What Chainlink’s 30-Day High and Increase in NFT Volume Mean for LINK Traders

Chain link [LINK] hit a thirty-day high of $8.80 and revitalized NFT trading volume to a new high after falling sharply on the second day of November. Interestingly, this development came after Chainlink announced new digital collectibles integrations.

⬡ DAILY CLOSING ⬡

⛓️ Integrations on #Ethereum and #Polygon ⛓️

• @Gustaves_NFT | VRF | Distributing #NFTs

• @itsdigits | VRF | Selection of raffle winners

• @sigmalaytn | VRF | Generate approval list pic.twitter.com/CKhISfmZ97— Chainlink (@chainlink) 4 November 2022

According to Chainlink, it integrated three NFT pools via its Polygon [MATIC] and Ethereum [ETH] lower chain. The decentralized oracle network was revealed through its “Daily Wrap-up”, noting that ItsDigits, Sigma on Katlyn and Gustave’s NFT were part of the latest alliance.

Here is AMBCrypto’s Price Prediction for Chainlink for 2022-2023

A tale of the fungible and the non-fungible

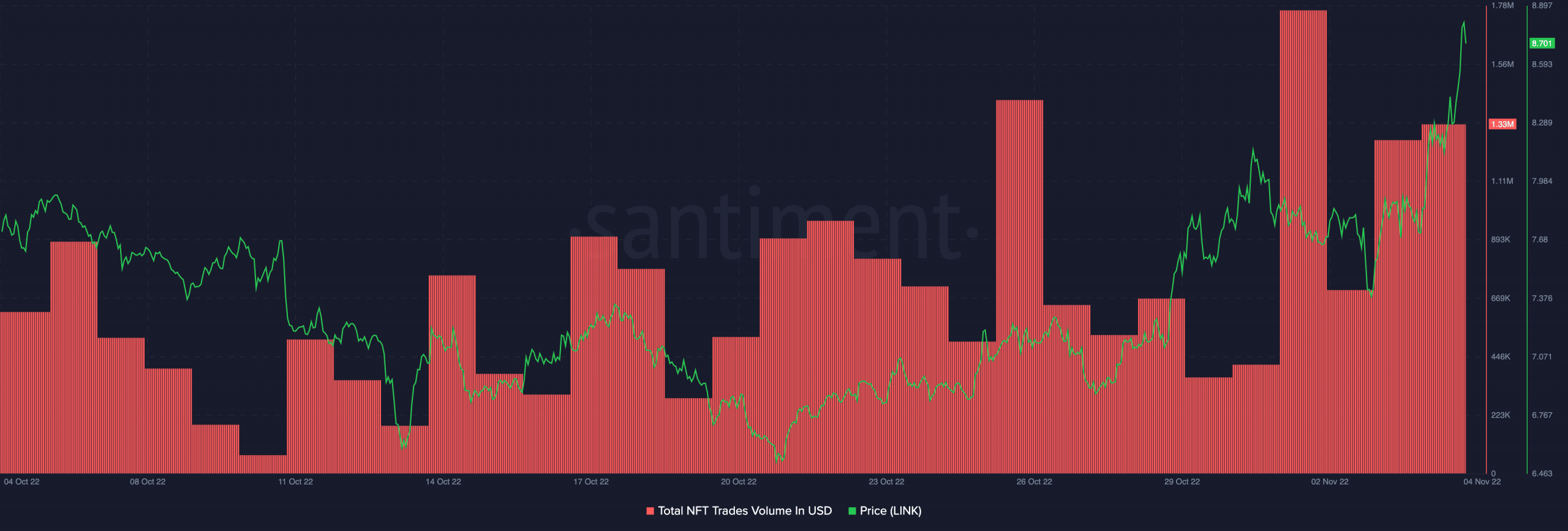

According to Santiment, NFT trading volume was $1.33 million at press time. The analytical platform on the chain as well revealed that the volume peak on 1 November decreased significantly over the last four days. Despite that, traders managed to renew their interest, especially as volume at press time managed to beat that of November 3rd.

