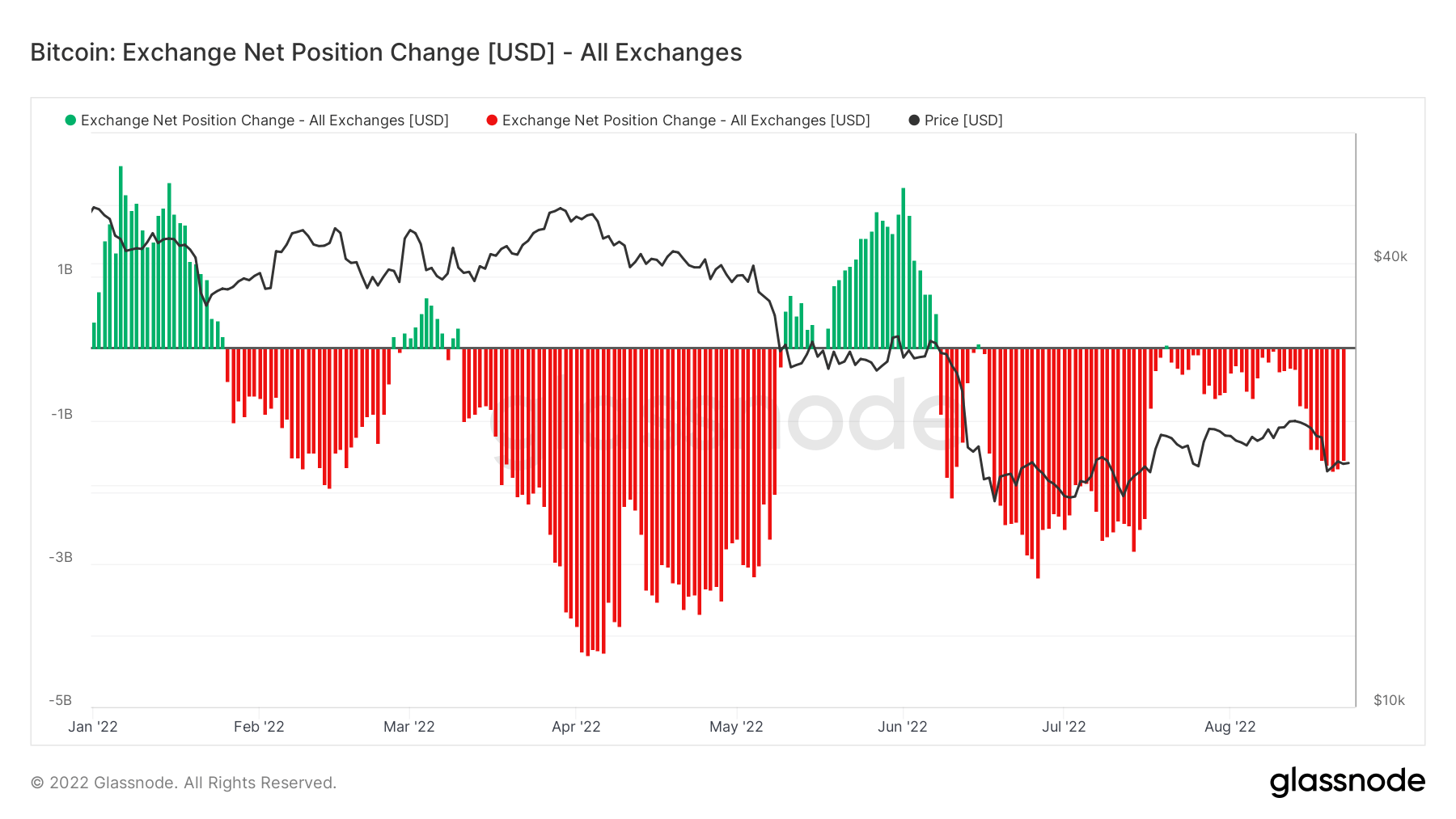

Bitcoin Exchange Net Position Change

After sharp price drops due to the Terra scandal and subsequent industry-wide de-leveraging, Bitcoin bottomed on June 18 at $17,600. The chart below shows consistent BTC outflows since the bottom, with daily outflows exceeding $1 billion daily on average.

Over the past week, the outflow rate has increased significantly, despite Bitcoin falling as low as $20,800 on August 19. This suggests that investors see value in today’s price range.

