When is crypto a value or a commodity?

Classification of cryptocurrencies in the United States as securities or commodities remains a source of confusion for market participants, as the distinction is not always clear-cut.

Ambiguity in US law leaves crypto market participants confused and seeking clearer guidance. Depending on the regulator consulted and the timing of the request, a crypto asset may be considered a security, a commodity, or something else entirely.

The Regulatory Landscape: SEC vs. CFTC

Two primary regulatory bodies, the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), govern cryptoassets in the United States. However, their jurisdictional boundaries are unclear, creating confusion for market participants.

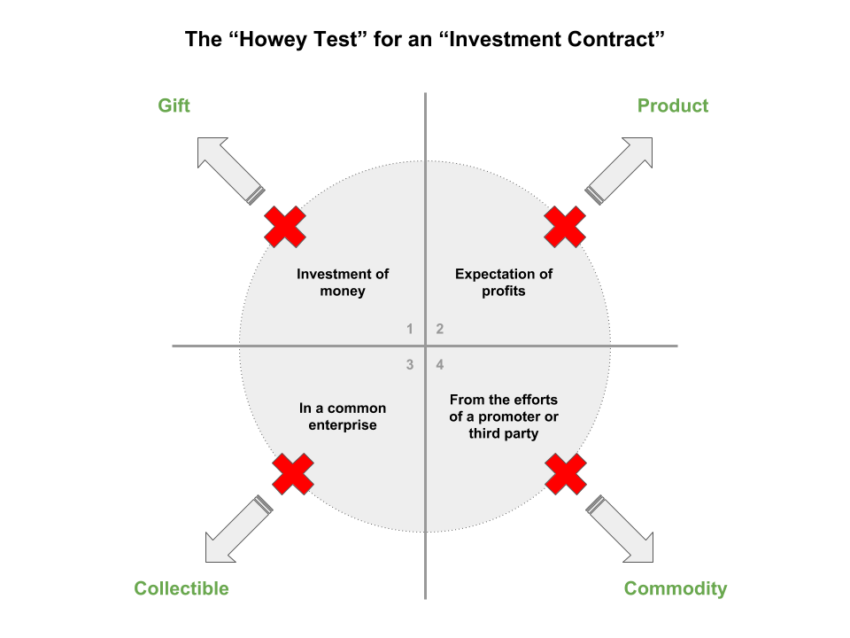

The SEC oversees securities and considers some cryptocurrencies securities under the Howey test. This legal standard was established in a 1946 Supreme Court case.

According to the Howey test, an asset can be a security if it involves an investment of money with an expectation of profit that comes primarily from the efforts of others.

On the other hand, the CFTC classifies cryptocurrencies such as Bitcoin and Ethereum as commodities. It claims jurisdiction over them under the Commodity Exchange Act. The distinction between securities and commodities is crucial, as each classification has its own regulatory and legal requirements.

For example, in the recently filed lawsuit against Binance and CEO Changpeng Zhao, the CFTC explicitly states that Bitcoin, Ethereum, and Litecoin are considered commodities. This legal action underscores the ongoing battle to classify cryptocurrencies within the regulatory framework.

Calls for clearer regulation and legal framework

This lack of clarity has resulted in a number of legal battles. Both regulators occasionally claim jurisdiction over the same cryptoassets. Market participants are uncertain about the legal status of their investments. While business operations such as the regulatory landscape remain in flux.

The demand for clearer and more comprehensive regulation is growing. Both industry leaders and legislators are advocating for a better defined legal framework. This will help protect investors and promote innovation and growth in the burgeoning crypto sector.

Coinbase’s legal director, Paul Grewal, expressed his confusion regarding the classification of cryptoassets. He stated that apparently they can be “both a security and a commodity, except when they are not.” Grewal highlighted the ambiguity by pointing out that the distinction “depends on which regulator you consult and when.”

Many industry leaders share Grewal’s frustration and wonder if this is really the best American law offering.

Market participants must navigate the complex regulatory maze carefully until the US develops a more consistent and coherent approach to cryptocurrency classification. Clarity from lawmakers and regulators will be key to fostering trust and stability in the world of digital assets.

Disclaimer

BeInCrypto has reached out to the company or person involved in the story for an official statement on the latest development, but has yet to hear back.