Source: Sentiment

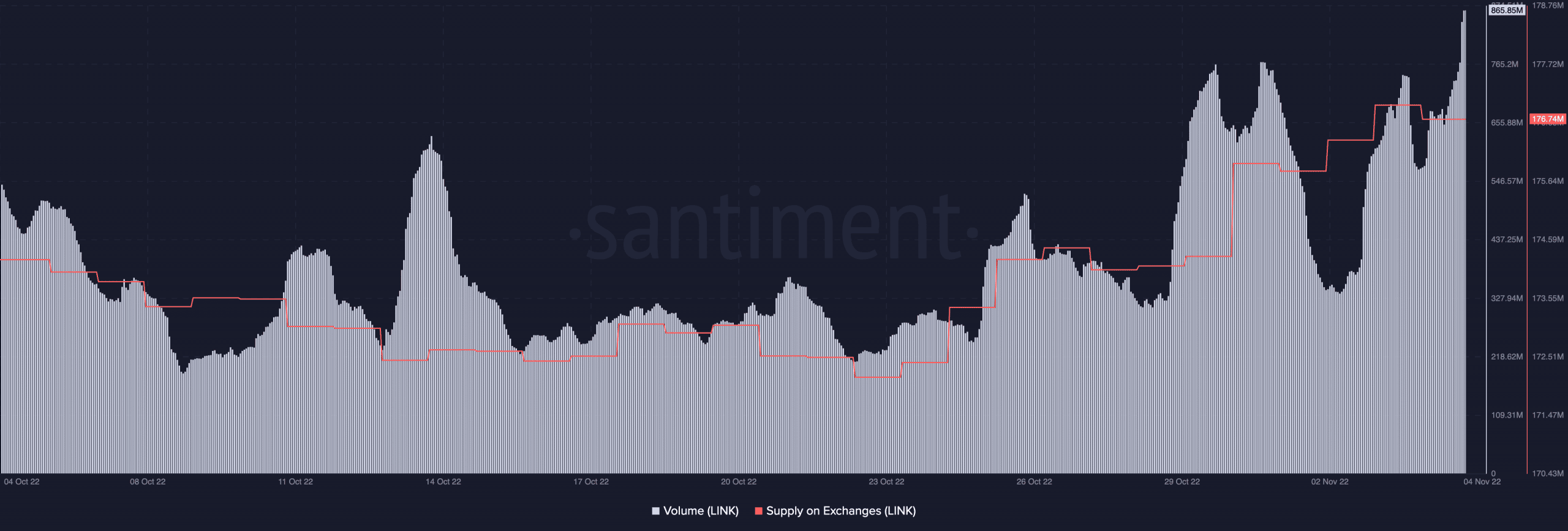

As for the price increase, there was no doubt that volume also played its part. Santiment showed that LINK volume had increased by 19% to $865.85 million. This increase meant that investors had chosen LINK as one of the cryptocurrencies to use for translations regardless of profit or loss. In addition to the increase in volume, the offer on exchanges indicated that the LINK pump had led investors to try to take profits.

At the time of writing, the exchange supply was 174.74 million. With an increasing flow rate, it was likely that LINK investors were in mode sell away what was won lately. As such, LINK may be on the verge of selling pressure leading to an easing of the rally. At press time, the signs were already beginning to appear.

Furthermore, CoinMarketCap data revealed that LINK’s price had dropped to $8.67 as one after effect of the increase in the exchange offer.

