What a Fed Rate Hike Pause Could Mean for Crypto

The meeting of the Federal Open Market Committee (FOMC) is next week. What would be the impact on crypto if the Federal Reserve (Fed) stopped its interest rate hikes?

As the consumer price index (CPI) reached 5% year-on-year, discussions among investors about a pause in rate hikes intensified. The next FOMC meeting is set for May 3, but will a break result in an upside move in the markets?

Sell the news event?

The bank collapse in March fueled expectations of a pause in the Fed’s interest rate hikes. Therefore, the price of Bitcoin (BTC) has risen by over 40%.

But given such a rally, some might argue that the market has already priced in the Fed rate hike. Evercore strategist Julian Emanuel told Barron’s, “In 2023, a pause, given that rate cuts are priced in for July, is likely a ‘sell the news’ event.

Crypto Flus Shivam Chhuneja also believes the market has taken note of the Fed interest rate breaks. But according to Chhuneja, an official announcement could result in a risk-on attitude from investors. He told BeInCrypto:

So, in my opinion, it would be a great move to bring some much needed relief to the people, but the markets seem to be taking it.

The markets have been relatively relaxed since talk of the Fed possibly stopping interest rate increases has been around.

However, for the crypto market, I feel it would be interesting to see how people take the risk-on attitude slowly.

We saw a good rally in Bitcoin, but not much in altcoins compared to how things have been in the past in crypto.

This possibly gives us an idea that people were still not much “risky” in their approach. It would be interesting to see if an official announcement of the pause in interest rate hikes will finally turn the tables for crypto traders and investors to start taking more risks.

Meanwhile, Gaurav Dahake, CEO of the BNS crypto exchange, believes that a break could increase the likelihood of the next bull run. However, he also warned about the uncertainty due to the Fed’s policy. He told BeInCrypto:

A pause in Fed rate hikes could encourage investors to explore alternative assets, such as cryptocurrencies, as they search for higher yields. This increased interest may translate into increased investment in the crypto market, increasing the likelihood of a future bull run.

However, it is crucial to note that the crypto market’s reaction to changes in the Fed’s interest rate policy may not be uniform or predictable.

Need a break in Fed rate hikes?

The subsequent interest rate increases have resulted in a liquidity crisis in the market. Industry participants also believe that the collapse of major banks, such as Silicon Valley in March, was due to the Fed’s tightening of monetary policy.

BeInCrypto reported that former Fed chief Claudia Sahm believes the agency should pause rate hikes and give the world a chance to catch up.

Robert Reich, a professor of public policy, wrote in The Guardian: “The sensible thing would be for the Fed to hold off on rate hikes long enough to allow the financial system to calm down. In addition, inflation is decreasing, albeit slowly. So there is no reason to risk more financial turmoil.”

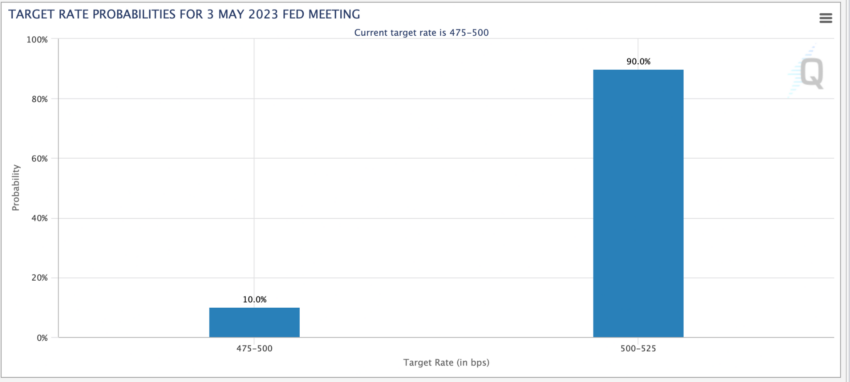

However, investors do not expect a pause in the next FOMC meeting. According to the CME Group, there is a 90% probability of a rate hike of 25 basis points in May. But will the FOMC meeting in July bring a zero rate hike?

Do you have anything to say about Fed rate hikes or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook or Twitter.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In accordance with the Trust Project guidelines, BeInCrypto is committed to objective, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify the facts independently and consult with a professional before making any decisions based on this content.