Zooming in on 3 Andreesen Horowitz fintech plays on housing and mortgages: Point, Valon, Vesta

This post originally appeared on The Basis Point: Zooming in on 3 Andreesen Horowitz Home & Mortgage Fintech Plays: Point, Valon, Vesta

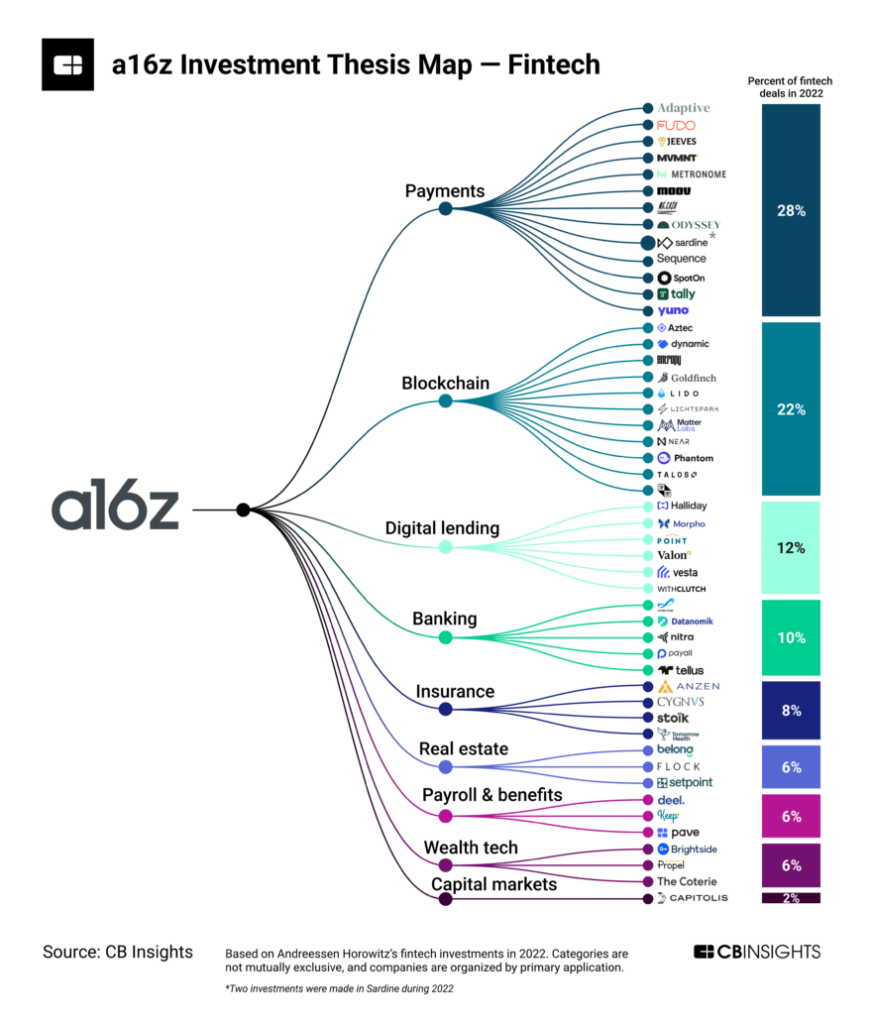

CB Insights reports that of the 206 venture capital investments Andreesen Horowitz (a16z) made in 2022, nearly 25% went to fintech. Sixty percent of these fintech deals closed in the first half of 2022, and 40 percent closed in the second half. Here are some notes on 3 mortgage and housing plays they’ve made:

1ST POINT

The point is a new version of lending where they don’t so much lend as invest together with you. They only give you a portion of the down payment to buy a home, and they get to share in future gratitude with you.

Point will front approximately half of the advance payment at zero interest. But you share about a third of the home’s appreciation with them for the first 10 years.

We wrote a detailed piece about Point during a previous funding round. Their last round 9 months ago was a Series C for $115 million. The linked post also covers Point’s primary – and more mature – competitor Unison.

2. VALON

Valon builds software to run mortgage servicing, of which there are $13 trillion in outstanding loans. Servicing is notoriously difficult to disrupt due to the extreme regulatory responsibilities and scale from day one typically required – very few mortgage servicers have small servicing books.

There are two main software players in this space. Black Knight is the oldest player in this market, and has majority market share – they also have other services like product and pricing engines and loan origination software (more on origination below), as well as robust housing data services given all the data they have.

Sagent is the second largest mortgage servicing software player and is taking big steps in innovation by developing a new cloud-based servicing platform in partnership with Mr. Cooper, one of the largest US mortgage servicers with a portfolio of $850 billion.

Because servicing is so difficult to simply develop from scratch and then sell to large servicing firms, Valon has taken the approach of acquiring mortgage rights as part of their business. This provides revenue, but it also provides real service resources that they can build their software to support. Service takes years to get the right scale, but it’s a sector that definitely needs innovation.

Valon’s last round was a $60 million Series B six months ago.

3. VEST

Vesta is a LOS (Loan origination software) platform for the segment of the mortgage industry that averages $2 trillion in new loans per year for each of the last 29 years.

This is another area of the highly complex and heavily regulated mortgage sector that needs innovation. The two main market share players are ICE Mortgage Technology’s Empower (formerly Ellie Mae) and Black Knight’s Empower.

ICE and Black Knight are now in the late stages of an announced merger pending regulatory approval. Regardless of whether regulators approve this deal, Vesta competes with both of these LOS platforms and is a new, cloud-based platform that I’ve hosted a few times during my demonstrations at industry conferences – and it’s cool to see the core of plumbing. of origin has been completely rethought.

The whispered consensus in the industry is that all lenders would love a new, fully modern origination platform, and Vesta shows great promise here. The industry is mostly looking to deploy with their first major customers and 2023 should be notable for them as this plays out.

Vesta’s last round was a series A of 30 million dollars this time last year.

===

Link to the CB Insights post below with more a16Z plays.

As for these companies, The Basis Point follows them and everyone else in mortgage and housing closely, so please comment or get in touch with questions.

___

Referral:

– a16z analyzes its fintech investment strategy: Where did VCs place their biggest bets in 2022? – CB Insights Research

– Why spend on an advance payment when Point or Unison will do it for you?

– Mortgage service giant Mr. Cooper hires fintech Sagent to run the giant portfolio. Companies will combine technology to serve $13t industry.

DO YOU LIKE MONEY? GET MORE ON THE BASICS®

The White House Renters Bill Of Rights has 5 things to help America’s 44 million renters

Top 4 Reasons Active Home Buyers Can’t Find a Home to Buy Right Now

What is the best home equity strategy for homeowners and lenders given 2023 rates and home prices?