Source: Sentiment

In other words…

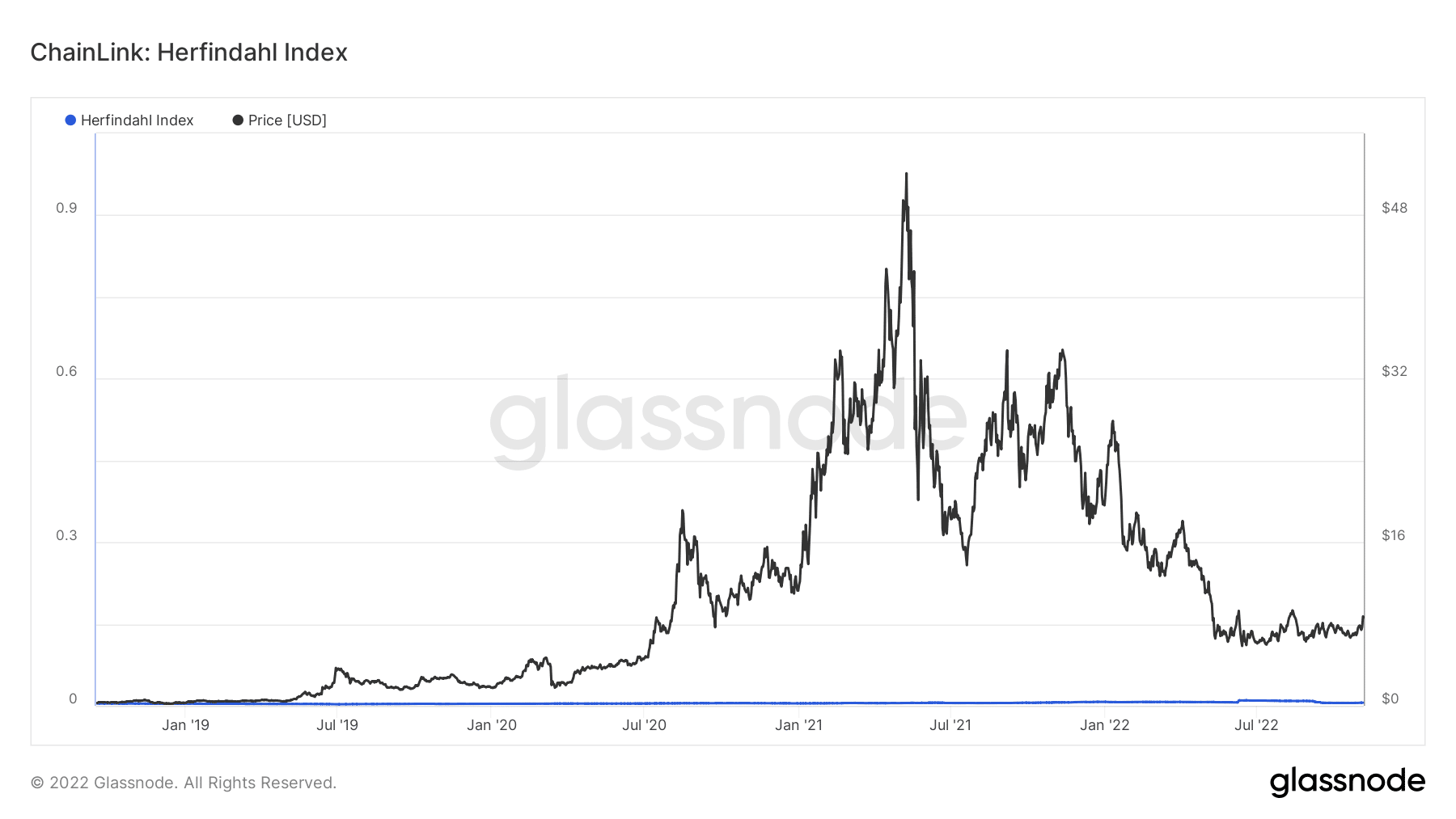

Per other parts of the Chainlink ecosystem, Glassnode had some updates in stock. According to the platform on the chain, the Herfindahl index was at a low value of 0.005. At that time, Chainlink supply concentration was moderately spread across addresses.

Additionally, this meant that the underlying LINK funds had balanced the weighted addresses on the network. Chainlink had therefore chosen to adapt to the requirements of its decentralization goals.

