What ChatGPT said about the best fintech startups in Nigeria

Over the weekend, my Twitter feed buzzed with screenshots of people’s conversations with ChatGPT—a prototype dialogue-based AI chatbot capable of understanding natural human language and generating human-like written text.

Although some experts have said that AIs like ChatGPT can replace professionals working in the content industry, we interacted with the chatbot and noticed that while it can perform some tasks, these bots will still need humans to fact-check their work, especially in journalism and other data research-related work.

According to the developers of the chatbot, “ChatGPT sometimes writes plausible but erroneous or nonsensical responses,” they also acknowledged misinformation as one of the bot’s limitations.

Our audience research manager asked ChatGPT to write an article on the best fintech companies in Nigeria, here are the results:

Nigeria’s fintech industry has grown rapidly in recent years, with a number of innovative startups emerging to disrupt the traditional financial sector. Here are the top ten fintech startups in Nigeria leading the way in this exciting space:

- Paystack: Founded in 2015, Paystack is a payment gateway that enables businesses to accept online payments from customers. The company has raised over $20 million in funding from investors such as Visa and Tencent, and has over 60,000 active merchants using the platform.

- Flutterwave: Founded in 2016, Flutterwave is a payment technology company that enables businesses to process payments across Africa. The company has raised over $30 million in funding from investors such as Mastercard and Y Combinator, and has processed over $8 billion in transactions on its platform.

- Kuda: Founded in 2018, Kuda is a digital-only bank that offers customers a range of financial services, including savings, loans and investments. The company has raised over $10 million in funding from investors such as CRE Venture Capital and Target Global, and has over one million customers using the platform.

- PiggyVest: Founded in 2016, PiggyVest is a savings and investment platform that enables customers to save and invest their money. The company has raised over $7 million in funding from investors such as Ventures Platform and LeadPath Nigeria, and has over two million users on the platform.

- Carbon: Founded in 2018, Carbon is a digital loan platform that gives small businesses and individuals access to affordable loans. The company has raised over $5 million in funding from investors such as Omidyar Network and the Digital Frontiers Institute, and has disbursed over $70 million in loans to over 60,000 customers.

- Trove: Founded in 2019, Trove is a digital investment platform that enables clients to invest in a variety of asset classes, including stocks, bonds and ETFs. The company has raised over $3 million in funding from investors such as Rise Capital and GreenTec Capital, and has over 20,000 users on the platform.

- Cellulant: Founded in 2004, Cellulant is a payments technology company that offers businesses a range of payment services, including mobile money, e-commerce and mobile banking. The company has raised over $47 million in funding from investors such as Helios Investment Partners and Satya Capital, and has over 60 million customers on its platform.

- Cowrywise: Founded in 2016, Cowrywise is a savings and investment platform that enables customers to save and invest their money in a variety of investment products. The company has raised over $2 million in funding from investors such as EchoVC and Ventures Platform, and has over 200,000 users on the platform.

- VertoFX: Founded in 2016, VertoFX is a foreign exchange platform that enables businesses to make and receive international payments. The company has raised over $2 million in funding from investors such as Ventures Platform and CardinalStone Partners, and has processed over $500 million in transactions on its platform.

- Remita: Founded in 2010, Remita is a payment processing platform that enables businesses to make and receive payments online. The company has raised over $5 million in funding from investors such as Suntory Holdings and Diamond Bank, and has processed over $20 billion in transactions on its platform.

These top ten fintech startups in Nigeria are leading the way in the country’s fast-growing fintech industry, offering innovative solutions to the financial challenges facing businesses and individuals.

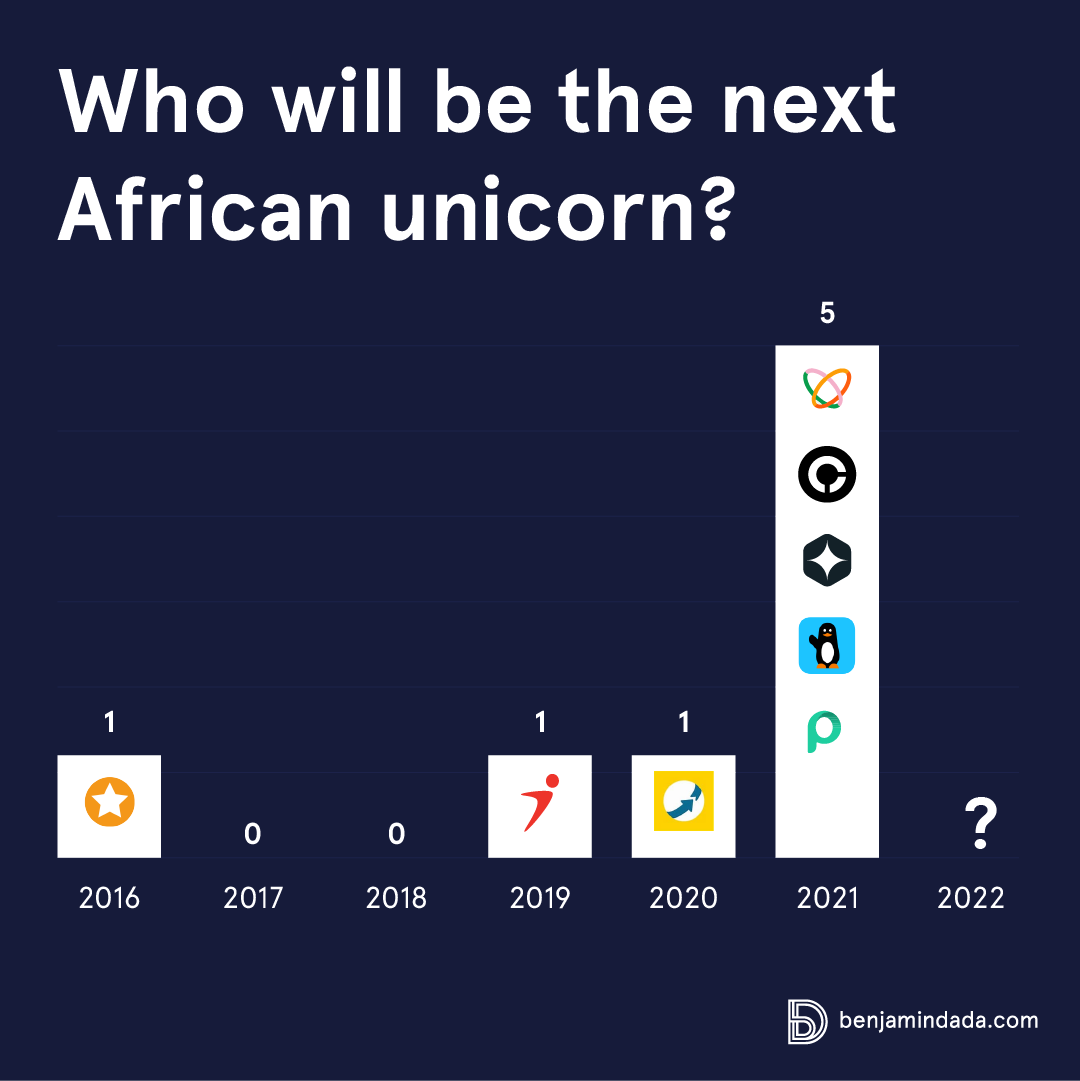

Who will be the next African unicorn?

We also asked ChatGPT about the next African unicorn. It said:

It is difficult to predict who the next African unicorn will be. However, some potential candidates could be companies such as Jumia, Interswitch and Flutterwave, which are among the most valuable startups in Africa.

🔎

Therefore, they are not potential unicorns.