What’s driving crypto prices this week? Are we finally in a bull market?

Over the past seven days, major cryptocurrency prices have risen across the board. From Bitcoin to Ethereum, Doge and Shiba Inu, almost every major crypto has shown a huge recovery this week. The global crypto market cap is up nearly 8% in a week, reaching $1 trillion for the first time in 45 days.

More specifically, Bitcoin is up almost 6%, while Ethereum has gained 17%. Most notably, Dogecoin prices have increased by over 110% in the past seven days, reaching the $0.1 mark for the first time in nearly 6 months.

So, what is the reason for this increase? And are we finally entering a long-awaited bull market?

Bloomberg’s historical crypto magazine

Last week, Bloomberg released a 40,000-word magazine dedicated to cryptocurrencies, titled ‘The Crypto Story’. This was only the second time in the Bloomberg publication’s 93-year history that it has published an entire issue on a single story. The report provided some critical insights and analysis in the crypto industry that focused on both positives and negatives.

The article emphasized that crypto has a long way to go in terms of building credibility, but it is the only way to reject the centralized control-oriented monetary institutes. Bloomberg writer Matt Levine called crypto as ‘trustless and censorship resistant. This kind of positive reflection shows that there is a growing awareness of crypto and its true potential in the industry. Such statements also show that local communities are rightly losing faith in centralized and obscure financial systems.

Although the report talks in depth about the risks and negative aspects of crypto, there is a certain bullish sentiment in the analysis that favors crypto as one of the biggest financial tools heading into the future. This report has clearly lifted market sentiment, which is one of the drivers behind the current bullish trend.

Elon Musk’s takeover of Twitter for $44 billion

After months of speculation and discussion, billionaire and Tesla founder Elon Musk has finally bought Twitter. But how does it affect crypto?

The Tesla CEO has been a proponent of cryptocurrency for a long time. Having a pro-crypto businessman at the helm of Twitter significantly affected market sentiment. More specifically, it affected the Dogecoin market. Elon Musk is an active proponent of the meme coin. In fact, the Tesla website accepts DOGE as payment for some of its products.

Musk’s takeover of Twitter is one of the main reasons DOGE is up over 110% in the past week. More and more people are investing in the leading meme coin as the liquidation slows down.

The stock market takes a plunge

Over the past 6 months, the primary stock market has crashed as inflation drives up interest rates around the world. The S&P500 is down 6.8% over the past 6 months, as the NASDAQ has fallen over 60%.

Although Bitcoin prices also fell during this time period, the volatility was relatively lower than the major stocks. Over the past five months, Bitcoin has maintained a steady resistance level of $19K and has not dipped below that level. While this is still a significant gap from the price a year ago, volatility has been significantly lower than large-cap stocks.

Therefore, many investors trust crypto over the stock market. There has also been a significant influx of DeFi projects offering high-yield staking and lending services for various tier-1 tokens. The prospect of passive income in a bear market also draws more people into the market.

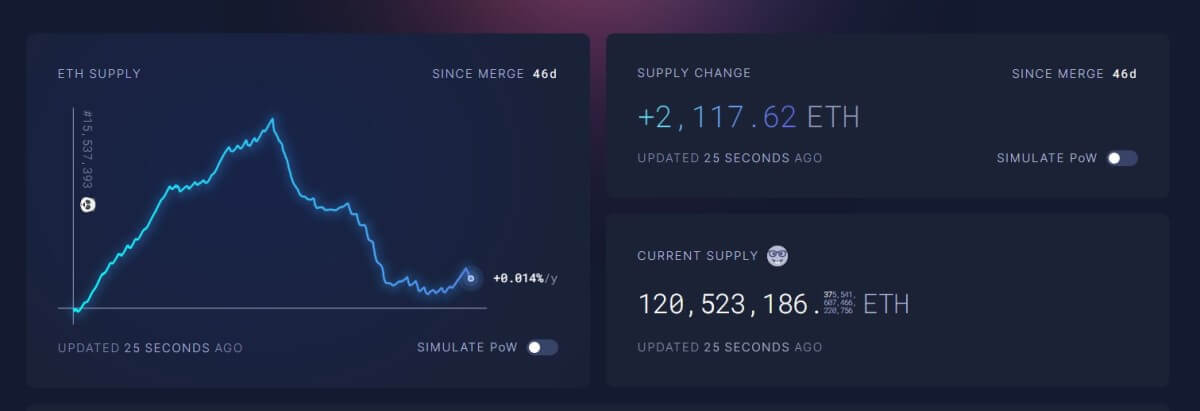

Ethereum has become deflationary

For the first time since the merger, Ethereum’s supply became deflationary on October 8. That means more ETH is burned every day through stake rewards than new supply. As the merger saw Ethereum shift to PoS, mining became obsolete and the daily production of new tokens dropped from 13,000 to 1,600.

It took almost a month for the existing tokens in circulation to be burned through stake rewards. On October 8, more ETH was burned than produced for the first time since the merger. The supply is continuously falling every day, which also drives the ETH prices in the market. The leading altcoin is currently up 17% in the seven days.

These are some of the main reasons why the cryptocurrency market has done well in the past week. So, are we in a bull market? We are definitely going through a bullish trend. However, whether we can officially say that it is a bull market depends on how long this trend is maintained. If prices continue to show resistance and an uptrend heading into November, we could be in for a bullish Christmas.