Source: Glassnode

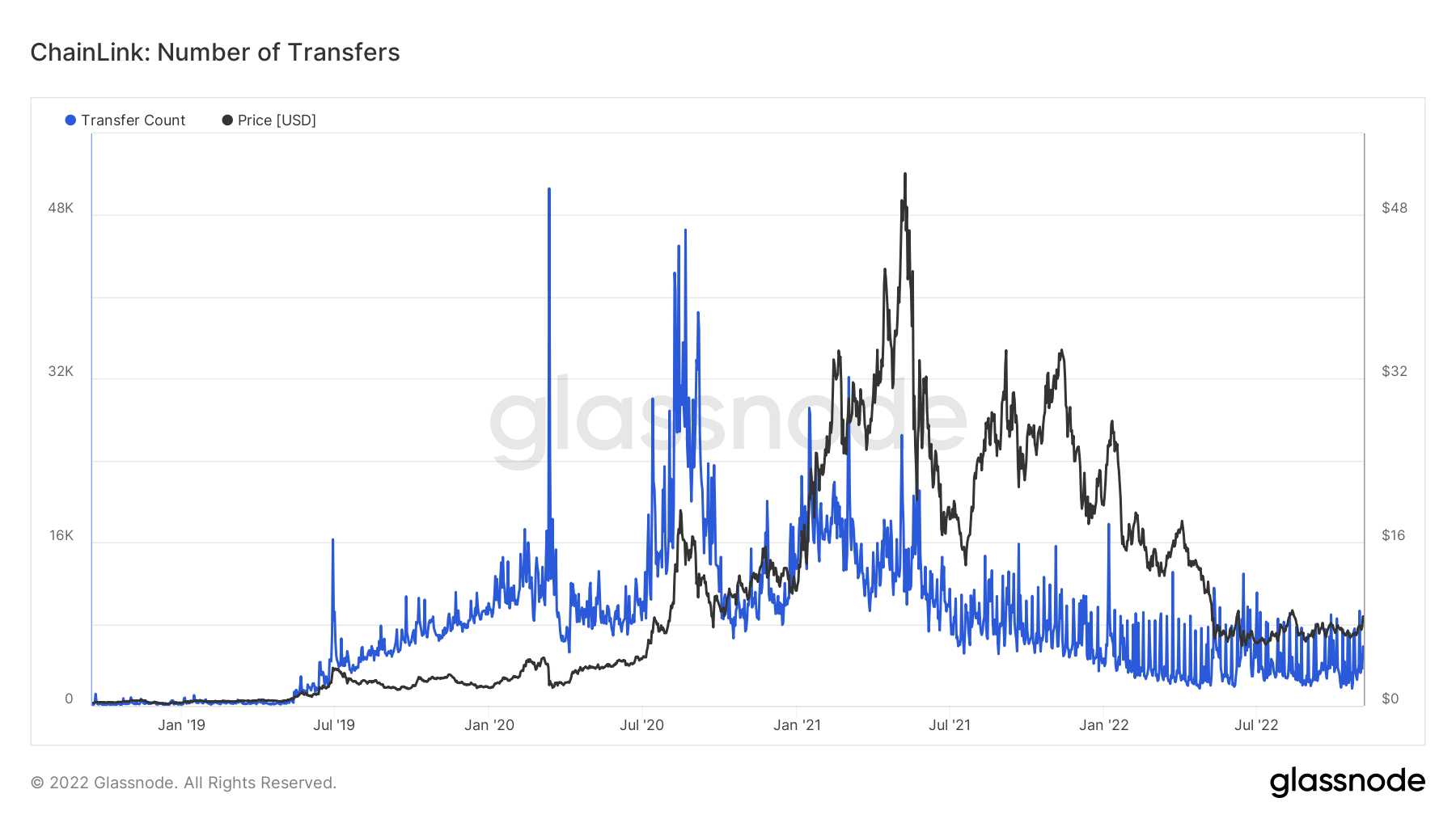

Furthermore Glassnode revealed that Chainlik’s transfer speed had improved recently. With an increase to 9,290, this metric indicated that investors had had more successful non-zero LINK transactions than the first few days of November.

At press time, LINK was still down 85.1% from its All-Time High (ATH). Nevertheless, trying to go closer to the highest point will require more upswing from these calculations.

Source: Glassnode