The European Innovation Council (EIC) is increasing its investment in the Swedish fintech company Invoier

The founders of Swedish fintech Invoier

Fredrik Mistander, CEO & Co-Founder Invoier

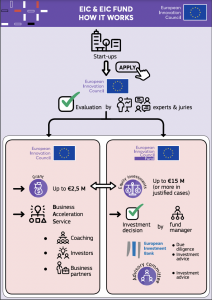

EIC & EIC Fund – how it works

The EIC fund identifies and invests in Europe’s most promising start-ups, focused on game-changing innovations and is now increasing its ownership in Invoier.

— Kinga Stanislawska, board member of the European Innovation Council (EIC).

STOCKHOLM, SWEDEN, Dec. 6, 2022 /EINPresswire.com/ — The EIC fund identifies and invests in Europe’s most promising start-ups with a focus on scaling up game-changing innovations. Invoier is one of their investments and the EIC fund has now increased its ownership, making them one of the largest owners alongside the founders.

Established in 2018, the Swedish fintech company Invoier was in 2019 one of the first companies to receive support under the EIC’s highly selective EIC Accelerator program launched at the end of 2019 under Horizon 2020, the research and innovation program of the EU. Today, the EIC fund continues to show confidence in the new technology solution by increasing its shareholding in the company. As part of the process, a verification of ownership has been approved by the Swedish Financial Supervisory Authority.

– Invoier continues to make impressive progress on its journey and we are delighted to continue to support the team. This success testifies to how the EIC fund strengthens the European startup ecosystem, says board member of the European Innovation Council (EIC) Kinga Stanislawska

This EIC Fund investment is in addition to the grant funding to Invoier previously, awarded through the same EIC Accelerator. All investments are preceded by a thorough evaluation by external experts, a due diligence process overseen by the European Investment Bank and a final decision by the manager of the EIC fund. Since its inception, around 20,000 European start-ups have applied under the EIC Accelerator and 2-3% were approved (616). To date, 29 Swedish companies have been selected for financing through grants alone or combined with equity.

– The fact that the EIC fund has once again confirmed that we are on the right track and creating radically better conditions for SMEs means a lot to us as a small company that stands up to the large established factoring players, says Fredrik Mistander, CEO & Co – Founder Invoier

About the EIC fund

The European Innovation Council Fund (EIC Fund) was established in June 2020 and is a ground-breaking initiative by the European Commission to make direct equity and quasi-equity investments (between €500,000 and €15 million) in high-impact European start-ups and deep technology. and scaling up. With a long-term perspective, the EIC fund invests in companies from all sectors, across all EU member states as well as associated countries.

The EIC fund aims to fill a critical funding gap and the main purpose is to support companies in the development and commercialization of disruptive technologies. This is achieved by penetrating market players, from a large network of capital providers and strategic partners suitable for co-investments and post-financing. The fund places particular emphasis on strengthening and supporting female founders as well as the ambition to reduce the innovation gap between EU countries. eic.ec.europa.eu

About Invoices

Invoier provides SMEs with affordable capital, through a competitive digital marketplace for invoices, built on a unique AI-based risk assessment method. In turn, this allows professional investors to enter this field and raise the capital using invoices as a new asset class. invoice.com

Related Material:

EU invests in Swedish fintech company to solve European credit crisis (17 August 2021)

Linda Rehn

Invoier AB

+46 73 539 12 22

[email protected]

Visit us on social media:

LinkedIn

![]()