What Bitcoin’s Losing Inflation Hedging Story Means for the Crypto Market

With Bitcoin (BTC) down 72% from its all-time high, the global cryptocurrency market appeared to be a shambles throughout the third quarter; however, long-term indicators pointed in the direction of a maturing market.

As the third quarter of 2022 draws to a close, chain analysis for the top cryptocurrency by market capitalization painted a depressing picture. Bitcoin’s flag has often flown high in the rather volatile space due to its store of value and inflation-hedging history.

BTC’s 50% rise in the third quarter of 2021 had attracted investors and traders to the network like bees to honey. However, the same cannot be said for the third quarter of this year.

A recent Messari report highlighted how the recent market crash was a “narrative breaker and reality check” for Bitcoin.

Bitcoin’s Inflation Hedging Story Dead?

At the time of writing, Bitcoin’s return on investment (ROI) vs USD over the last three months was -10%, while its annual ROI vs USD was 53.38%. The low short-term and long-term returns showed that both short-term and long-term BTC HODLers suffered a net loss.

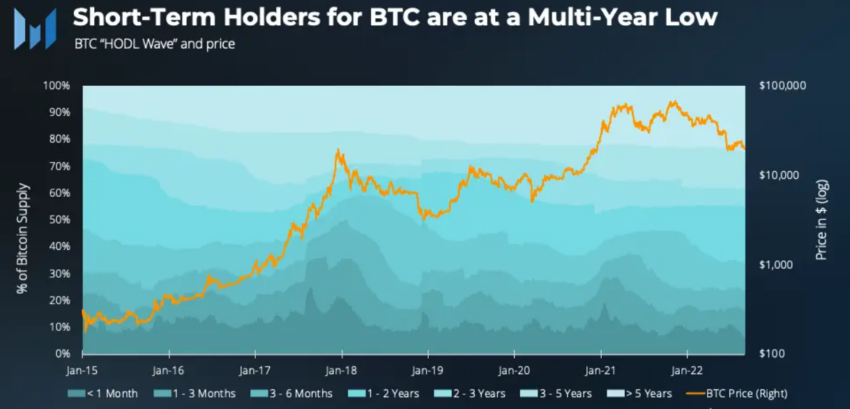

The BTC HODL wave and price chart shows that short-term owners (less than six months) were at a multi-year low and only owned 23% of the Bitcoin supply as of August 31.

An increase in short-term holders is usually considered a macro bullish signal and usually occurs around price gains. However, it was notable that BTC’s November 2021 ATH did not attract as many new investors most likely due to macro environmental factors.

In addition, BTC’s negative returns and range-bound price momentum below the $30,000 mark since June have negated the inflation hedge and store-of-value narrative.

For many in the market, BTC’s negative returns mean the inflation hedge story is dead, while for others like MicroStrategy’s Michael Saylor, Bitcoin’s low prices are just another opportunity to buy the valley.

Losing network vitality

After hitting an all-time high of $69,000, BTC’s price saw a pullback of over 70% amid the risk-off macro environment.

A comparison of BTC and the Nasdaq 100 revealed that Bitcoin’s price has been equal to that of a high-beta US tech stock, negating its value narrative.

During this quarter, the average correlation between BTC and the Nasdaq 100 was 0.6 as inflation and rate hikes dominated the narrative, while BTC was least correlated to debt. Interestingly, however, digital gold (BTC) and physical gold were much less correlated with an average correlation of 0.2.

In addition to this, BTC’s funded addresses and active addresses saw a rather reduced growth throughout the third quarter. Funded addresses only grew by 1.1% compared to 2.5% in Q2 2022, while average daily active addresses were down 4% compared to Q2 2022.

Any hope ahead?

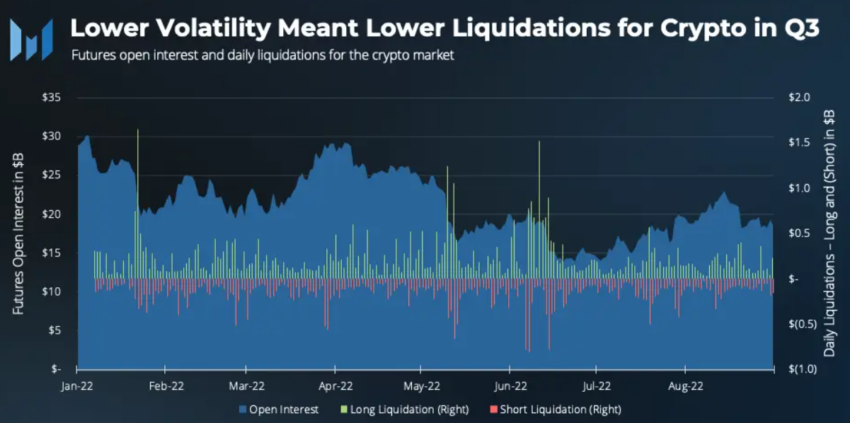

Despite the negative return and BTC almost losing its inflation hedge narrative, the coin’s realized volatility trended downward as the price gradually recovered in the third quarter. Lower volatility for the top asset resulted in lower liquidations for the larger crypto market.

Average 30-day volatility in August was 60% compared to over 80% for June. In contrast, total long liquidations in August were $5 billion, less than half of that in June, while short liquidations were also significantly lower.

Overall, while volatility was low for BTC throughout the third quarter, the asset has not yet “matured” into a lower risk spectrum. That said, BTC’s weakened bullish narrative has taken a toll on the larger crypto market as well, with sentiment tipping more on the bearish side for digital assets.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.