Trading Bot Known For Beating Crypto Markets Picks Cardano (ADA), Polygon (MATIC) and Chainlink (LINK)

A bot that has gained a reputation for outperforming the markets reveals its latest altcoin allocations as most cryptocurrencies give up their latest gains.

Each week, the Real Vision Bot conducts surveys to generate algorithmic portfolio assessments that reveal a “hive mind” consensus.

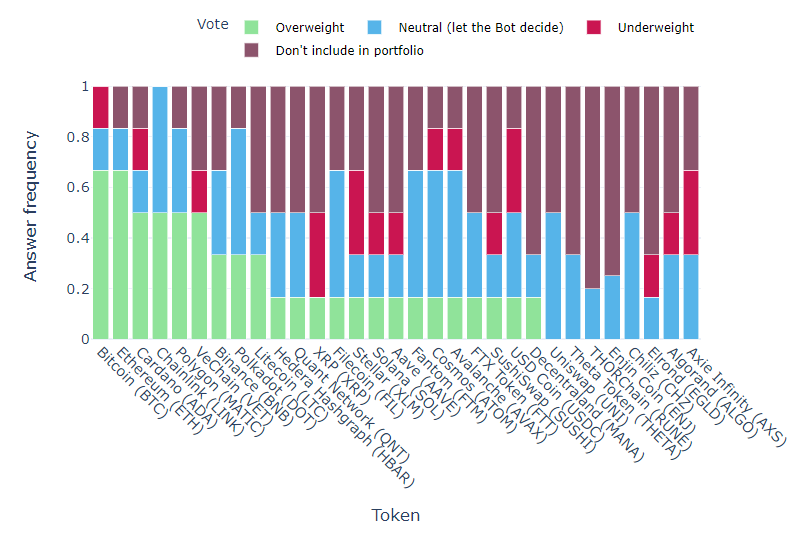

The bot is the newest data finds that traders’ risk appetite remains aggressive, with most market participants voting to overweight their portfolios with 21 altcoins in addition to crypto stalwarts Bitcoin (BTC) and Ethereum (ETH) both at 67%.

In third place with 50% votes for allocation of overweight were ETH challenger Cardano (ADA), decentralized oracle network Chainlink (LINK) and layer-2 scaling solution Polygon (MATIC).

“Latest results from RealVision Exchange crypto survey. Cardano, Chainlink and Polygon surprise with equal % votes for overweight.

1. Bitcoin 67%

2. Ethereum 67%

3. Cardano 50%

4. Chain link 50%

5. Polygon 50%”

With a fraction below 50% was blockchain VeChain (VET) for supply chain management, and in seventh place with a 30% increased allocation was popular cryptocurrency exchange Binance’s native token BNB, cross-chain interoperability protocol Polkadot (DOT) and decentralized peers. -to-peer cryptocurrency Litecoin (LTC).

Participants also named 14 other prominent digital assets as “overweight” by nearly 20%, including decentralized application creation protocol Hedera Hashgraph (HBAR), enterprise-class interoperability solutions provider Quant Network (QNT), distributed ledger XRP, decentralized storage network Filecoin (FIL), decentralized payment network Stellar (XLM), Ethereum competitor Solana (SOL), lending and borrowing protocol Aave (AAVE), enterprise-grade blockchain platform Fantom (FTM), scalability and interoperability ecosystem Cosmos (ATOM), layer-1 smart contract platform Avalanche (AVAX ), FTX cryptocurrency exchange FTX Token (FTT), automated market maker SushiSwap (SUSHI), dollar-pegged stablecoin US Dollar Coin (USDC) and virtual reality world Decentraland (MANA).

The latest survey-based exchange portfolio allocation is led by Chainlink at 17.1%, followed by Ethereum at 14.3%, Polygon at 12.2%, Bitcoin at 11.9% and Polkadot at 8.57%. Eight other cryptoassets ended up with between 2% and 7% allocation.

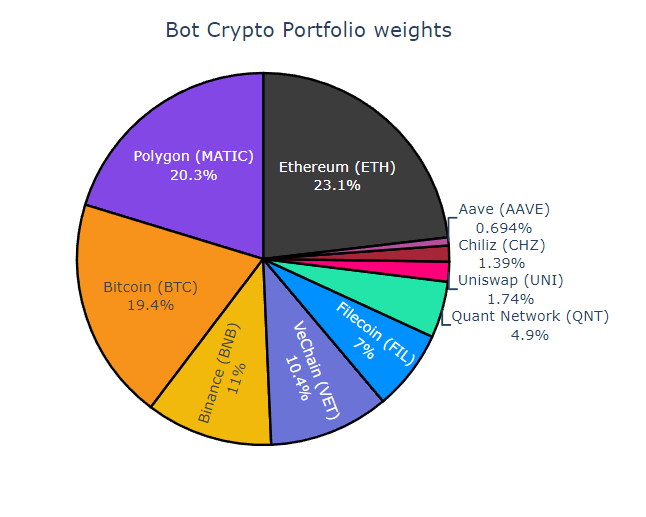

Boten himself also compiles a portfolio on his own, and Real Vision notes the four digital assets that make up nearly 75% of the weekly holdings.

“Final weights of the RealVision Exchange crypto portfolio. Rebalancing took place on Saturday. Chainlink weight was surprising in the Exchange portfolio.

The bot sticks to Ethereum, Polygon, Bitcoin and Binance.”

Real Vision Bot was developed by quant analyst and hedge fund manager Moritz Seibert and statistician Moritz Heiden.

Real Vision founder and macroeconomics expert Raoul Pal has called the bot’s historical performance “amazing,” saying it outperforms a combined bucket of the top 20 cryptoassets on the market by more than 20%.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered straight to your inbox

Check price action

Follow us on TwitterFacebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making high-risk investments in Bitcoin, cryptocurrency or digital assets. Please note that your transfers and trades are at your own risk and any losses you incur are your responsibility. The Daily Hodl does not recommend the purchase or sale of cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured image: Shutterstock/Dai Yim