With EPS growth and more, TradeGo FinTech (HKG:8017) makes an interesting case

For beginners, it may seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a record of revenues and profits. Sometimes these stories can cloud the minds of investors, causing them to invest with their emotions rather than on sound fundamentals. Loss-making companies can act as a sponge for capital – so investors should be careful not to throw good money after bad.

If this type of company is not your style, you like companies that generate revenue, and even make a profit, then you may well be interested in TradeGo FinTech (HKG:8017). While profit is not the only metric that should be considered when investing, it is worth recognizing businesses that can consistently produce it.

Check out our latest analysis for TradeGo FinTech

How fast is TradeGo FinTech growing?

In general, companies experiencing growth in earnings per share (EPS) should see similar trends in share prices. So it makes sense for experienced investors to pay close attention to a company’s EPS when conducting investment research. To the delight of shareholders, TradeGo FinTech has achieved impressive annual EPS growth of 46%, compounded, over the past three years. That kind of growth rarely lasts long, but it’s well worth paying attention to when it happens.

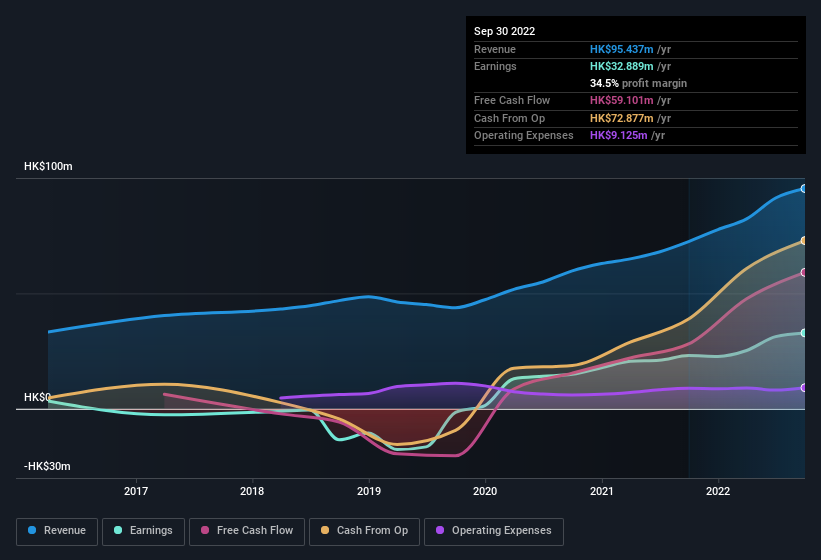

It is often useful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get a fresh perspective on the quality of the company’s growth. The music to the ears of TradeGo FinTech shareholders is that EBIT margins have grown from 33% to 39% in the last 12 months and revenues are also on an upward trend. Both are good metrics to tick off for potential growth.

You can take a look at the company’s revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Since TradeGo FinTech is no giant, with a market cap of HK$630m, you should definitely check cash and debt for getting too excited about the prospect.

Are TradeGo FinTech insiders aligned with all shareholders?

It is said that there is no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks can blow up the market. Too often, buying shares is a sign that the buyer sees them as undervalued. However, insiders are sometimes wrong and we don’t know exactly the thinking behind their acquisitions.

Not only did TradeGo FinTech insiders refrain from selling shares during the year, but they also spent HKD 869,000 buying them. It puts the company in a good light, as it signals that the managers feel confident about where the company is going. We also note that it was Executive Chairman and CEO, Yong Liu, who made the largest single acquisition, paying HK$368k for shares at approximately HK$0.76 each.

Along with the insider buying, another encouraging sign for TradeGo FinTech is that insiders as a group have a significant shareholding. In fact, their holdings are valued at HK$168m. It shows significant buy-in, and may indicate conviction in the business strategy. In percentage terms, this amounts to 27% of the shares issued for the business, a significant amount considering the market value.

Shareholders have more to smile about than just insiders adding more shares to their already substantial holdings. The cherry on top is that the CEO, Yong Liu, is paid relatively modestly to CEOs of companies of similar size. Our analysis has discovered that the median total compensation for CEOs of companies such as TradeGo FinTech with market capitalizations below HK$1.6b is approximately HK$1.9m.

The CEO of TradeGo FinTech received only HK$884ki in total compensation for the year ending March 2022. That looks like a modest pay package, and may suggest some respect for shareholder interests. CEO compensation is hardly the most important aspect of a company to consider, but when it’s reasonable, it gives a little more confidence that management is looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Is TradeGo FinTech worth keeping an eye on?

TradeGo FinTech’s earnings have taken off quite impressively. Equally encouraging; insiders both own and buy more shares. These factors seem to indicate the company’s potential and that it has reached a turning point. We suggest that TradeGo FinTech belongs at the top of your watch list. Before you take the next step, you should know about 1 warning sign for TradeGo FinTech which we have uncovered.

The good news is that TradeGo FinTech is not the only growth stock with insider purchases. Here’s a list of them… with insider buys in the last three months!

Please note that the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we help make it simple.

Find out about TradeGo FinTech is potentially over- or under-rated by checking out our extensive analysis, which includes fair value estimates, risks and warnings, dividends, insider trading and financial health.

See the free analysis

Do you have feedback on this article? Worried about the content? Contact with us directly. Alternatively, you can email the editors (at) simplywallst.com.

This article by Simply Wall St is general. We provide commentary based on historical data and analyst forecasts only using an objective methodology, and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell shares, and does not take into account your goals or your financial situation. We aim to provide you with long-term focused analysis driven by fundamental data. Please note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.