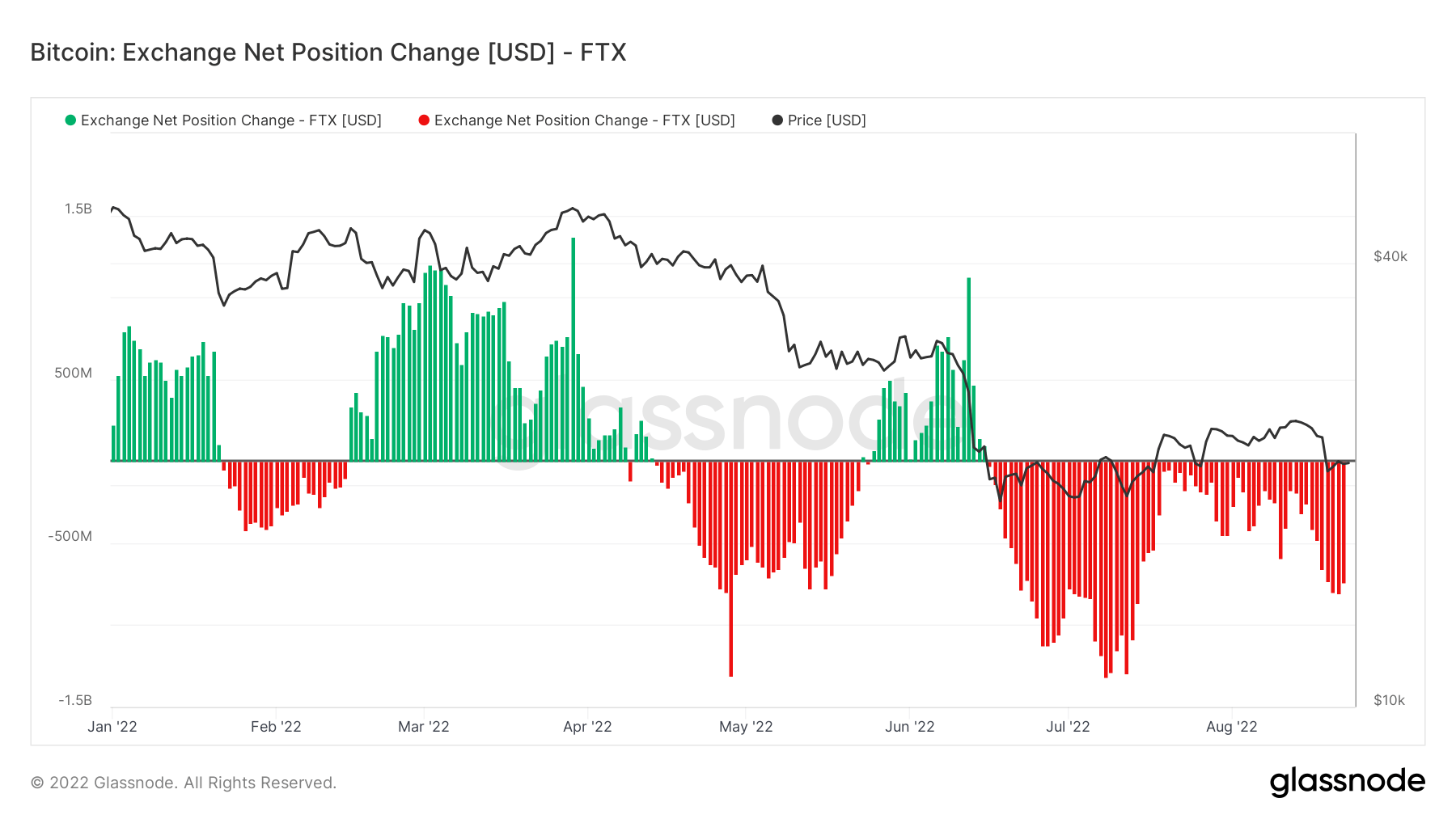

The FTX exchange accounted for more than half of the total outflows in the last week. There are no obvious root causes for this event. However, on August 20, “leaked documents” revealed that FTX increased its revenue by over 1,000%, from $90 million in 2020 to $1 billion in 2021.

