A software upgrade is usually no cause for celebration. But in the crypto world, this one apparently is.

The crypto platform Ethereum is preparing for a major system overhaul that will, among other things, make it more energy efficient. Analysts and investors say the planned transition, known as the “merger” in crypto circles, is driving up the price of ether, the internal token on the Ethereum blockchain.

Starting at. 5:00 PM ET on August 19th, the price of ether was up 87% from the June 18th low. Bitcoin, the only cryptocurrency larger than ether, was up about 20% in the same time frame, according to Dow Jones Market Data. Aggregate open interest in ether futures across exchanges — a measure of investor enthusiasm for the cryptocurrency — has increased since the start of July, according to data from The Block.

To be sure, the ether rally could fade at any time. This month Ethereum co-founder Vitalik Buterin said via Twitter that the upgrade should take place on or around September 15, although he said the exact date is not guaranteed. The merger has been going on for years and has been delayed several times for technical reasons.

The upgrade is a difficult technological undertaking in part because there are already thousands of decentralized applications with billions of dollars deposited in them running on the Ethereum blockchain, according to Katie Talati, director of research at crypto-asset manager Arca.

READ Former watchdog executive sues Binance, Kraken for £10bn in UK’s first crypto competition claim

“Because there is so much potential for value to be lost, they had to be very careful with each step of the roadmap to make sure there were no problems or errors,” Talati said.

Some investors think that’s a recipe for trouble.

“The Ethereum team is trying to fix an airplane in mid-flight,” said Cory Klippsten, founder and CEO of Swan Bitcoin, a bitcoin financial services company. “You’re trying to make massive changes to it while it’s actually operating.”

Danny Ryan, a researcher at the Ethereum Foundation, expressed confidence in the September launch. The Ethereum Foundation is a non-profit organization that supports Ethereum and related technologies.

“It’s probably the most complicated blockchain upgrade that’s ever happened, but the amount of prep work, testing and security analysis that’s gone into this is pretty astounding,” Ryan said.

Ethereum is a platform for developers to build and operate crypto applications, much like IOS or Android. But instead of being controlled by Apple or Google, these applications are decentralized.

The crypto market has mostly been in a slump since the peak in November. Some analysts and investors see the Ethereum upgrade as one of the few upcoming catalysts that could revive the market.

The upgrade is called Merge because it is the merger of the current proof-of-work Ethereum blockchain and the proof-of-stake “Beacon Chain” created by Ethereum developers.

Both proof of work and proof of stake are mechanisms that cryptocurrency networks use to verify transactions and add them to the blockchain.

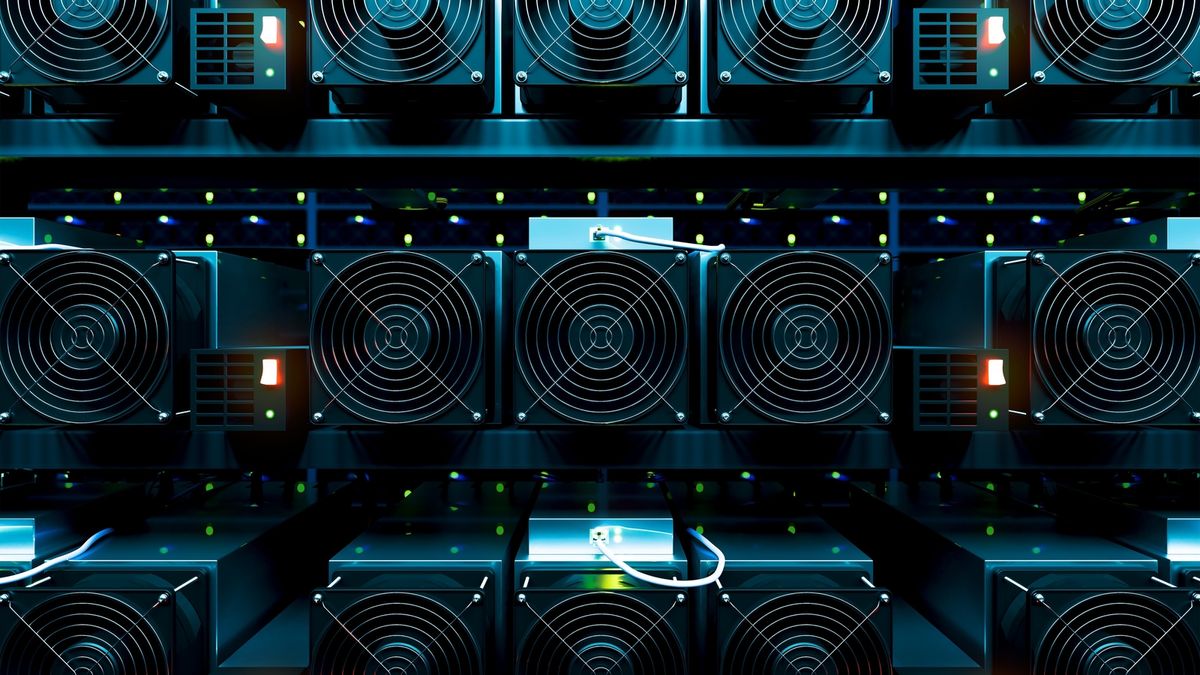

Bitcoin pioneered the proof-of-work model in which a global, decentralized network of computers solves complex mathematical puzzles to process transactions and earn rewards in the form of newly created bitcoins. The people and companies that set up these computers are called miners. The process is energy intensive because the network requires miners to run powerful machines 24/7.

READ Crypto crash? It’s “just a blip”, says BTCS CEO Charles Allen

Proof of Stake, on the other hand, allows users to participate in securing a network by staking their own crypto holdings. The idea is that by locking their coins, investors have a financial incentive to ensure that transactions are valid.

Last year, the NFT craze clogged the Ethereum network and increased transaction fees. Switching to the proof-of-stake model is likely to make Ethereum faster, more secure, and more energy efficient. The Ethereum Foundation said the change is expected to reduce Ethereum’s power consumption by approximately 99.95%.

The two largest stablecoin issuers, Tether and Circle, have both said they will support the proof-of-stake Ethereum blockchain.

For users and investors, the newly upgraded Ethereum will work largely the same. But for miners who have invested in hardware to mine ether, the upgrade could hurt.

“There are tons of miners and mining pools. They will immediately lose millions and millions of dollars in revenue when the merger happens,” said Kosala Hemachandra, CEO and founder of MyEtherWallet, an open source software company for cryptocurrency wallets.

Many proof-of-work miners are preparing to migrate to the new Ethereum blockchain and become so-called validators. But some miners said they would continue to support the current Ethereum blockchain.

Write to Vicky Ge Huang at [email protected]

This article was published by Dow Jones Newswires, another Dow Jones Group service