What hope can there be for the Bitcoin (BTC) price?

In this article, BeInCrypto shares experts’ Bitcoin (BTC) price forecast for May 2023 and what obstacles the cryptocurrency may face this month

Bitcoin Price Forecast: Expert Opinions

Independent financial expert Alexander Ryabinin believes that “May for Bitcoin, like April, will be difficult and interesting.” In his opinion, the main task on the road to Bitcoin (BTC) will be to maintain the level of $30,000.

The Bitcoin forecast for May from our expert includes two scenarios:

- Bitcoin has $30,000 and will come out higher in mid or late May. This means that BTC is in the long-awaited bullrun.

- Bitcoin will not be able to hold $30,000 and will fall below that. This will mean continued accumulation for at least several months.

Also Dmitry Noskov, an expert at StormGain crypto exchange, presented his Bitcoin forecast for May 2023. In his opinion, the way is open for BTC to reclaim the $30,000 level, with the prospect of further breakouts against the backdrop of the market preparing for the upcoming 2024 halving.

At the same time, our expert noted that the coin is under pressure from US regulators. According to Noskov, encryption from regulatory authorities could certainly become the main obstacle for BTC to trade above $30,000 in May 2023.

Alexey Busov, an entrepreneur and co-founder of the Cryptobaron community, gave May’s most positive Bitcoin forecast.

“In May, Bitcoin’s price will definitely continue to rise and possibly reach $35,000-$36,000. This is beneficial primarily for market makers who buy at lows and sell at highs. A fall in Bitcoin price over the next two to three weeks is not expected: it is important for major players to bring new players to the market. That was the reason for the sharp increase from $17,000 to $30,000.”

However, Busov believes that another collapse may await the crypto market at the beginning of the summer.

Bitcoin forecast with an eye on halving and history

Traditionally, May is not the best month for Bitcoin. Statistics show that since 2011, Bitcoin has performed poorly compared to other months.

At the same time, the Bitcoin price forecast for May, with an eye to the cyclicality theory, indicates the growth potential of the coin.

In the cycle following the 2020 halving (green curve), BTC largely followed a similar pattern to the 2016 halving (blue curve). If the cryptocurrency continues to move along the path of the previous cycle, the coin will be able to create a local top.

Encryption

The outlook for cryptocurrency largely depends on the actions of US financial regulators. As part of the fight against inflation, the Federal Reserve (Fed) intends, according to Bloomberg, to continue raising the key interest rate, despite the increasing pressure on the economy.

Against the background of a long increase in interest rates, the American banking system has experienced a number of bankruptcies. Over the weekend, First Republic Bank became the latest victim of the US banking crisis.

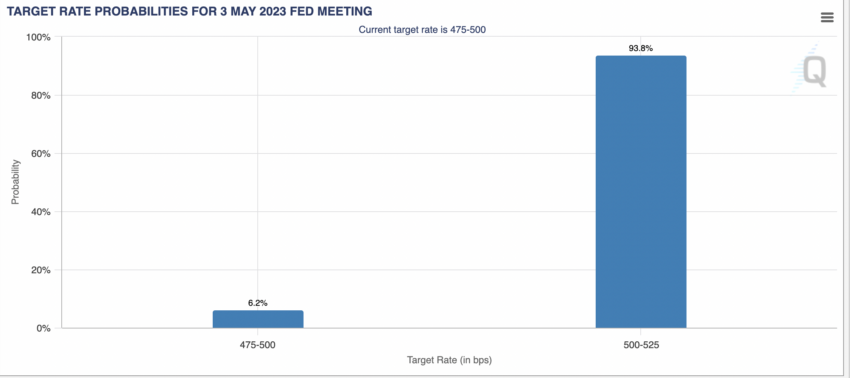

The next meeting of the regulator is scheduled for 3 May. Based on the results, the Federal Open Market Committee of the US central bank (FOMC) will announce the next decision on the key interest rate.

At the time of writing, over 90% of market participants expect an interest rate increase of 0.25 basis points at the beginning of May. Increasing pressure on the traditional financial market could negatively affect BTC.

In parallel, the Fed continues to increase the size of its balance sheet. The crypto market grows as quantitative easing, or money printing, increases.

The March series of bankruptcies in the banking system led to a temporary increase in the balance sheet. BeInCrypto reported that the Fed injected over $300 million to save the banking system.

On the back of the Fed turning on the “printing press”, BTC broke through the $30,000 level.

Bitcoin’s forecast for May largely depends on whether the collapse of First Republic Bank will be the cause of another increase in the Fed’s balance sheet and whether there is a risk of new bankruptcies in the financial market.

Results: Bitcoin forecast for May 2023

Experts interviewed by the editors of BeInCrypto give a moderately optimistic Bitcoin forecast for May 2023. The crypto market is under pressure from the Fed. In particular, we are talking about the key interest rate. The next decision on the calculation will be announced on 3 May.

The increase in the Fed’s interest rates and the regulators’ prolonged battle with inflation put pressure on BTC. Therefore, the opportunities for further growth of the cryptocurrency are limited.

The history of BTC behavior allows us to give a positive forecast for Bitcoin for May 2023. During this period, four years ago – after the halving in 2016 – the cryptocurrency moved towards updating the local maximum.

At the same time, it is important to note that the market situation is different from previous cycles for the worse. Therefore, it is possible that Bitcoin may spend May 2023 struggling to move forward.

Have something to say about this article or something else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook or Twitter.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In accordance with Trust Project guidelines, this opinion piece presents the author’s perspective and does not necessarily reflect the views of BeInCrypto. BeInCrypto remains committed to transparent reporting and maintains the highest standards of journalism. Readers are advised to independently verify information and consult with a professional before making decisions based on this content.