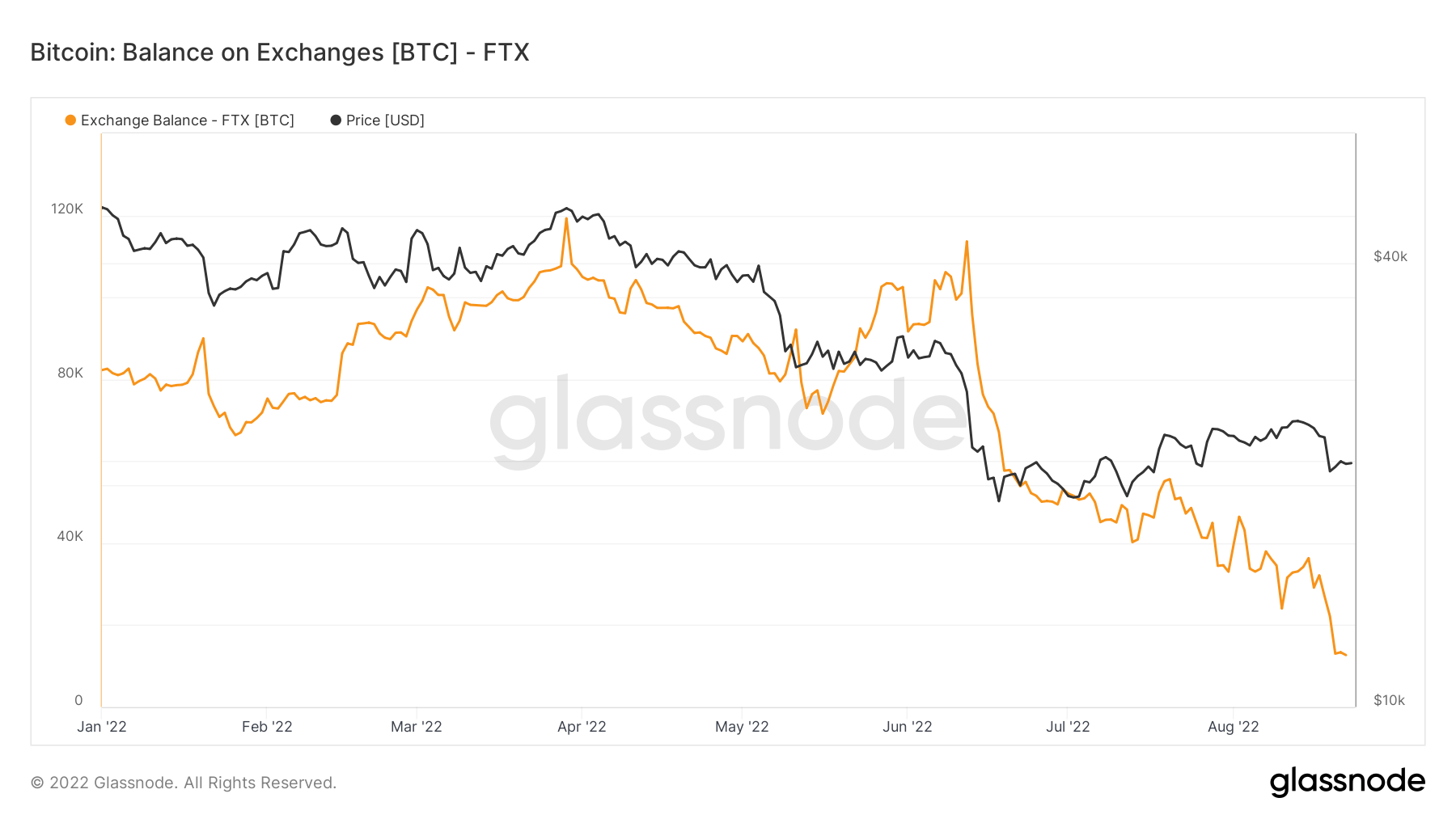

Further analysis of FTX’s BTC reserves shows a significant decrease in its holdings. In March, the company had over 120,000 BTC. But now, halfway through Q3, this has dropped to just 13,000 tokens, with the period from June showing the sharpest drop, leading to a progressive drop in BTC held.

