Volatile months ahead for Ethereum and USD 1,711 likely by year-end, says Crypto Industry Panel

The price of Ethereum’s native token ETH could fall to a low of $675 – and rise to a high of $2,673 – before ending at $1,711, according to a panel of crypto industry professionals surveyed by the comparison site Finder.com.

According to an average of the responses given by the panelists, ETH faces five months of exceptional volatility, with both a 57% drop and a 68% gain from the current price likely to occur, before the price ends the year at USD 1,711 – about. 7% higher than today’s price.

At the time of writing (14:25 UTC), ETH was trading at USD 1604. The token is up 4% in a day and almost 54% in a week.

Many panelists pointed to the merger – Ethereum’s transition from the proof-of-work (PoW) to the proof-of-stake (PoS) consensus mechanism – as critical to the asset’s price going forward.

Ben Ritchie, CEO of Digital asset managementsaw it,

“Since Ethereum’s correlation to bitcoin remains high, we can speculate that if the merger happens before the end of the year, the price could decouple [from the rest of crypto]. However, the external economic factor is decisive, and brings obstacles to the short-term price action.

A similar sentiment was shared by Kevin He, CEO of the fintech firm CloudTech Group.

“If Ethereum completes the merger this year, we expect the price to rise because PoS and faster [transactions per second] lead to higher demand for ETH from miners, investors and Dapp users, and if the market problems are alleviated in the second half of the year, it is possible for the ETH price to rise to the previous high or break the previous high due to the rising demand, he said.

Others also agreed, with Joseph Raczynski, a technologist and futurist for Thomson Reutersand said the merger “is not priced in [ETH]”yet.

“[Ethereum] still supports hundreds of billions of dollars in transactions and value, with thousands of tokens. At this stage, Ethereum is still the blue blood of the crypto world, Raczynski said.

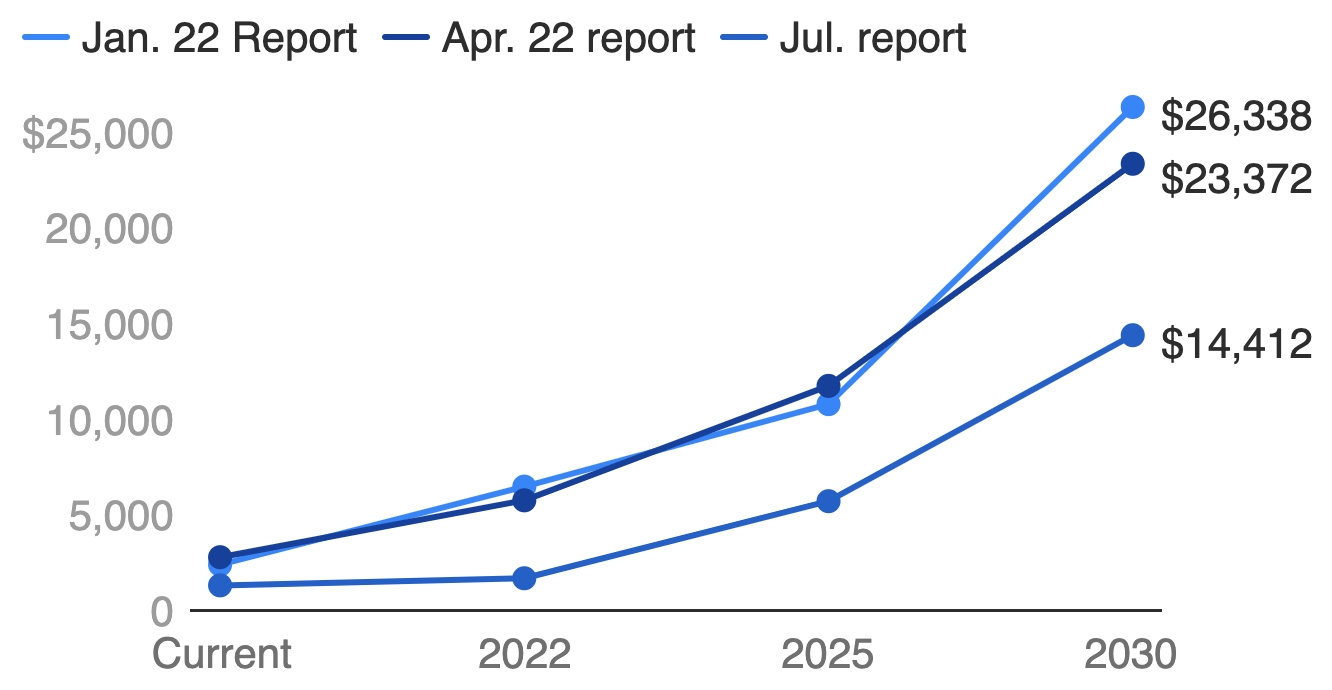

Looking further out, the average of the panelists’ responses indicated a price for the end of 2025 of USD 5,739, and for 2030 of USD 14,412.

And while that may sound bullish, it still marks a significant downgrade in price predictions compared to previous surveys by the panel from January and April this year.

In April, the panel predicted that ETH would reach USD 11,764 by the end of 2025 and USD 23,372 by the end of 2030. In January, the panelists were also positive, predicting a year-end price for 2025 of USD 10,810 and for 2030 of USD 26,338 .

As previously reported by Cryptonews.com, similar downgrades have also been seen in Finder.com’s bitcoin price predictions. As recently as April, Finder.com’s panel predicted that BTC would end the year at $65,185. Then, in July, the panel revised down that prediction, saying a year-end price of $25,500 is more likely.

Finder.com’s panel consists of various crypto industry players, including analysts, founders, CEOs and academics in the field.

____

Learn more:

– Massive liquidations push Ethereum higher as the looming merger boosts sentiment

– Ethereum merger date proposed for September

– Bitcoin and hard assets will win when inflation rises, Novogratz says, seeing BTC at $500,000

– Bitcoin could fall to USD 13.6K this year, panel says after adjusting predictions once more

– Year-end Cardano price at $0.63, increasingly bearish panel estimates

– The crypto winter will end before 2022 is out – Korbit