Robinhood Stock: With Crypto Down, This Will Be Tough (NASDAQ:HOOD)

Kimberly White

Investment thesis

Robin Hood (NASDAQ:HOOD) has seen its shares rally since this summer’s low of $7 a share, as investors believe that Robinhood’s restructuring plan will be enough to right this ship.

Still, I remain bearish.

The author’s work

I believe that the recent downward movements in crypto will further weigh on investors’ appetite to trade on Robinhood’s platform. This is contrary to Robinhoods recent comment.

As Robinhood’s brokerage clients have fewer crypto transactions, this will lead to weaker earnings in the near term, thus causing Robinhood’s Q4 2022 to miss analysts’ estimates.

In short, avoid this name.

Robinhood’s August figures, here’s the good news

Robinhood’s operating data from August

For the month of August, Robinhood’s cumulative net deposits were up 26% year-over-year. This coincided with the market rising after the summer declines.

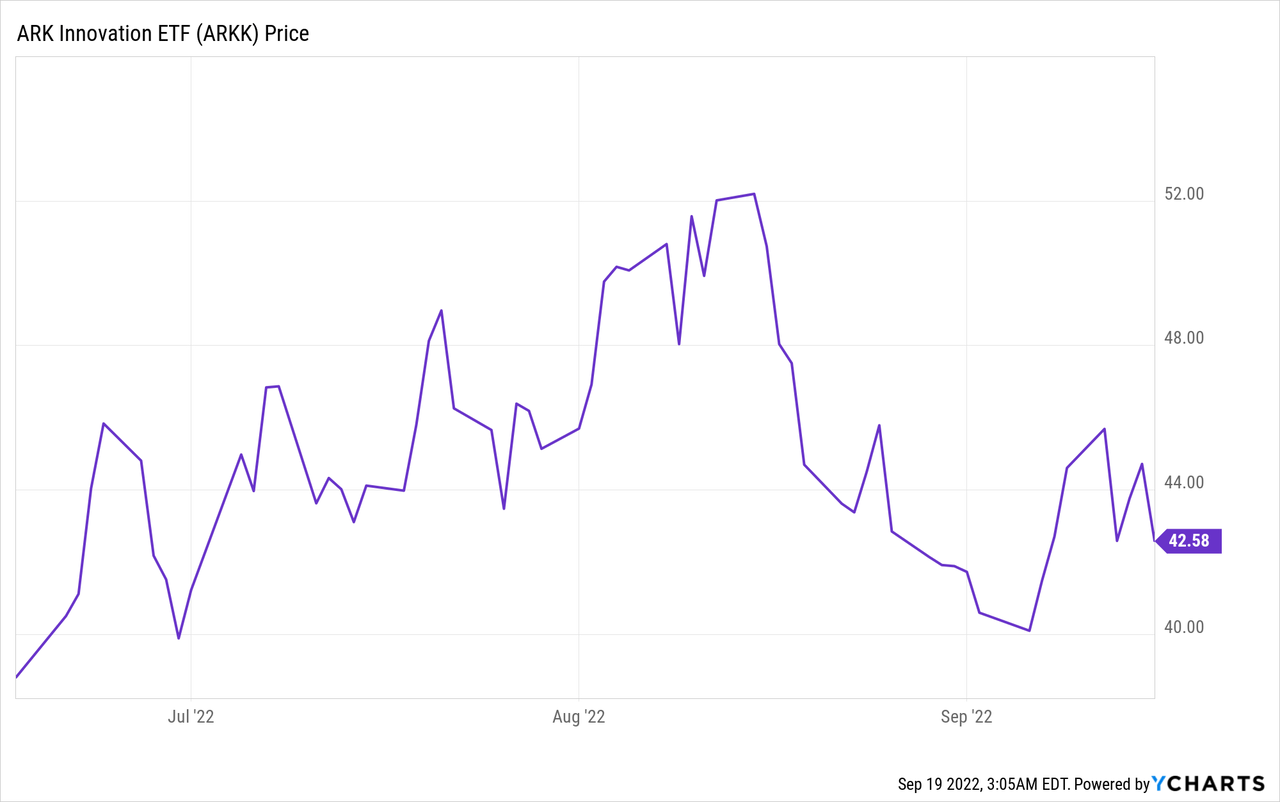

As a proxy for retail interest in stocks, I have used ARK (ARKK). As you can see above, from early July to mid-August, ARKK was up 50% during those two months before selling off in late August.

Therefore, I think it is very positive for Robinhood’s Q3 results. And that has led to a short-term rally in HOOD as investors tried to buy the decline in this name.

But I don’t think there is lasting value in this recent pop.

I believe that the recent rally in the share price will soon moderate as investors look beyond Q3 and into Q4 2022.

Robinhood’s Q4 results will be weak

Robinhood’s Q2 2022 presentation

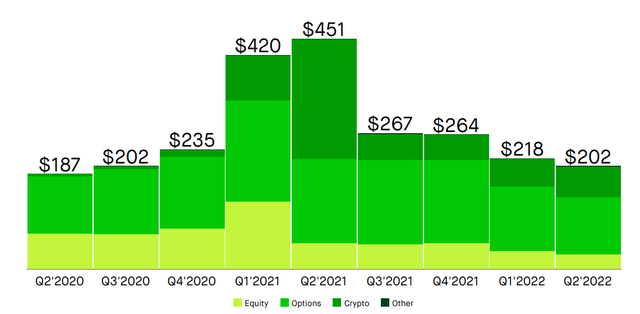

As you can see above, back in Q4 2020, about two years ago, Robinhood’s revenue from crypto was largely negligible as a share of total revenue.

And when we compare Robinhood’s exposure to crypto in Q4 2021, $48 million of the total revenue of $264 million was derived from crypto revenue (see slide 24).

Consequently, as the crypto market continues to trend lower, there is a significant looming risk to Robinhood’s Q4 earnings.

Accordingly, I believe that it is very likely that as Robinhood enters Q4 2022, next month, Robinhood’s revenue from crypto will fall lower, so that Q4 2022 will report less than $30 million in revenue for the quarter.

Therefore, when Robinhood reports its results for the fourth quarter of 2022 in early 2023, investors will be in for a negative surprise.

HOOD Stock Valuation – 6x 2022 earnings

Robinhood is still priced at 6x this year’s earnings. Given that this market is becoming increasingly selective about where the value is, I don’t think paying 6x this year’s earnings for Robinhood, a business with such poor visibility, is a good investment.

Looking around at my various available opportunities, I see countless high quality businesses with long runways that are priced at 6x sales.

For example, in cybersecurity or enterprise software companies, there are many companies that have many Fortune 500 companies as customers. Not retail investors facing a cost of living crisis.

Moreover, the compelling businesses are growing at a rapid pace and are either already profitable or have a clear path to profitability. And they are priced at 6x sales!

Therefore, why would investors risk paying 6x sales for Robinhood?

Frankly, I think it’s an investment with a poor risk-reward profile.

The bottom line

Ever since Robinhood went public, it seems to have hit one rough patch after another. As we now enter a “new bear market”, I find it difficult to be optimistic about this company’s prospects.

In particular, I am focusing my bearish investment thesis not so much on Robinhood’s Q3 2022 results, which I believe, as discussed above, may positively surprise the investment community, but on Robinhood’s Q4 2022, when I believe that investors’ appetite for trading crypto on the Robinhood platform can be significantly reduced.

Even though the share price has fallen so significantly, by more than 70% since IPO, I still find little value on offer for new investors coming to this stock.