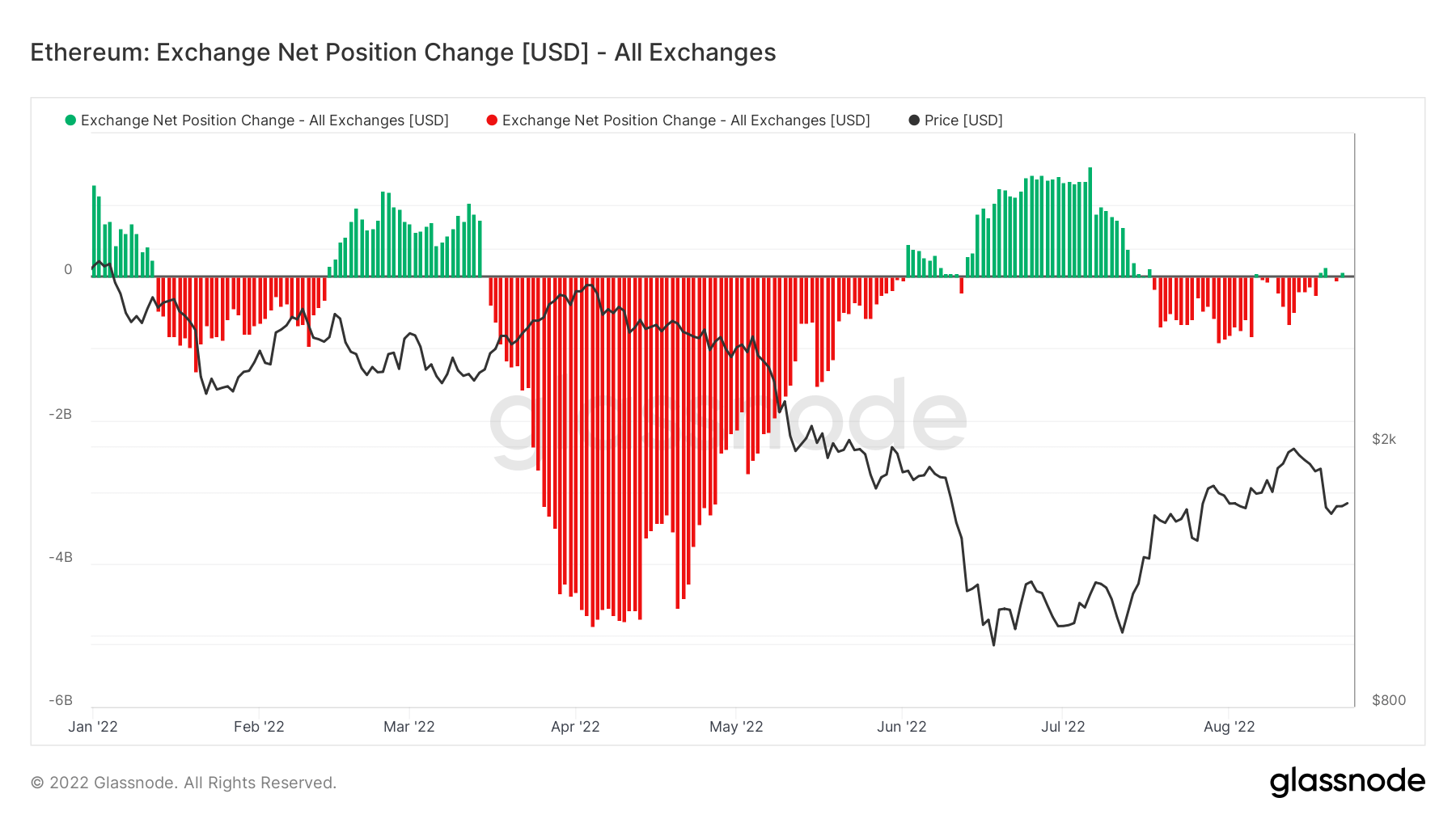

Ethereum Exchange net position change

In contrast, Ethereum’s net position change shows that despite massive outflows from mid-March onwards, the amount of tokens leaving exchanges has returned to near net zero.

This development is a negative sign, especially as the merger approaches. It suggests that investors believe the move to Proof-of-Stake (PoS) is a “buy the rumor, sell the news” event.

The contrasting activity between Bitcoin and Ethereum may indicate that investors view BTC, and not ETH, as the long-term play against macro developments, such as inflation or escalating geopolitical tensions.